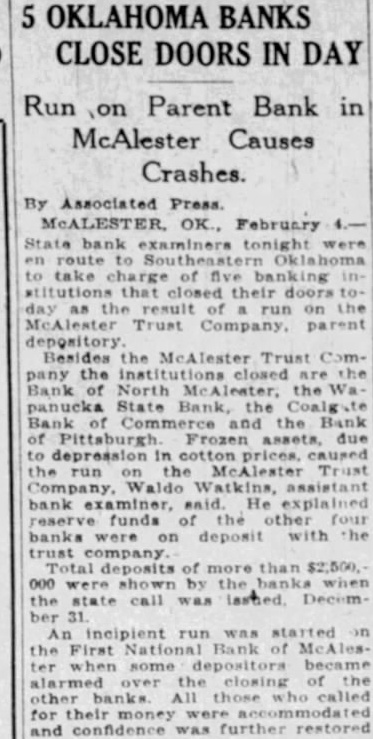

Article Text

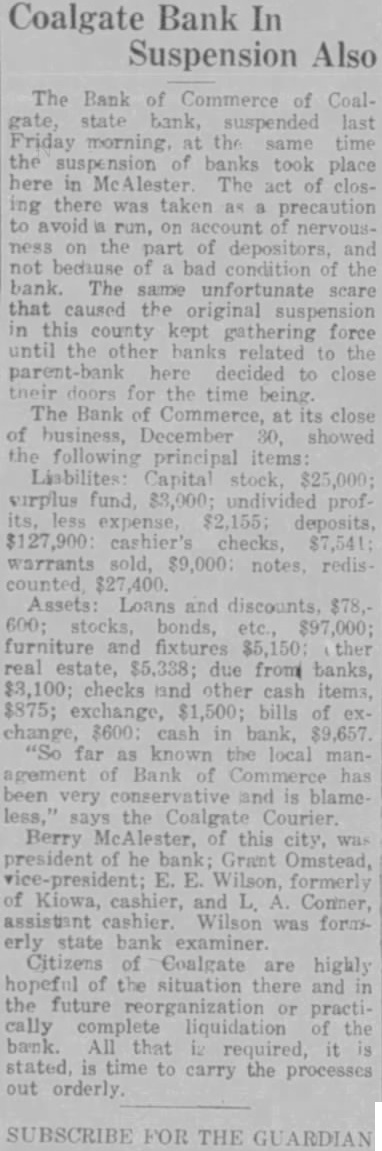

5 Banks Topple In Failure Of McAlester Bank Assets Tied When McAlester Trust Company Fails to Open for Business Run On Other Bank National Institution Is Hard Pressed. But Stand Heavy Withdrawals of fifth bank southeastern sult of the failure this morning of the Trust today at the office state banking The bank of Pittsburg was the fifth Like the small banks involved reserve on deposit with the Vlester Trust pany had deposits $67.the close year. Five bank examiners were to take charge the banks that closed their result of the the Mc Alester Trust company, the parent bank. The other four institutions are the company, the Bank of North the State bank and Coalgate bank of commerce. Frozen by the pression in cotton caused the run on the Vlester Trust company was by Waldo sioner Reserve funds of the other three banks were on deposit with the trust company he said. The four institutions showed total deposits of nearly $2,500.000 when the state bank call was issued December Deposits of the Alester Trust company to taled the Wapanucka bank $22,000 bank $135000 the North ter $65000 Ernest, and Charles the aminers who have been assigned take charge of the failed insti- Both the Vlester Trust and the Bank of North Mc. Alester business this morning The the State bank Hartshorne and the Bank of Krebs, According financial statement that will be issued mediately the affairs of the MeAlester are such that the banks will re-open in the very The deposits of the two MeAlester institutions approximately two million dollars. Capital stock of the Trust company was $125,000 and the North MeAlester bank capitalization, $15.Banking conditions here caused furore excitement and when the First National bank. the only remaining bank in the city ened at o'clock run started. Depositors and spectators gathered in big throngs an hour before doors opened. Ample on hand assured to stem the Before 10:30 o'elock this mornpractically every business in Alester had made deposits in the First National bank. The number of depositors in line equalled the number of other per. seeking windows in the department. Several of the most prominent men of the munity took position outside of the bank and addressed the crowds. assuring them that the resources behind the Me Vlester banks are adequate protect deThe effect of these talks, considerable measure, tended to restore confidence prevailing found Morrison company