Click image to open full size in new tab

Article Text

DEPOSITORS' HOPE DIMMED AS BANK REPORT IS MADE

Continued from Page

$200,000 held by the Chelsea Bank and Trust Company, which closed few days after the Bank the United States. Register James McQuade of Brooklyn shown as indebted the bank by $10,000. His note indorsed by former Controller HerMetz, director of the closed Other jurists in the loan list are Magistrate Louis Brodsky cently exonerated by the Appellate Division on charges of engaging business while bench; Supreme Court Justice Aaron Levy, County Judge Max Levine former City Court Judge Gustave Hartman. The loans Justice Levy and Judge Levine were revealed in the Eagle some time The estate of James Riorago. dan, president of the County Trust Company and close friend end clate former Governor Alfred Smith, on the list indebted the bank by $340,037, secured notes.

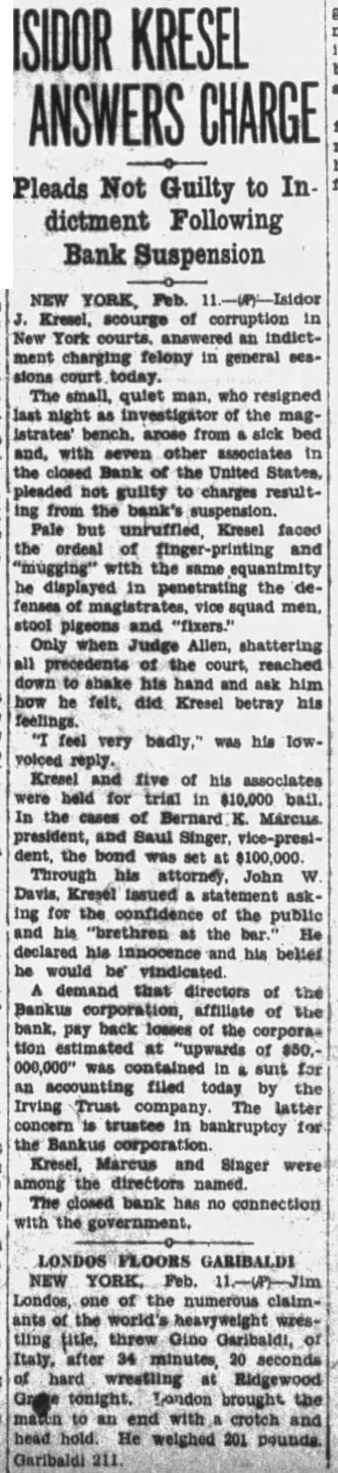

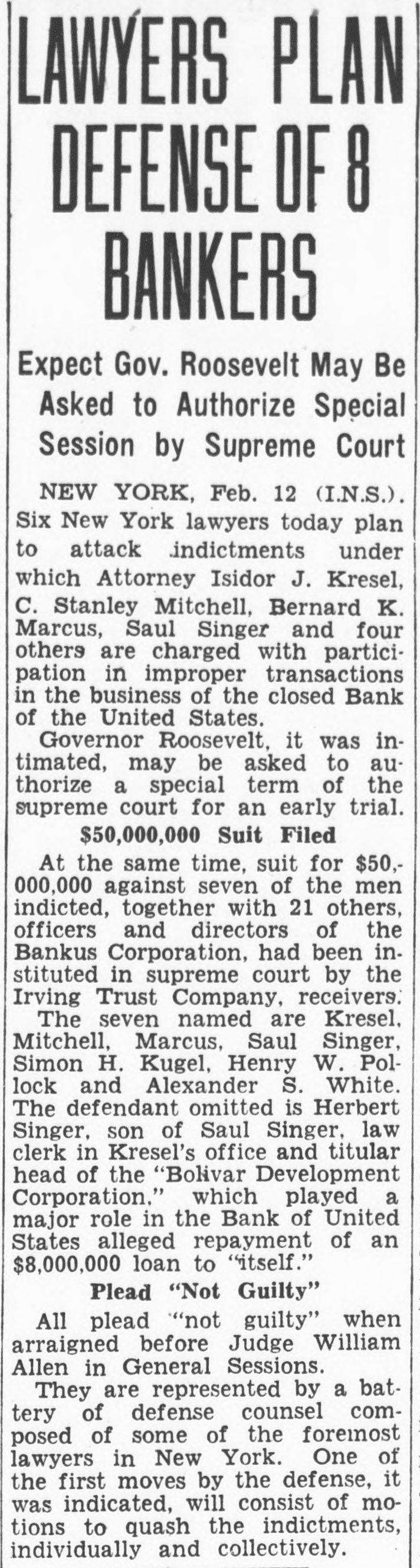

Jurists' Loans The jurists' loans are given follows: Magistrate Brodsky County Judge George Martin, of Brooklyn, also appears rower on unsecured note $10,000. declared. did Register McQuade, that he ranging to pay the loan when matures. Sheriff Aaron Jacoby, Brooklyn, listed as having two loans totaling $5,120. Isidor Kresel, director and counsel the bank, said today that has been paid since the bank closed. Samuel Koenig, Republican leader of Manhattan, listed owing the bank unsecured, on the day closing. He issued that obligations have been paid off his since the bank closed. Edward Flynn, Secretary State Bronx Democratic leader. listed having secured loan: Joseph Tumulty. secretary the late President down having discounted and Dr. Wilnote liam Greeff, Hoshaving an $800 unsecured pitals, as note. $20,000 unsecured note of the Holding Company bears the "indorsed by Arnold Rothstein."

Loan Distributions The bulk the loans are distributed in the garment and real estate trades. Several, however, are listed against theatrical personages, cluding unsecured note held against Florenz Ziegfeld small notes signed Mariyn Miller Winnie Leightner. William Klein, theatrical lawyer and close friend of the missing Justice Crater, carried owing $100,000 secured note. Former Judge Emil Fuchs down obligated the extent secured by stock the Boston National League Baseball Club, of which he president. Among the large borrowers are Samuel Rubel, Brooklyn coal ice operator, unsecured obligations totaling Telsey, Simon Kugel, director the Samuel Rubel, Loans well up in the mark involve Seel Ringer. brother Saul Singer, vice president of the bank, the extent of Morris White, director, $900,000.

Loans Political Clubs The Manhattan County Committee and the National Republican Club are listed as having obligations $20,000 and $5,000 spectively, while the West Flatbush Democratic Club and the New Utrecht Democratic Club Brooklyn are down for loans of $600 and each. Churches, synagogues, educational centers religious and social organizations listed having substantial loans.

The Key to Lifuidation The "meat" schedule is garded centering the 800-odd pages devoted to the 10,000 loans and the lists of mortgages, building loans stock bond holdings. amount realized from liquidation of these resources the key the liquidation. The loans are down as totaling which are distributed among the bank's chain 57 affiliates investing, speculating, in real estate. of these loans unsecured. with the ception note of the Bankus Corporation. security this instance consists entirely shares of members of the affiliate chain, which record as heavy debtors the bank with unknown resources. The collateral comprises 100 shares Manhattan Square Inc.; shares of York Corporation, 20,516 shares of Municipal Financial Corporation and 20,906 shares City Financial Corporation. The bank's involvements. through stock holdings and building mortgage loans, in affiliate chain total more than $32,000,000.

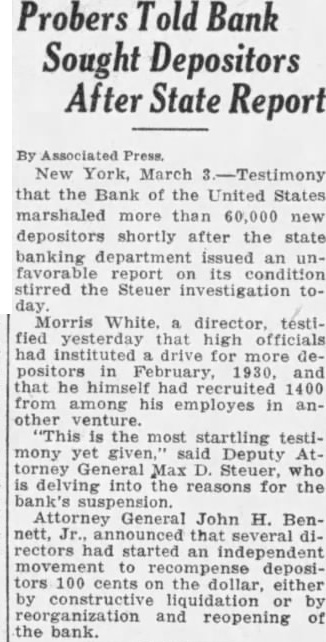

Not Damaging in Itself That the bulk of the loans are amounts are tabulated in the held damaging itself, because the large among the garment trades. howare that many of the smaller loans may have taken out by small of the bank units when stock hit the high point the 200s, and number these may be hard recover. The unstable condition of the real estate market makes the liquidation on estate obligations hazardous the best. The Department's examination last September placed $37,000,000 the loans in the classes slow, doubtful criticized. Just which these loans were is not apparent in the schedule. The vailing opinion that the exigencies including virtually forced sales, further impair loan list, $60,000,000 of the outside figure.

Realty Market The slow real estate market may, pointed effect of nearly 50 percent the each under the headings and building loans the market. Approximately 10 percent the mortgages are listed Among the bond on the skyscraper the Borough Hall section. Real estate involvement in bonds and affiliate stocks figure, according