Article Text

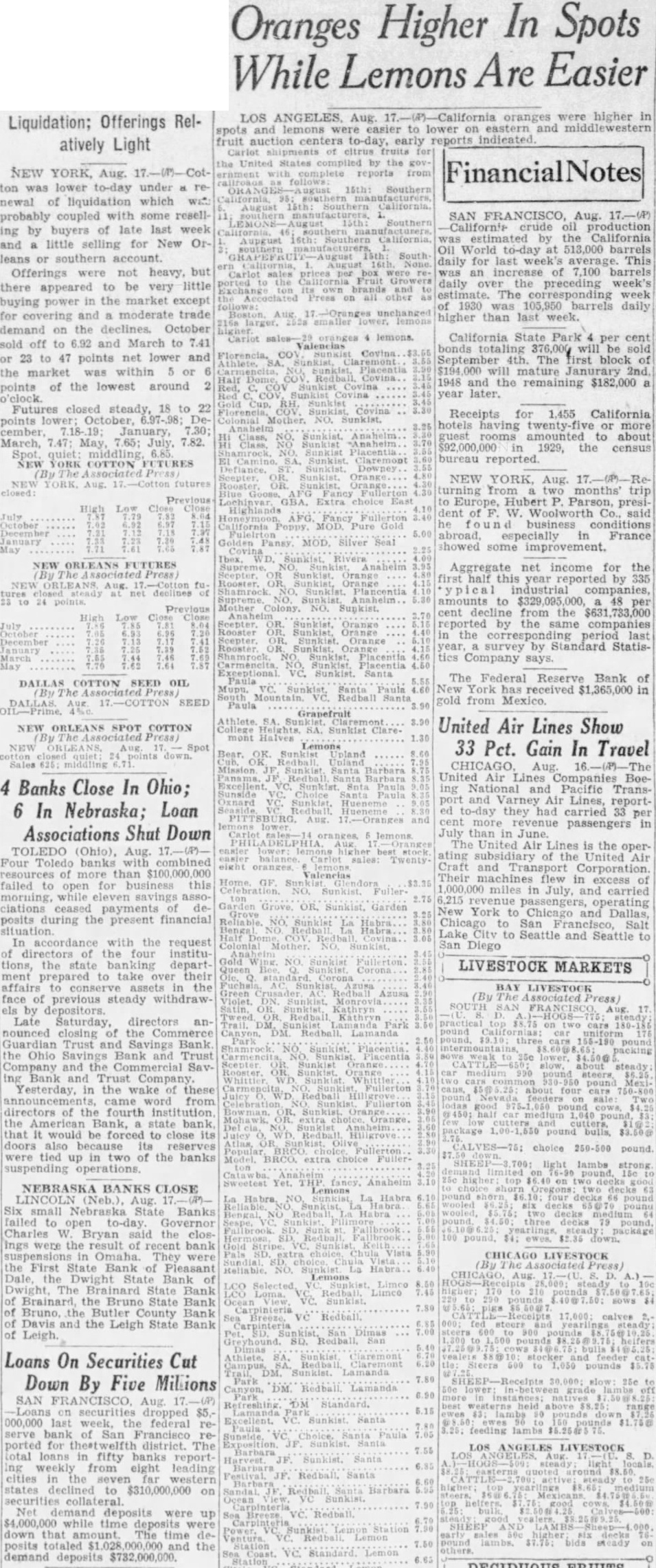

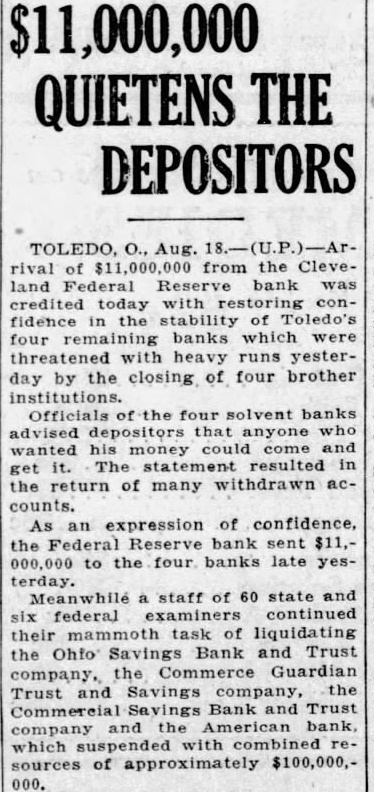

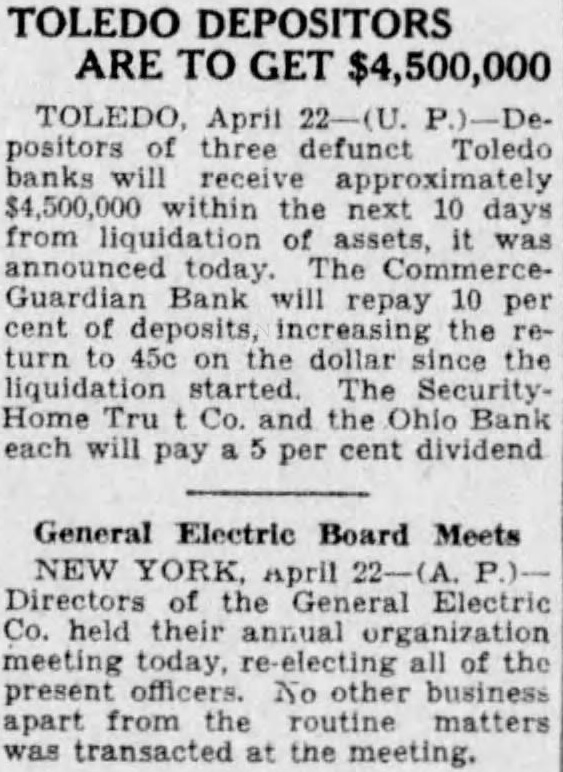

Silver Bar silver continued un changed at the close of the week holding at 27% an ounce New York and 12% pence in London Washington, August 15the Farm Board finally will adopt to the Southern cot farmer his low dilemma tonight the close interest of toel-Operations of steel mills in Washington the Youngstown district next week Hope been virtually abandoned will average per cent of rated for its proposal that third of the an increase of one per cent current crop be destroyed and over the past week, Dow, Jones & ization supplies held off the market Co. estimates. for year At least five actual rejections been received the Governors TOLEDO BANKS CLOSED. who were asked to join in the program. Three Savings Institutions Turned There apparently is no immediate Over To State Department. prospect of action although many to that Toledo, Ohio, August end have out. The disposit Directors of the Ohio Savings Bank seems be to leave the actual for & Trust Co., the Guard plan squarely up to the board to be Trust & Savings Bank and the worked out the counter Commercial Savings Bank & Trust proposals put forward by Governors. Co., at special meetings tonight. de- Senators and cided to close the three board members continued banks and turn their assets their efforts to reach an agreement the State Superintendent of Banks with the directors the American This action means that the three Cotton Cooperative Association on down-town banks and their 34 the amount advances to be branches throughout the ed in handling this city not be opened Monday year's The bumper morning pective crop 15,584,000 In the of said the this action for protection of all de- tions have been in process for during an unparalleled several days. TRY OUT GROUP MARKETING Salem, Ohio, August Orchardists Mahoning and Columbiana Counties today began their first in group marketing. They completed deal whereby large of the apple and peach will be sold an agency 700 and 800 cars of fruit will be shipped with East Palestine New Coford and Canfield