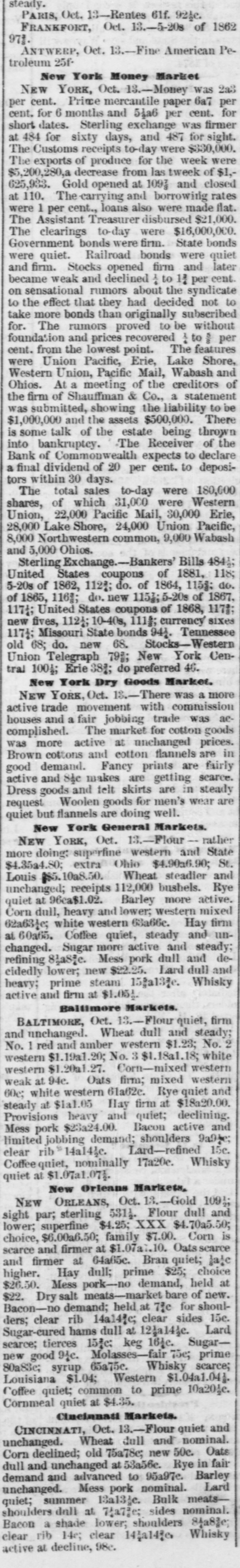

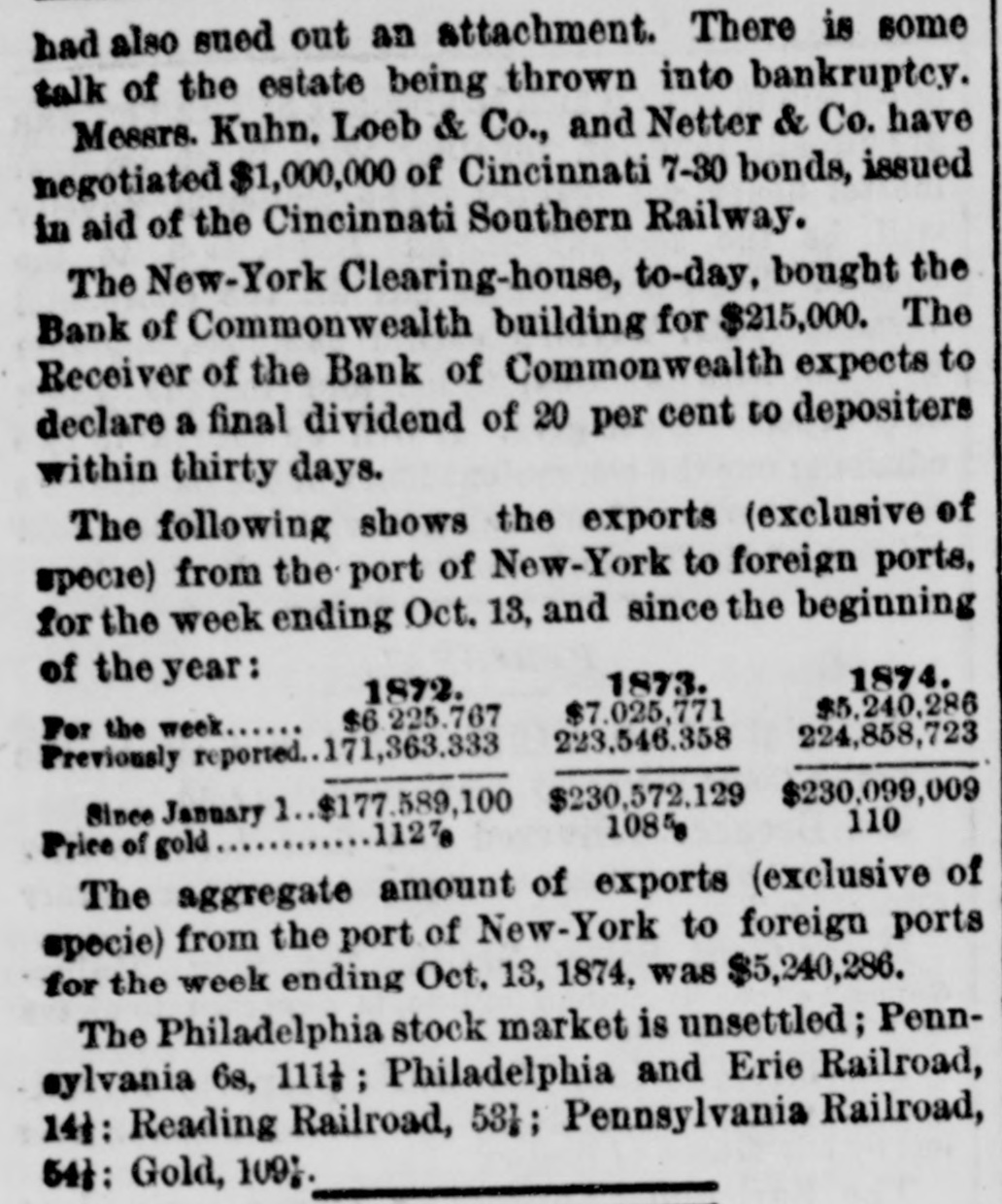

Article Text

- FROM NEW YORK. FAILED NEW YORK, September 20, 1:15 p.m Brown, Wadsworth, & Co. have failed THE BANK STATEMENT will, it is said, not be ready before night, if then. To give the usual quotations of stocks is not possible to-day. THE FAILURES OF BROKEES came in such quick succession that blocks of stocks were thrown upon the market to realize THE GOVERNMENT TO THE RESCUE A special from Washington says it may be stated on the highest authority that should the order to purchase $10,000,000 of bonds fail to check the financial excite ment, it has been decided by Secretary Richardson to issue any part of the FORTY-FOUR MILLIONS RESERVE necessary to restore confidence There were THIRTEEN PROPOSALS to sell bonds to the government at the sub-treasury, aggregating $2,672,659 at from 109 to 112. CLOSED ITS DOORS The National Trust Co. has closed its doors. OUT OF THE CLEARING HOUSE Certificates of the Mechanic's Banking Association and the Continental bank have been thrown out of the clearing house. THE CROWDS AND EXCITEMENT in Wall and Broad streets are unprecedented, and even in the neighbor lood of those financial centres, groups are gathered discussing the situation At this hour, nearly 1 o'clock, the millions promised from Washington cannot be made available owing to the RED TAPE REQUIREMENTS of opening and reading the offering to sell bonds, and telegraphing to know if the rates are acceptable. The tills of the best and strongest houses MUST BE GETTING LOW, having stood the run now of nealy three days Under the order issued by the president of the Stock Exchange forbidding members under penalty of expulsion to engage in operations outside, it 18 not possible to 1 realize on securities, and EACH MAN'S OWN VAULT is now his only stand by. GOLD at one o'clock, 111] The bank of North America HAS CLOSED ITS DOORS An effort is said to be making to get the public and private bankers to act SIMULTANEOUSLY and close at once, not waiting for the ust ual hour. NOT SUSPENDED The Bank of North America has not ( suspended. THE EXCITEMENT AND PANIC II which followed the announcement in the c stock exchange of the suspension of the 8 b Union Trust company, and the bank of e Commonwealth, were beyond description W The Stock Exchange 11 RESEMBLED A MAD HOUSE, b and the streets were blocked with people, II 11 laboring under the greatest excitement a and laney prices tumbled from 2 to 16 per C cent, and stocks were slaughtered without C8 my apparent regard to value. Amid the P SURGING OF THE EXCITED CROWD. o n the stock exchange and the continued t destruction of values, there were it SOME FEW COOL A ND LEVEL HEADS. a These men conceived the idea of initiat 11. ng it plan of closing the exchange and m immediately the governing committee el as convened to take action therein In in few minutes the board was di CALLED TO ORDER th nd the announcement made that W be exchange would be closed until urther orders from the president This S as received with great joy, and the ex. m hange N & RESOUNDED WITH CHEERS for 'he gong was sounded, and in less time er ian it takes to record the fact, the wild xoitement was over and the surging st rowd of frantic brokers disappeared and un he Stock Ex range was th A DESERTED HALL C The retunds of the treasury was m rowded with people listening to the prolie osals to sell bonds as they were read off, m while the Wall street steps of the build. the ng resembled a mass meeting the SENATOR MORTON 12 f Indiana was in the treasury when the lig proposals were read tr Certifications of the Bank of North ce America have been ele HROWN OUT OF THE CLEARING HOUSE lo hi gave rise to the rumor of its suspenC on pe THE BANK PRESIDENTS of ave passed a resolution to issue immedi ely ten million in loan certificates is MEETING ALL DEMANDS sa do NEW YORK September 20, 1:80 p.m CO he Fourth National bank is meeting all