Article Text

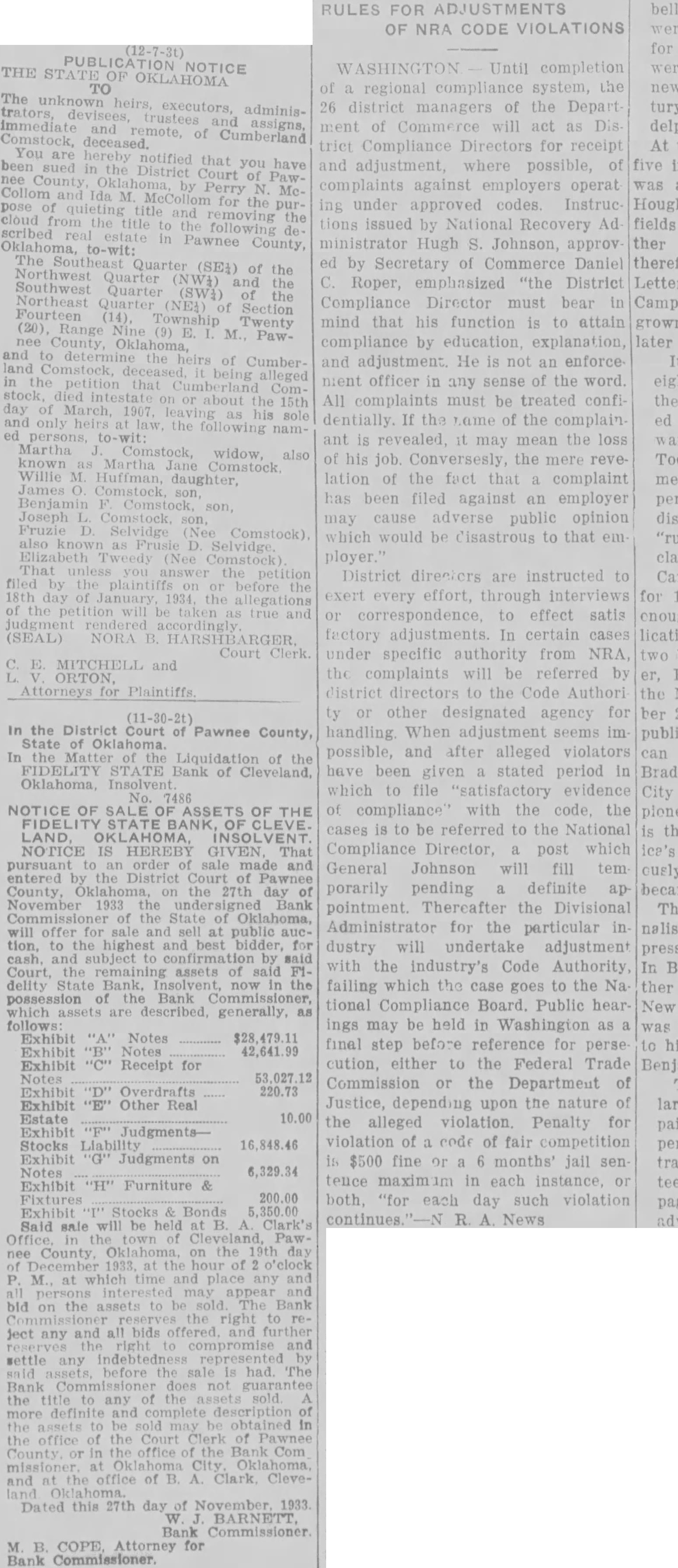

NOTICE THE TO The unknown heirs, administrators, devisees, trustees immediate and remote, of Cumberland Comstock, deceased. You notified that you have sued District Court McCollom Ida M. McCollom for the pose quieting title and removing the from the title scribed in Pawnee Oklahoma, County, to-wit: Northwest The Southeast Quarter Quarter (SE) of the Southwest Quarter the Northeast Quarter Section Fourteen nee (20) County Range Township M. Twenty PawOklahoma, and land to Comstock, heirs of Cumberstock, petition that being alleged the 15th day of and only law the his nampersons, to-wit: Martha Comstock, widow, also known Martha Jane Comstock Willie M Huffman, daughter, James Benjamin Comstock, son, Fruzie Selvidge also known as Frusie Selvidge That the filed by plaintiffs day the the petition will taken true rendered (SEAL) NORA Court Clerk. MITCHELL and ORTON, Attorneys Plaintiffs (11-30-2t) In the District of Court of Pawnee County, State Oklahoma. In Matter Liquidation of the FIDELITY STATE Bank of Cleveland, Oklahoma, 7486 NOTICE OF OF OF THE STATE BANK, OF CLEVE. LAND, OKLAHOMA, NOTICE IS HEREBY GIVEN That pursuant order made and entered the District Court County, Oklahoma, the 27th day November 1933 the Bank Commissioner the State Oklahoma, will offer for sale and public auction, to the highest and best cash, and by said Court, the remaining assets of said State now the possession of Bank which assets are described, generally, Exhibit "A" Notes Exhibit Notes Exhibit Receipt for Notes Exhibit Overdrafts 220.73 Exhibit Other Real Estate 10.00 Exhibit JudgmentsStocks 16,848.46 Exhibit "G" Judgments on Notes 6,329.34 Exhibit "H" Furniture & Fixtures Exhibit Stocks Bonds sale will be held Clark's Office, town Cleveland, PawCounty, the 19th day which time and place any may bid on the assets to Bank right ject any and bids and and compromise settle any indebtedness represented before the sale is had. The Bank Commissioner does not guarantee the title to any the assets sold more definite sold office of the Court Clerk Pawnee in Oklahoma missioner. and the office of Clark, CleveDated this 27th day November 1933. Bank Attorney for Bank Commissioner. RULES FOR ADJUSTMENTS OF NRA CODE VIOLATIONS WASHINGTON Until completion regional compliance system, the 26 district managers of the Depart of Commerce will act as Dis Compliance Directors for receipt and adjustment, where possible, of complaints against employers operat ing under approved codes Instruc tions issued by National Recovery Ad ministrator Hugh S. Johnson, approv ed by Secretary of Commerce Daniel Roper, emphasized "the District Compliance Director must bear in mind that his function is to attain compliance by education, explanation, and adjustment. He is not an enforce nient officer in any sense of the word. All complaints must be treated confidentially. If the name of the complain ant is revealed, it may mean the loss of his job. Conversesly the mere revelation the fact that complaint has been filed against an employer may cause adverse public opinion which would be disastrous to that em ployer. District directors are instructed to exert every effort, through interviews correspondence, to effect satis factory adjustments. In certain cases under specific authority from NRA the complaints will be referred by district directors to the Code Authori or other designated agency for handling. When adjustment seems im possible, and after alleged violators have been given stated period In which to "satisfactory evidence of compliance with the code, the cases is to be referred to the National Compliance Director, post which General Johnson will fill tem porarily pending definite ap pointment. Thereafter the Divisional Administrator for the particular in dustry will undertake adjustment with the industry's Code Authority, failing which the case goes to the Na tional Compliance Board. Public hearings may be held in Washington as final step before reference for perse cution, either to the Federal Trade Commission or the Department of Justice, depending upon the nature of the alleged violation. Penalty for violation of code of fair competition is $500 fine or months' jail sen tence in each instance, or both, "for each day such violation A. News