Article Text

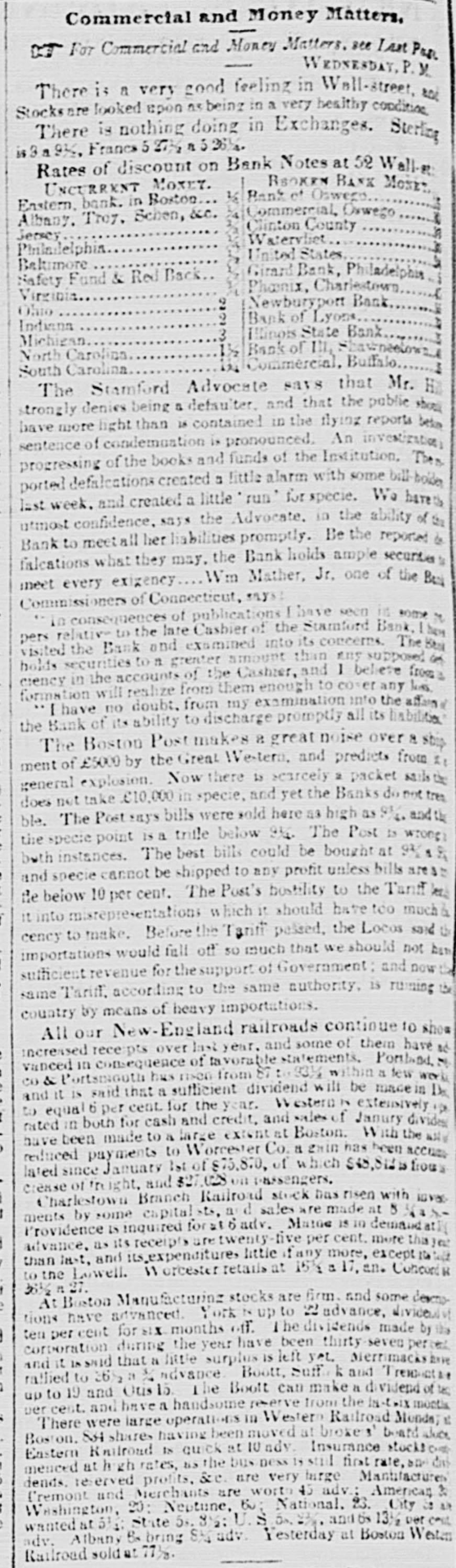

Commercial and Money Matters. at For Commercial and Money Matters. see Last Pus. WEDNESDAY P.Y. There is a very good feeling in Wall-street, soe Stocksare looked upon as beinz in a very healthy condition There is nothing doing in Exchanges. Sterling i339% Francs 5 271/2 a Rates of discount on Bank Notes at 52 Wall-g BROKEN BANK Most: UNCURRENT MOXET. Bank et Oswega Enstern. bank. in Boston Commercial, Oswego Albany. Tro7. Schen, &c. Clinton County Jersey Watervliet Philadelphia United States Baltimore Girard Bank, Philadelphia Safety Fund & Red Back Phaenix, Charlestown Virginia 2 Newburyport Bank Ohio 2 Bank of Lyon Indiana Illinois State Bank 3 Michigan Bank of 114 Shawneelows 2 North Carolina Commercial. Buffalo South Carolina The Stamford Advocate savs that Mr. H strongly denies being a defaulter and that the public shoell have more light than is contained in the flying reports beton sentence of condemnation is pronounced. An investigation progressing of the books and funds of the Institution. Then ported defalcations created IS little alarm with some bill-holder last week. and created a little run' for specie. We have utmost confidence. says the Advocate. in the ability of the Bank to meetall her liabilities promptly. Be the reported falcations what they may. the Bank holds ample security meet every exigency Wm Mather, Jr. one of the Best Commissioners of Connecticut, says in consequences of publications I have seen is some pers relative to the late Cashier of the Stamford Bank, have visited the Bank and examined into its concerns. The Best holds securities to n greater amount than any supposed (e) ciency in the accounts of the Cashier, and I believe from formation will realize from them enough to cover any less I have no doubt. from my examination into the affirm the Bank of its ability to discharge promptly all its liabilities Post makes a great noise over a ship £5000 by the Great explosion. Now there is a ment general The of Boston We-term. searcely and predicts packet from £ does not take £10,000 in specie, and yet the Banks do not tree ble. The Post anys bills were sold here as high as 91/2 and th the specie point is a trille below 93. The Post is wrong both instances. The best bills could be bought at 914 and specie cannot be shipped to any profit unless bills areas fle below 10 per cent. The Post's bostility to the Tanff the it into misrepresentations which it should have too much cency to make. Before the Tariff passed. the Locos said importations would full off so much that we should not has sufficient revenue for the support of Government: and now same Tariff. according to the same authority, is running the country by means of heavy importations. All our New-England railroads continue to show increased receipts over last year. and some of them have ad vanced in consequence of favorable statements, CO& Portsmouth has used from 87: 931/4 within a few work and it is said that a sufficient dividend will be made in Da to equal b per cent for the year. Western extensively rated in both for cash and credit, and sales of January divides have been made to a large extent at Boston. With the reduced payments to Worcester Co. a gain has been accus lated since January 1st of $75.8.0, of which $48,Stillations crease of freight. and $27,028 passengers. Charlestown Branch Railroad stock has risen with ioves some sts. are at is inquired for is in ments Providence by capital 6adv. sales Matoe made demandatli 8 was advance. as its receipts are twenty-five per cent. more thatez than last, and its_expensitures little if any more, except 10 with ,the Lowell. Worbester retails at 15% a 17, an. Concert it 361/2 it 27. At Buston Manufacturing stocks are firm. and some descript tions have advanced York N up to 22 advance. dividend ten per cent for SIX months off. The dividends made by lla corporation during the year have been thirty seven perter and it is and that a little surplus is left yet. Merrimacks bree raflied to 26 2 it 3/4 advance Boott. Suff. k and Transaction up to 19 and Ouis 15. The Boott can make a dividend of ta per cest. and haven handsome reserve from the in-tein month There were large operations in Western Railroad Monday Boston. 834 shares having been moved at broken' board alia Eastern Restroud IS quick at 10 ndv. Insurance stockson menced at eigh rates, his the bus ness still first rate, dends. reserved profits. & are very large Mantifactures ('remont and Merchants are worth 45 adv.: American as Washington, 20: Neptune, Bu: National. 23. City is wanted 51.1 State 5. 3% U. 5a. and os 131/2 per call adv. Albany B. bring 84 adv Yesterday at Boston Western Railroad sold at 77%