Article Text

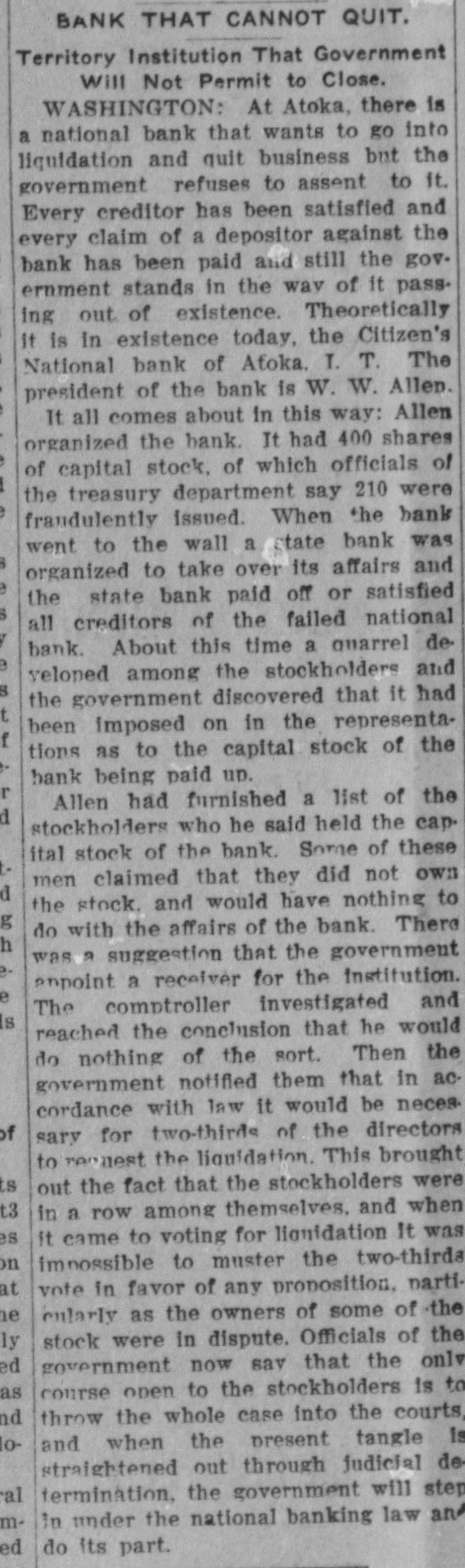

BANK THAT CANNOT QUIT. Territory Institution That Government Will Not Permit to Close. WASHINGTON: At Atoka, there is a national bank that wants to go into liquidation and quit business but the government refuses to assent to it. Every creditor has been satisfied and every claim of a depositor against the bank has been paid and still the government stands in the wav of it pass. ing out of existence. Theoretically it is in existence today, the Citizen's National bank of Afoka. T. T. The president of the bank is W. W. Allen. It all comes about in this way: Allen organized the bank. It had 400 shares of capital stock, of which officials of the treasury department say 210 were fraudulently issued. When the bank went to the wall a state bank was organized to take over its affairs and the state bank paid off or satisfied all creditors of the failed national bank. About this time a quarrel develoned among the stockholders and the government discovered that it had been imposed on in the representations as to the capital stock of the bank being paid up. Allen had furnished a list of the stockholders who he said held the capital stock of the bank. Some of these men claimed that they did not own d the stock. and would have nothing to g do with the affairs of the bank. There h was a suggestion that the government anpoint a receiver for the Institution. e The comptroller investigated and S reached the conclusion that he would do nothing of the sort. Then the government notified them that in accordance with law it would be neces. of sary for two-thirds of the directors to regnest the liquidation. This brought s out the fact that the stockholders were t3 in a row among themselves, and when es it came to voting for liquidation It was on impossible to muster the two-thirds at vote in favor of any proposition. partie entarly as the owners of some of the stock were in dispute. Officials of the ly ed government now sav that the only as course open to the stockholders is to nd throw the whole case into the courts loand when the present tangle is straightened out through judicial de al termination, the government will step in under the national banking law an med do its part.