Article Text

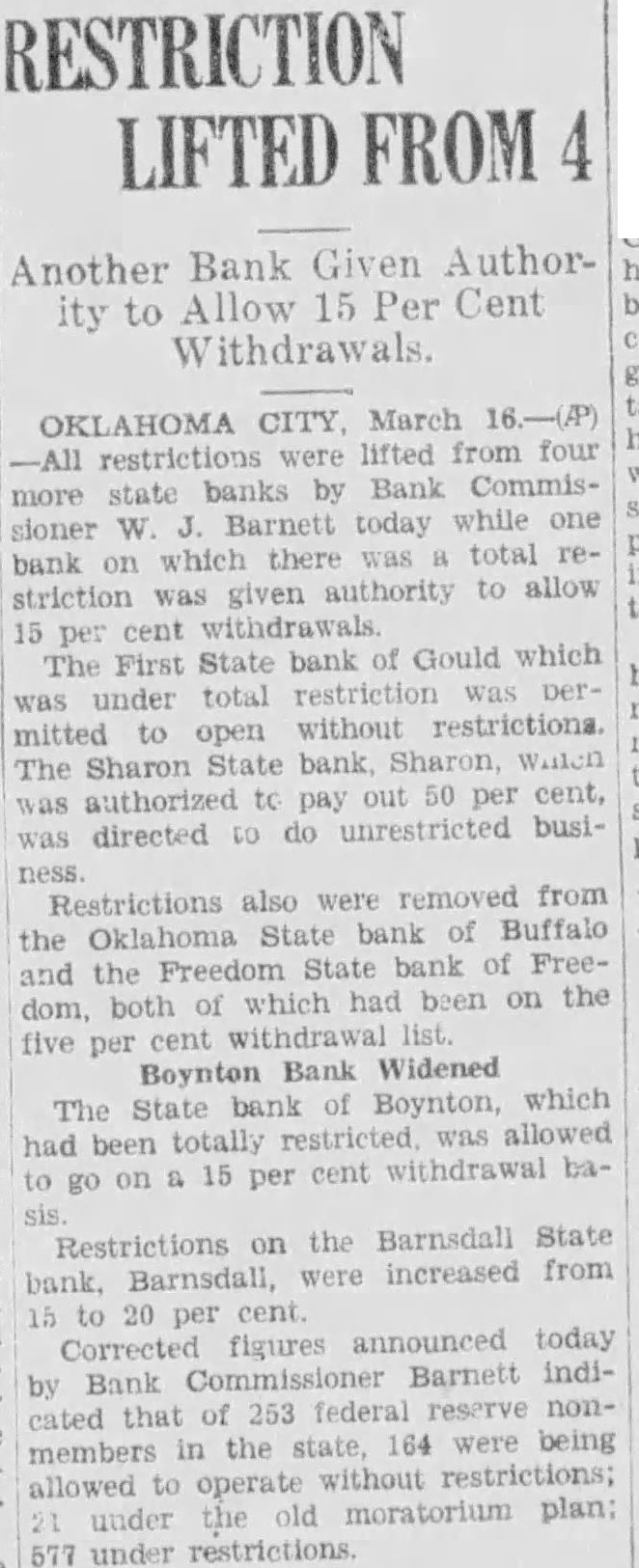

RESTRICTION LIFTED Bank Given AuthorAnother Allow Per Cent ity to March were lifted from four restrictions banks Bank Commismore state Barnett today while one sioner which there total on authority to allow striction given 15 cent withdrawals per First State bank of Gould which under total restriction mitted open without The Sharon bank out per cent, authorized pay do unrestricted busidirected Restrictions also from the of Buffalo and the of Freehad been on the dom, both of which five per cent Bank Widened Boynton, which The State bank was allowed had cent withdrawal bago on & 15 per Restrictions on the Barnsdall State increased from bank, Barnsdall, 20 per today Corrected figures by Bank Barnett indiof 253 federal cated the 164 were being members allowed operate under moratorium 577 under restrictions