Article Text

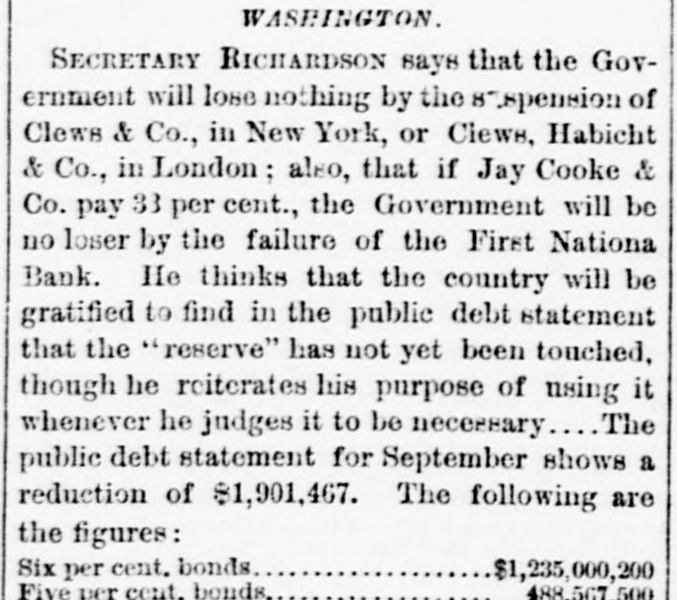

good, but I won't. You may state, however, that I have abiding confidence in the integrity of ex-Governor Cooke, and the firm of Jay Cooke & Co., and I believe that all moneys held by him in trust in a fiduciary capacity will be paid, even if he has to sacrifice his property. Reporter.-Does his appointment by the board make him a government officer? Mr. Sargent.-Certainly; and as such he bonds under the law governing such officers, and gives bonds for the faithful performance of the duties. ### OTHER DISTRICT CHARITIES AFFECTED BY THE CRASH. It is stated that there was deposited in the First National bank $20,000 to the credit of the St. John's Sisterhood, a charity connected with the Fpiscopal church of St. John's; $10,000 o the uninvested funds of the Smithsonian Institution; $11,000 belonging to the Soldiers' and Sailors' Orphan Home, of which ex-Governor Cooke acted as trustee and treasurer-from the sum set apart for its appropriation by Congress a warrant for $15,000 had been drawn, of which vouchers for $4,000 have been audited, leaving an unexpended balance of $11,000. ### OTHER HEAVY DEPOSITORS. It is said that ex-President Andrew Johnson had $60,000 to his credit in the First National bank, on which he was receiving six per cent. interest; Senator Patterson, of South Carolina, $14,000 in one of the suspended banks; Admiral Rowan, $6,000. Mrs. Wm. H. Scott, widow of a former navy agent, had $17,000, the proceeds of the sale of all the property she had. Gen. Hunter had a handsome credit in Jay Cooke & Co.'s. Col. Webster, register of wills, had all his savings deposited there. ### THE STOCK OF THE FIRST NATIONAL. Of the five thousand shares of the First National bank, about thirty-five hundred shares are owned either by Jay Cooke & Co. or individual members of the firm. ### OUR BANKS TO-DAY. Matters financial are in their normal condition throughout the city to-day, and the banks are transacting business as usual. Many depositors who drew their money under the prevailing excitement have returned their funds and express the fullest confidence in the security of the banks. The general conviction is that a portion of the community here became unduly and unnecessarily frightened. ### MR. STICKNEY, OF THE FREEDMAN'S SAVINGS BANK, says the reason that institution deemed it expedient to require the legal notice of sixty days for those desiring to withdraw their deposits was because all the books which had not such notice posted therein were now paid, and that the failure of Clews & Co., announced yesterday, left bank officers in the dark as to where the trouble would end. He deemed it a matter of prudence to require the full legal notice. Payment, however, in special cases, are being made.