Click image to open full size in new tab

Article Text

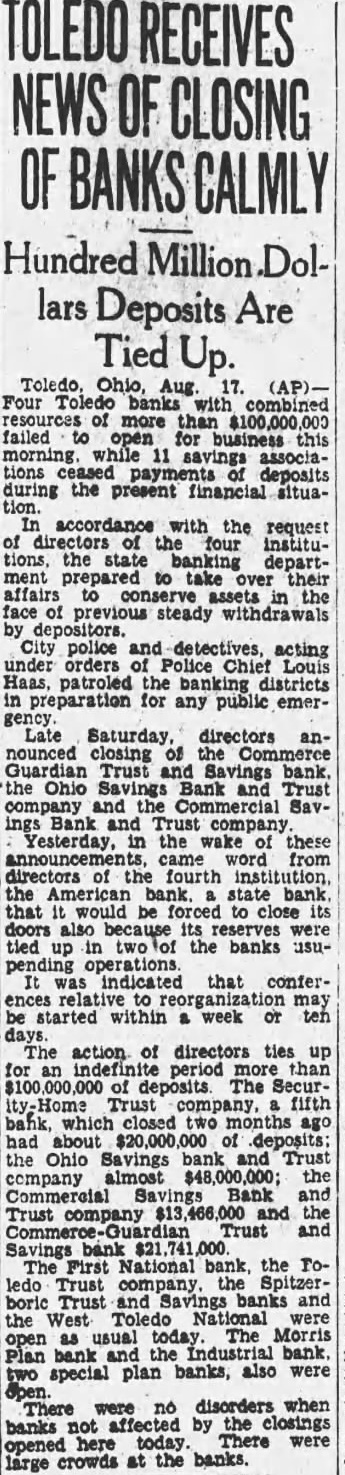

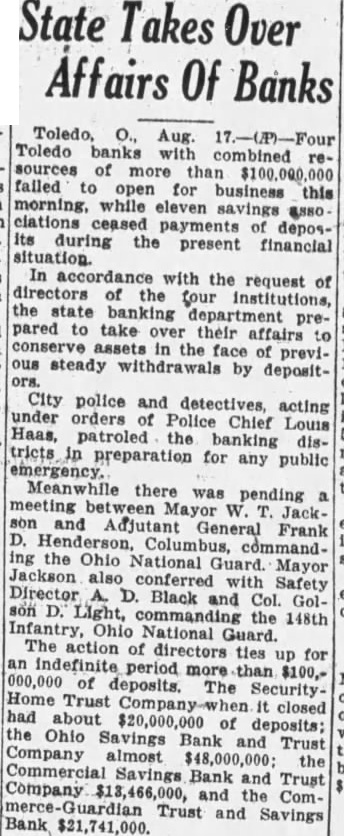

PROSPERITY PLAN WORKS IN TOLEDO Set-up Devised to Make Good All Deposits in Four Big Banks Which Closed. By the Associated Press. TOLEDO, Ohio, November 23.-Without waiting for a return of Nation-wide prosperity to give it a helping boost, this city, hard hit by a series of large bank failures, is pulling itself out of the mire "by its boot-straps." Although approximately $100,000,000 was tied up in the four big banks which closed several months ago, Toledo has kept the wheels of commerce running steadily, and 'now at last things are getting better. Factories are working faster and longer, retail trade is picking up, people on the streets are smiling again, and best of all-the closed banks are expecting to pay a hundred cents on the dollar. The initial dividends of 15 to 30 per cent are scheduled to be paid December 15. Ingenious Scheme Devised. The four large banks which closed, and their approximate deposits, were: Ohio Savings & Trust Co., $36,000,000; Commercial Savings Bank & Trust Co., $17,000,000; Security-Home Trust Co., $20,000,000, and the Commerce-Guardian Trust & Savings Bank, $18,000,000. An ingenious scheme was devised to cope with the problems of these closed institutions. Instead of selling their assets at "distress-sale" prices, special financial machinery is being set up to give the depositors all the ready cash possible, yet save them from the losses of a hasty liquidation. Under the salvaging plan, approved by the State banking department, a new bank and three holding companies are being organized to take over the Ohio, the Commercial and the Security-Home, December 15. Fourth to Be Reorganized. All available cash and prime securities are to be transferred that day to the new bank and credited pro-rata to the old despositors. The initial credit from the old banks will average 20 per cent. The rest of the assets will be deposited separately with the holding companies. The new bank is to be capitalized at not less than $2,500,000, of which half is to come voluntarily from the depositors themselves. The fourth bank, the Commerce-Guardian, will be reorganized under a new name, independently of the others. Its successor also will open December 15, and will put 30 per cent of each old deposit in new accounts.