Article Text

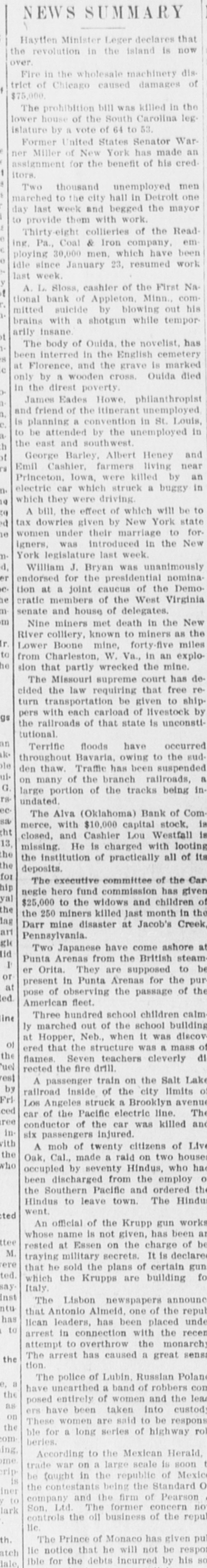

NEWS summary Haytlen Minister Leger declares that over. the revolution in the island is now Fire in the wholesale machinery dis. trict $75,000 of Chicago caused damages of The prohibition bill was killed in the lower house of the South Carolina leg. islature by a vote of 64 to 53. Former United States Senator Warner Miller of New York has made an assignment itors. for the benefit of his cred. Two thousand unemployed men marched to the city hall In Detroit one to day last week and begged the mayor provide them with work. Thirty-eight collieries of the Reading. Pa., Coal & Iron company, em ploying 30,000 men. which have been Idle since January 23, resumed work last week. ! A. L. Sloss, cashier of the First National bank of Appleton. Minn., committed suicide by blowing out his brains with a shotgun while temporarily Insane, The body of Ouida, the novelist, has been interred In the English cemetery at Florence, and the grave is marked only by a wooden cross. Ouida died in the direst poverty. James Eades Howe, philanthropist and is friend of the itinerant unemployed planning a convention in St. Louis, to be attended by the unemployed in h the east and southwest. if George Barley, Albert Heney and If Emil Cashier. farmers living near Princeton, Iowa, were killed by an a. electric car which struck a buggy in Q which they were driving. 0 A bill. the effect of which will be to a tax dowries given by New York state e women under their marriage to for. igners, was introduced in the New à York legislature last week. d. William J. Bryan was unanimously er endorsed for the presidential nominac. tion at a joint caucus of the Demoe cratic members of the West Virginia = senate and house of delegates. m Nine miners met death in the New r River colliery, known to miners as the to Lower Boone mine, forty-five miles 10 from Charleston, W. Va., in an explosion that partly wrecked the mine. The Missouri supreme court has decided the law requiring that free return transportation be given to shipgs pers with each carload of livestock by the tutional. railroads of that state is unconstiin k. Terrific floods have occurred le throughout Bavaria, owing to the sudniden thaw. Traffic has been suspended G. on many of the branch railroads, rsundated. large portion of the tracks being in- a ecsa The Alva (Oklahoma) Bank of Comtht merce. with $10,000 capital stock, is 13. closed, and Cashier Lou Westfall is he missing. He is charged with looting he the deposits. institution of practically all of its for hip The executive committee of the Car yal negle hero fund commission has given the $25,000 the to the widows and children of lag 250 miners killed last month in the an Pennsylvania. Darr mine disaster at Jacob's Creek, gle lid Two Japanese have come ashore I Punta Arenas from the British steam at or er Orita. They are supposed to be at present in Punta Arenas for the pur ed. pose of observing the passage of the American fleet. ine Three hundred school children calm ly marched out of the school building of at Hopper, Neb., when it was discov the ered that the structure was a mass of uel flames. Seven teachers cleverly di rected the fire drill. est by A passenger train on the Salt Lake Fri railroad inside of the city limits o ced Los Angeles struck a Brooklyn avenue ree car of the Pacific electric line. inconductor of the car was killed The and six passengers injured. ith the A mob of twenty citizens of Live who Oak, Cal., made a raid on two house occupied by seventy Hindus, who ha been discharged from the employ O the Southern Pacific and ordered the went. Hindus to leave town. The Hindus ted An official of the Krupp gun works tee whose name is not given, has been ar M. rested at Essen on the charge of be ere traying military secrets. It is declare ted. that he sold the plans of certain gun ay Italy which the Krupps are building fo nst ntu The Lisbon newspapers announc has that Antonio Almeid, one of the repul to lican leaders, has been placed unde arrest in connection with the recen attempt to overthrow the monarch the tion. The arrest has caused a great sens: a The police of Lubin, Russian Polane the have unearthed a band of robbers con as posed entirely of women and the lear on ers have been taken Into custod the ble These women are said to be respons om beries. for a long series of highway rol ing. me According to the Mexican Herald, riptrade war on a large scale is soon be fought in the republic of is