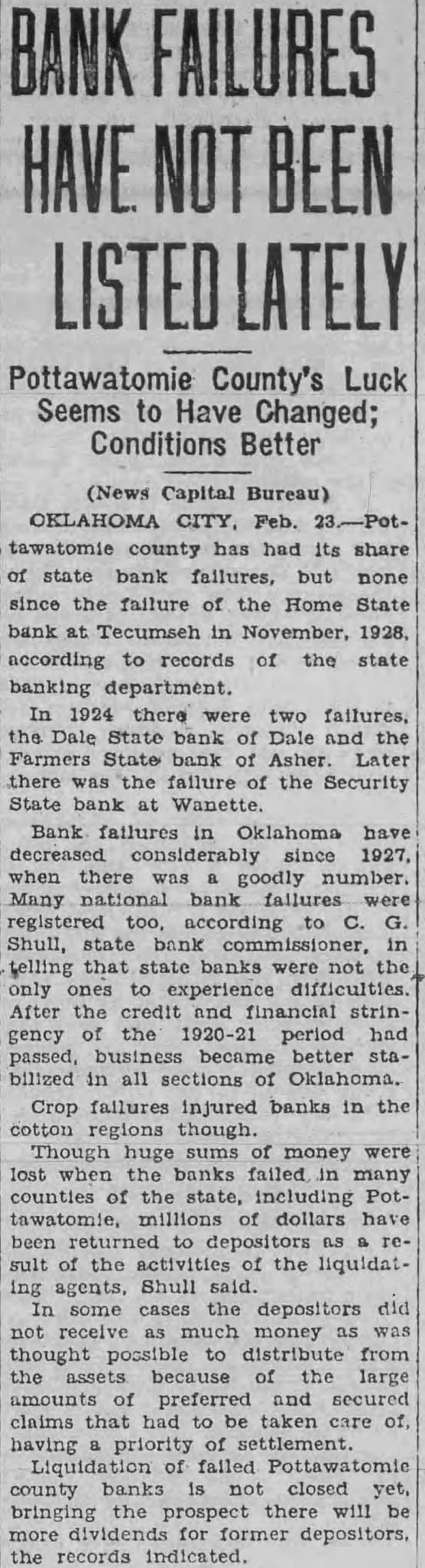

Article Text

Pottawatomie County's Luck Seems to Have Changed; Conditions Better (News Capital Bureau) CITY, Feb. tawatomie county has had its share state bank failures, but none since the failure of the Home State bank Tecumseh in November, 1928, according to records of the state banking department. In 1924 there were two the Dale State bank Dale the Farmers State bank Asher. Later there failure the Security State bank at Wanette. Bank failures Oklahoma have 1927, when there goodly number. Many bank registered Shull, bank state banks not ones experience difficulties. the credit financial stringency the period had passed, became better bilized in all sections Oklahoma. Crop failures injured banks in the regions though. Though huge sums money were lost when the failed counties state, including Pottawatomie, dollars have been sult the activities the liquidatagents, Shull said. some the depositors did much money thought to distribute from the because large amounts preferred and secured claims that had taken care of, having priority settlement. county closed yet, bringing the prospect there will be for former depositors. the records indicated.