Article Text

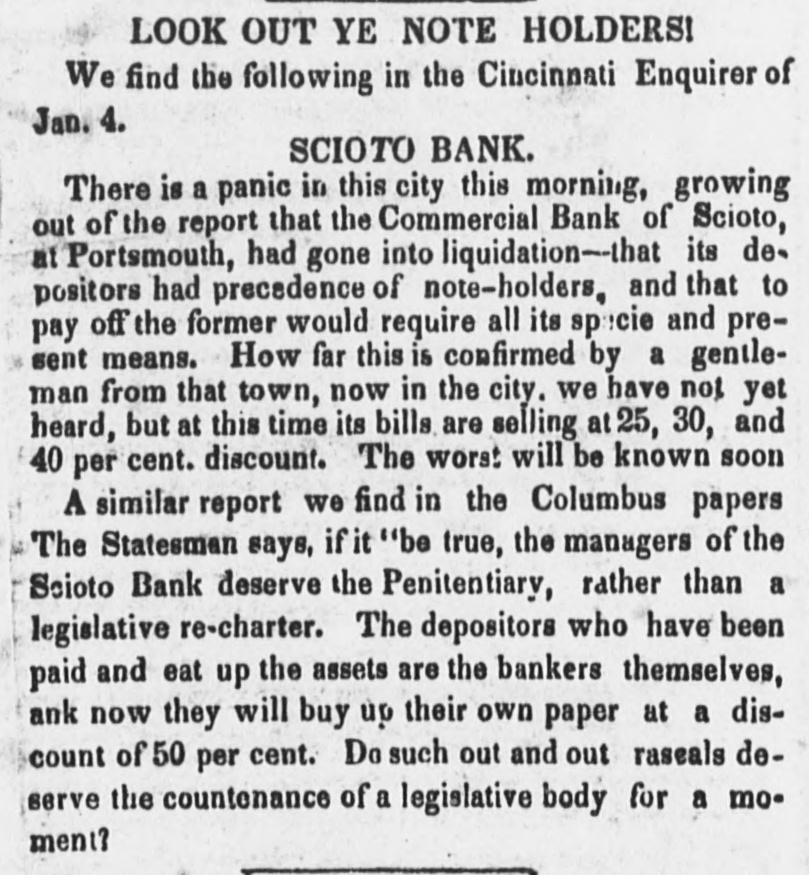

LOOK OUT YE NOTE HOLDERS! We find the following in the Cincinnati Enquirer of Jan. 4. SCIOTO BANK. There is a panic in this city this morning, growing out of the report that the Commercial Bank of Scioto, at Portsmouth, had gone into liquidation- that its depositors had precedence of note-holders, and that to pay off the former would require all its specie and present means. How far this is confirmed by a gentleman from that town, now in the city. we have not yet heard, but at this time its bills are selling at 25, 30, and 40 per cent. discount. The worst will be known soon A similar report we find in the Columbus papers The Statesman says, if it "be true, the managers of the Seioto Bank deserve the Penitentiary, rather than a legislative re-charter. The depositors who have been paid and eat up the assets are the bankers themselves, ank now they will buy up their own paper at a discount of 50 per cent. Do such out and out raseals deserve the countenance of a legislative body for a moment?