Article Text

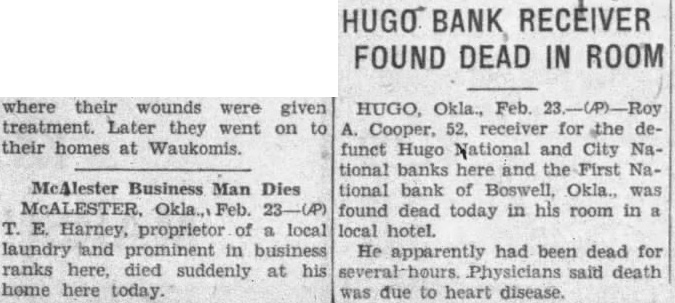

HUGO BANK RECEIVER FOUND DEAD IN ROOM HUGO, Okla., Cooper, receiver for the funct Hugo National and City tional banks here and the National bank of Boswell, Okla., found dead today in his room in local hotel. apparently had been dead for Physicians said death due to heart disease.