Article Text

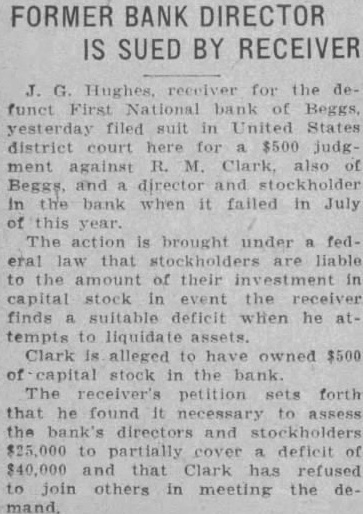

FORMER BANK DIRECTOR IS SUED BY RECEIVER J. G. Hughes, receiver for the defunct First National bank of Beggs yesterday filed suit in United States district court here for $500 judg ment against R. M. Clark, also of Beggs and director and in the bank when it failed in July of this year. The action is brought under a federal law that stockholders are liable to the amount of their investment in capital stock in event the receiver finds suitable deficit when he attempts to liquidate assets. Clark is alleged to have owned $500 of capital stock in the bank The receiver's petition sets forth that he found It necessary to assess the bank's directors and stockholders $25,000 to partially cover a deficit of $40,000 and that Clark has refused to join others in meeting the de