Article Text

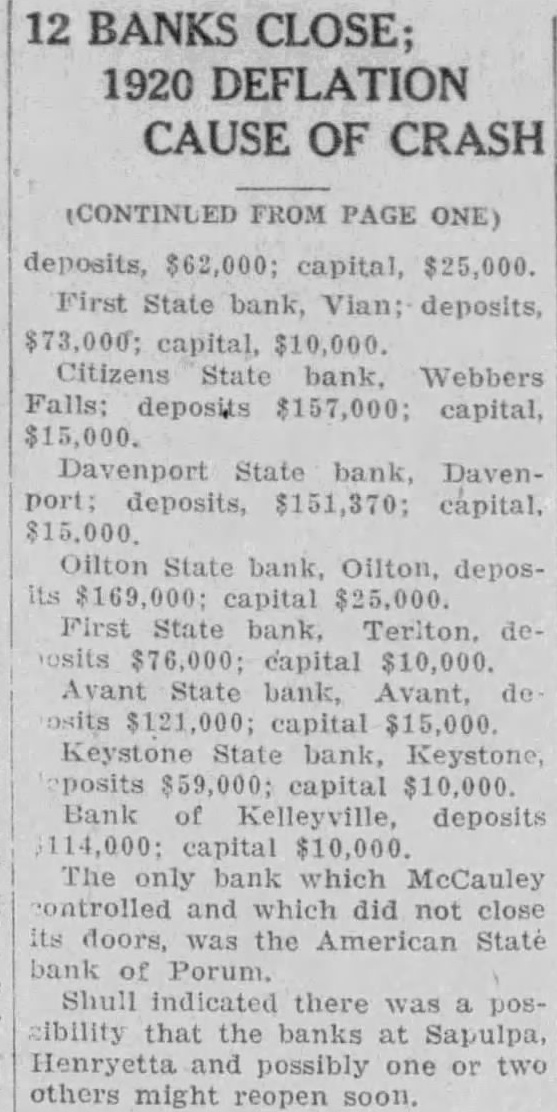

12 BANKS CLOSE; 1920 CAUSE OF CRASH (CONTINUED FROM PAGE ONE) deposits, $62,000; capital, $25,000. First State bank, Vian; deposits, $73,000; capital, $10,000. Citizens State bank, Webbers Falls: deposits $157,000; capital, $15,000. Davenport State bank, Davenport: deposits, $151,370; capital. Oilton State bank, Oilton, deposits capital $25,000. First State bank, Terlton. $76,000; capital $10,000. State bank, Avant, capital $15,000. Keystone bank, Keystone, posits capital $10,000. Bank of Kelleyville, deposits 14,000: capital $10,000 The bank which McCauley controlled and which did not close Its doors, was the American State bank of Porum. Shull indicated there pos:lbility that the banks at Henryetta and possibly one or two others might reopen soon.