Article Text

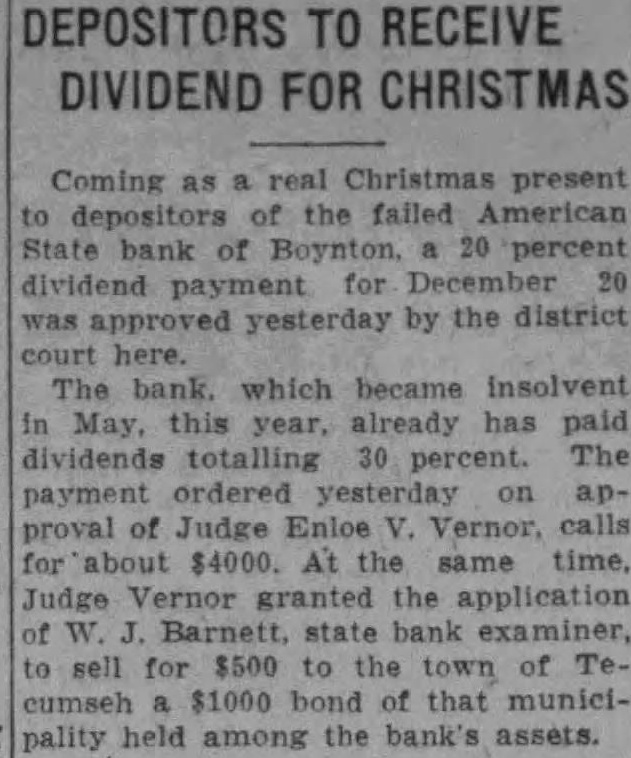

DEPOSITORS TO RECEIVE DIVIDEND FOR CHRISTMAS Coming as a real Christmas present to depositors of the failed American State bank of Boynton. a 20 percent dividend for December 20 was approved yesterday by the district court here. The bank. which became insolvent in May, this year, already has paid dividends totalling 30 percent. The payment ordered on approval of Judge Enloe V. Vernor, calls for about $4000. At the same time, Judge Vernor granted the application of W. J. Barnett, state bank examiner, to sell for $500 to the town of Tecumseh $1000 bond of that municipality held among the bank's assets.