Article Text

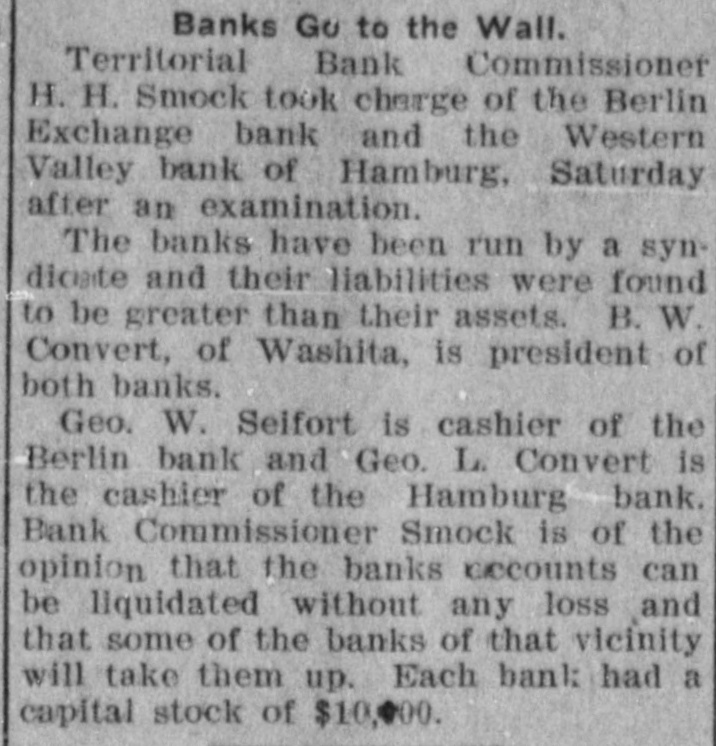

Banks Go to the Wall. Territorial Bank Commissioner H. H. Smock took charge of the Berlin Exchange bank and the Western Valley bank of Hamburg, Saturday after an examination. The banks have been run by a syndicute and their liabilities were found to be greater than their assets. B. W. Convert, of Washita, is president of both banks. Geo. W. Seifort is cashier of the Berlin bank and Geo. L. Convert is the cashier of the Hamburg bank. Bank Commissioner Smock is of the opinion that the banks accounts can be liquidated without any loss and that some of the banks of that vicinity will take them up. Each bank had a capital stock of $10,000.