Click image to open full size in new tab

Article Text

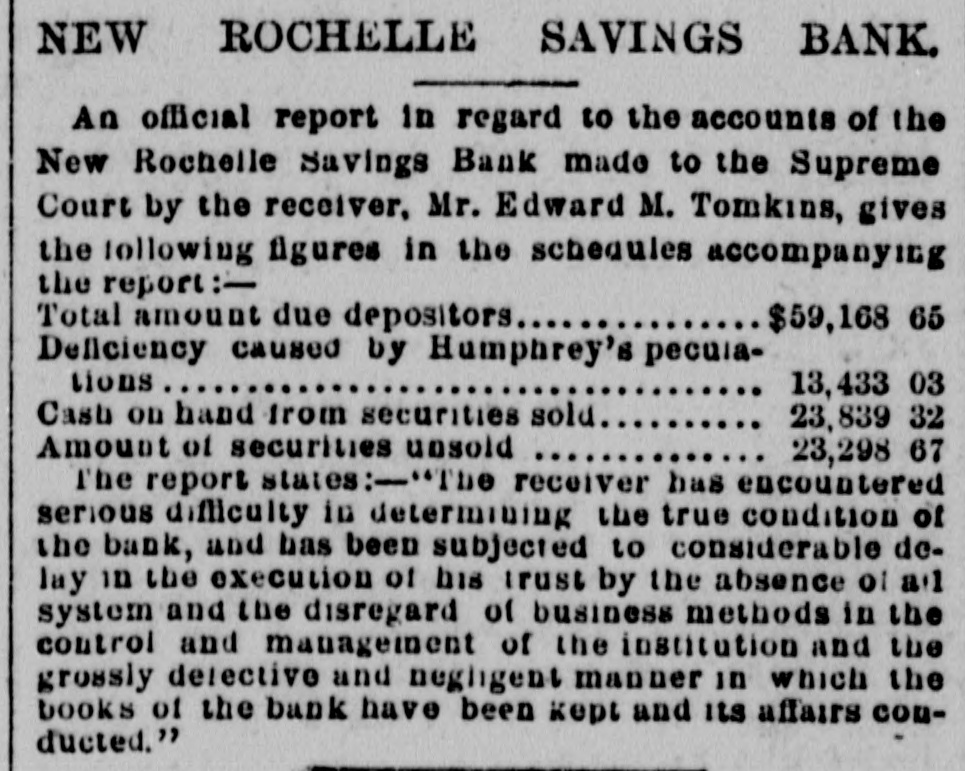

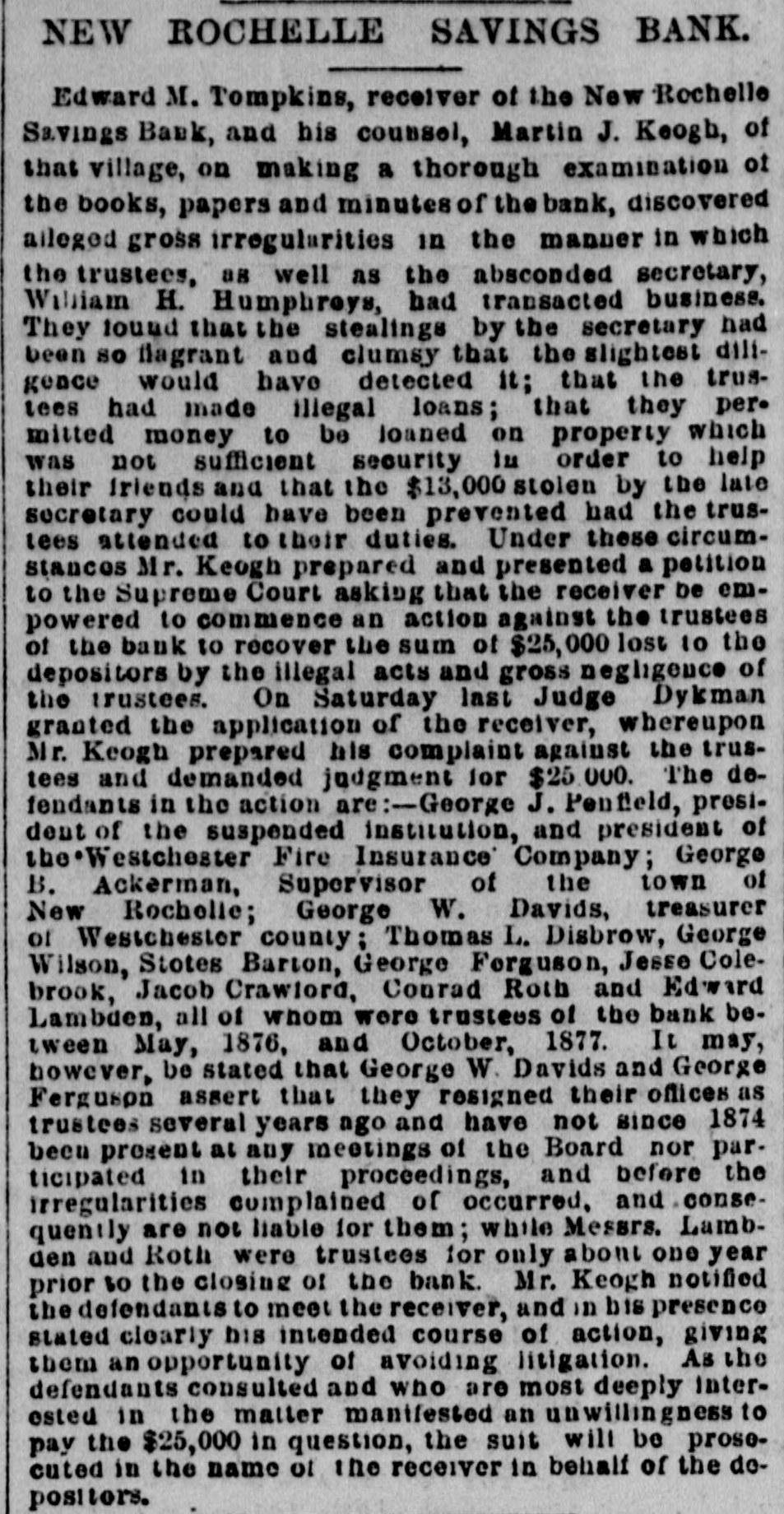

NEWS SUMMARY. Eastern and Middle States. Before & commistee of the Pennsylvania Legislature appointed to investigate the Pittsburgh railroad riots, R. A. Ammon, of Pitteburgh, who was at the head of the Trainmen's Union at the time of the strike, testified that the citizens offered the strikers arms to resist the troops two prominent citizens having of fered a hundred stand of arms each one of these citizens went to see him at Allegheny told him that he hoped the men would stand for their rights, and promised them arms and money. The steam chimney of the Hudson river steamer Magenta exploded two miles below Sing Sing, N. Y., and two passengers were killed outright, two were fatally scalded and several others received seriousinjuries. Warren Lane, bookkeeper of the Planet Mills Manufacturing Company, Brooklyn, N. Y., was returning from the company's bank in New York where he had drawn $4,000 with which to pay off the employees. He was ao companied by an assistant, who carried $700 in silver. When in an unfrequented locality they were approached by three men, dressed as laborers, who suddenly attacked the two, knocking them down with blows from sand clubs and relieving them of the money in a twinkling. Before they could gain their feet the thieves were rattling off in a wagon that was waiting in charge of a confederate and made good their escape. Peter McHugh, Patrick Hester and Patrick Tully were hanged at Bloomsburg. Pa., for the murder of mining superinteudent named Rea, in 1868. The town was filled with people from the surrounding country, but only about two hundred persons were admitted to the jail The yard where the execution took place, three men were hanged together, and exhibited little signs of fear. Hester, who was in substantial circumstances and for whom strenuous efforts had been made to obtain an amelioration of the death sentence, protested his innocence to the last. While the men were still hanging a shed on the side of the jail yard gave way with a crash, precipitating about fifty persons to the ground and injuring a little boy 80 severely that he died soon after. Fires Twenty-three buildings were destroyed by fire in Keeseville, N Y., causing a loss aggregating $65,000. Nearly a whole block of large business houses in Philadelphia was burned, the fire being one of the largest that has ever visited the city and causing an estimated loss of over $1,000,000. Comptroller John Kelly, of New York city, has written a letter to the attorney general of the State in favor of the release of William M. Tweed from further confinement. Comptroller Kelly says in his letter " As a public officer I urge his discharge, because I believe his further detention in a debtors' prison is neither beneficial to the State as an example to evildoers, nor in any sense serviceable to the Meanwhile. Tweed has refused to testify further in regard to ring frauds until he is released. The Higgins Building five-story marble structure on Canal street, New York-was almost totally destroyed by fire, and seventeen business firms suffered losses aggregating $645,000. Judge Blatchford, of New York, has rendered an opinion against ex-Governor Samuel J Tilden. in the suit of the United States for the recovery of several years income tax. This snit was instituted during the election campaign in 1876. The effect of the deci-ion will be to bring the case before a jury on the question of the amount of Mr. Tilden's income during the eleven years from 1862 to 1872, during which he made up no return himse'f, but allowed the assessor to make up the return and paid the tax thereon subject to a penalty of five per cent. The recent report of Acting Superintendent Henry L Lamb on the condition of the savings banks in the State of New York shows that nine savings banks were closed during 1877the Long sland. of Brooklyn: Clairmont, Clinton. German, Oriental and Yorkville, of New York Rock and of Nyack, Saratoga, of Saratoga Springs, and the New Rochelle, with a total amount due depositors of $1,601,719.34. In the State, to-day, 186 savings banks are doing business. The total deposits and the number of depositors have decreased during the year. The deposits fell off nearly $6,000,000 the transactions of the year were smaller in their volume than in other recent years more accounts were opened than were closed the average of each deposit declined, and the surplus of the institutions has shrunk. The total resources of the banks. now in operation, was on January 1. 1878, $56,786,336 total liabilities, $51,455,238, leaving a surplus of $5,331,098. From these facts the superintendent finds reason for the belief that the savings banks are coming back to sound rules in administration, are commanding reasonable confidence of depositors, and are sound. The Broadway Savings Bank, of Lawrence, Mass., and the Sixpenuy Savings Bank, of New York city have been enjoined from doing further business. The latter institution was patronized by the remarkably large number of 33.000 depositors, most of them poor people and children with little accounts. Its liabilities are $1,808 269 77, and the deficiency is estimated at #82, 425. Careless management. amounting almost to indifference, is charged against its officers by the bank examiners The trial of Insurance Superintendent Smyth, of New York, charged by the governor with regularities in office, ended in his acquittal by the Senate by & vote of 19 to 12. The Vanderbilt contested will case drag along in the New York surrogate's court. Much of the evidence offered to show that the Commodore wasmentally unsound or unduly influenced in making his will is excluded. The Pennsylvania Republican State convention will be held at Harrisburg, May 15. Thomas P. Fisher was hanged at Mauch Chunk, Pa., for complicity in the murder of Morgan Powell, a mine boss." While on the scaffold Fisher read part of a statement, emphatically averring his innocence. A bill has been introduced in the New York Legislature providing for a Moffet liquor law similar to that which prevails in Virginia. By ts provisions liquor dealers will be compelled to register each drink sold. A receiver has been appointed for the emearrassed Sixpenny Savings Bank, of New York city. Western and Southern States. Rumors of an Indian confederation in the Northwest have been confirmed. Scouts are reported to have found several thousand Cheyennes and Sioux in Northern Montana on the warpath It is said that Big Bear, one of the chiefs of the league demands as an ultimatum hat the buffalo law shall be repealed, and that Indians shall be allowed to settle their troubles among themselves without interference from the mounted police or the Canadian government. Mrs. George Wallace. her infant child and Miss Church, & schoolgirl, were murdered near Wheeling, W Va., by the former's brother-inlaw, John Wallace. After the murder he aocused his brother of the crime and both we re