Click image to open full size in new tab

Article Text

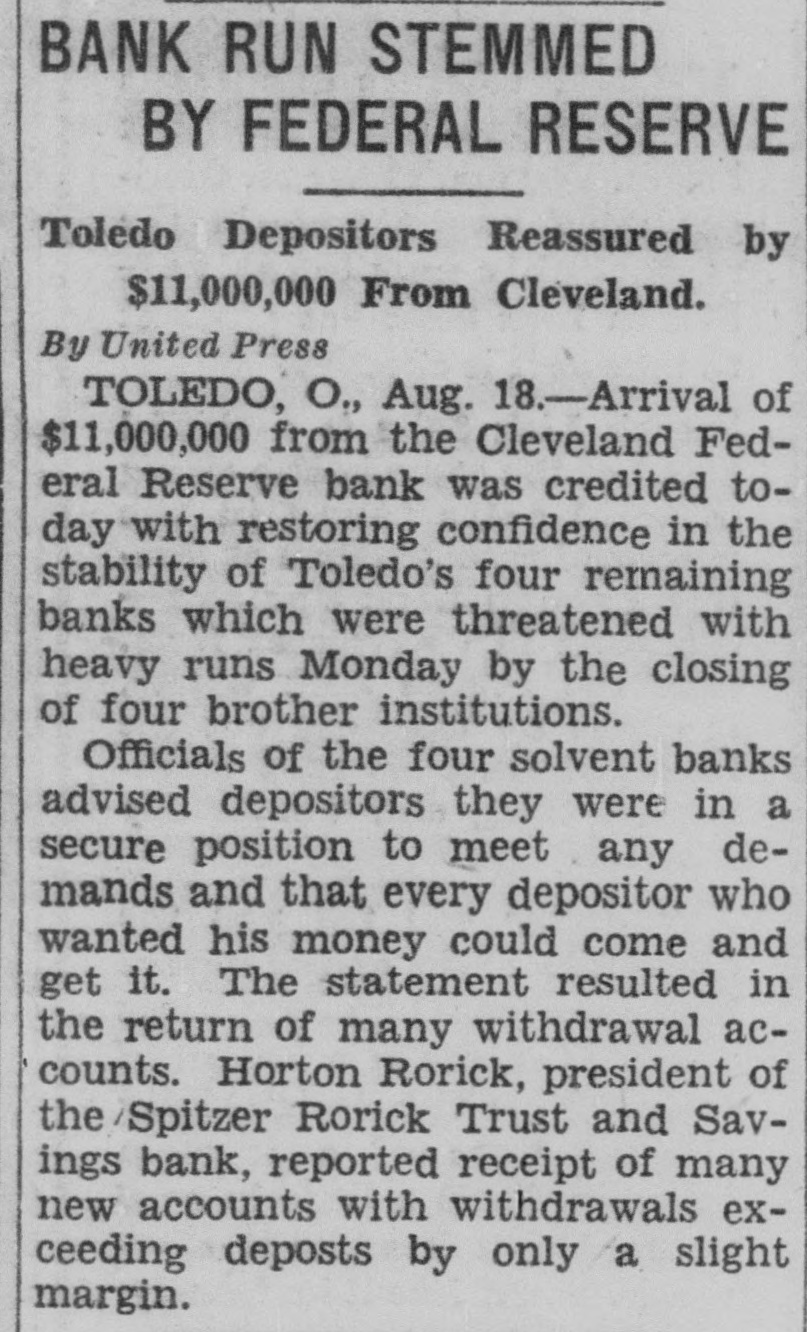

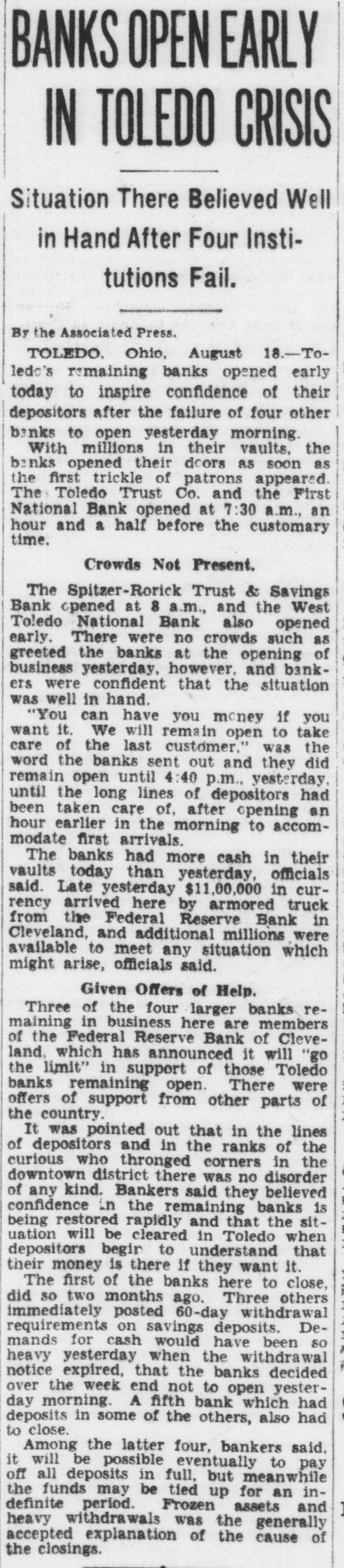

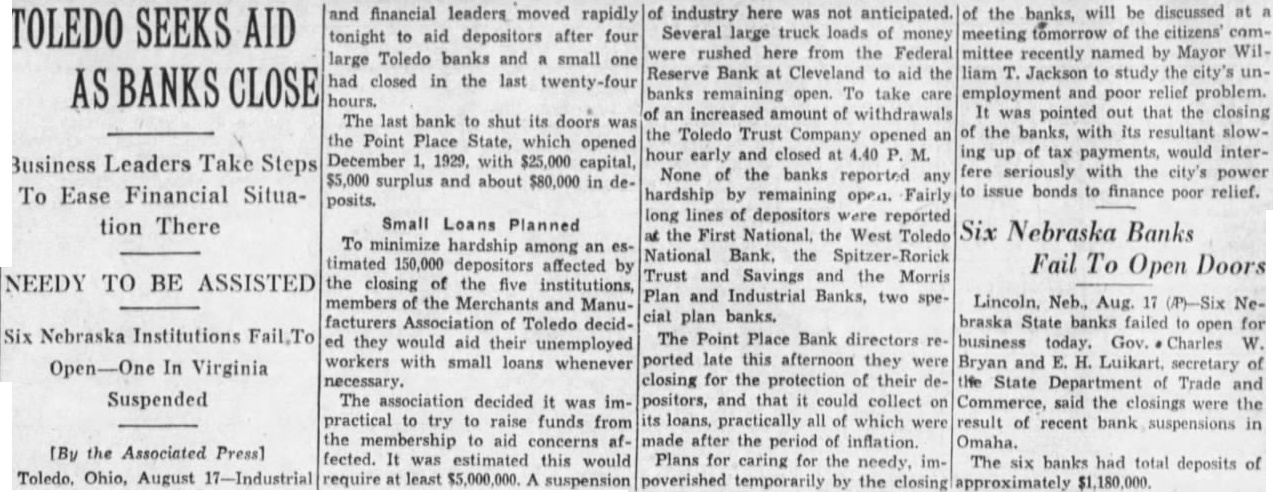

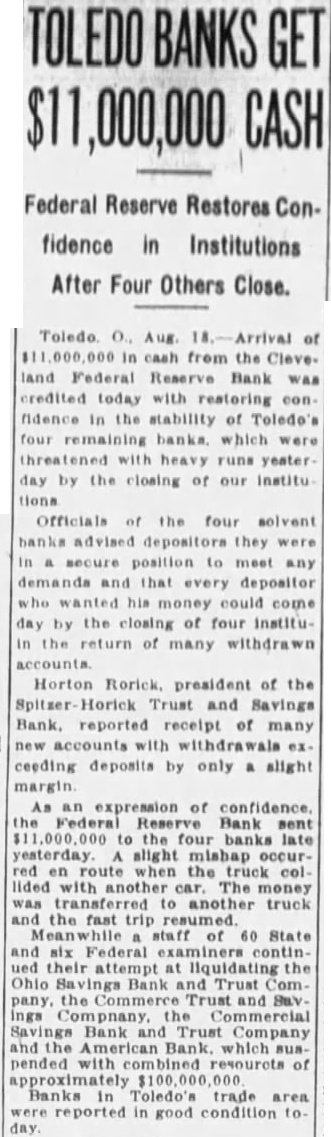

TOLEDO SEEKS AID AS BANKS CLOSE

Business Leaders Take Steps To Ease Financial Situation There

NEEDY TO BE ASSISTED

Six Nebraska Institutions Fail,To Open-One In Virginia

Suspended

[By the Associated Press] Toledo. Ohio, August 17-Industrial and financial leaders moved rapidly tonight to aid depositors after four large Toledo banks and a small one had closed in the last twenty-four hours. The last bank to shut its doors was the Point Place State, which opened December 1929, with $25,000 capital, $5,000 surplus and about $80,000 in deposits.

Small Loans Planned To minimize hardship among an estimated 150,000 depositors affected by the closing of the five institutions, members of the Merchants and Manufacturers Association of Toledo decided they would aid their unemployed workers with small loans whenever necessary. The association decided it was impractical to try to raise funds from the membership to aid concerns af. fected. It was estimated this would require at least $5,000,000. A suspension of industry here was not anticipated. of the banks, will be discussed at a Several large truck loads of money meeting tomorrow of the citizens' comwere rushed here from the Federal mittee recently named by Mayor WilReserve Bank at Cleveland to aid the liam T. Jackson to study the city's unbanks remaining open. To take care employment and poor relief problem. of an increased amount of withdrawals It was pointed out that the closing the Toledo Trust Company opened an of the banks, with its resultant slowhour early and closed at 4.40 P. M. ing up of tax payments, would interNone of the banks reported any fere seriously with the city's power hardship by remaining open. Fairly to issue bonds to finance poor relief. long lines of depositors were reported at the First National, the West Toledo National Bank, the Spitzer-Rorick Trust and Savings and the Morris Plan and Industrial Banks, two special plan banks. The Point Place Bank directors reported late this afternoon they were closing for the protection of their depositors, and that it could collect on its loans, practically all of which were made after the period of inflation. Plans for caring for the needy, impoverished temporarily by the closing

Six Nebraska Banks Fail To Open Doors

Lincoln. Neb., Aug. 17 (P)-Six Nebraska State banks failed to open for business today. Gov. Charles W. Bryan and E. H. Luikart. secretary of the State Department of Trade and Commerce, said the closings were the result of recent bank suspensions in Omaha. The six banks had total deposits of approximately $1,180,000.