Click image to open full size in new tab

Article Text

New Bank's Successful Climax To Months Of Hard Work A 10 Opening

HUGE TASK FINDS OUTSTANDING MEN AIDING MOVEMENT

Long Uphill Grind Crowned With Charter Grant as Reward

By ELDORUS DAYTON Writer The First National Bank of New Rochelle rose like Phoenix, youthful freshness own dead ashes. Behind origin of this new banking institution tale conquest, story of the victory hope, perseverance and purpose the doubts and fears which harassed the munity since the failure the National City Bank to reopen in March. Bank "Holiday" Declared It was back on that momentous day, March that, unknowingly. circumstances were created which were eventually lead the death one of City's leading banks and the birth of new one in place. that the same date on which Franklin Delano Roosevelt took over the helm of the Ship State, Governor Herbert H. Lehdeclared bank because "the spread of hysand the restrictions upon the banking of the country through the measures adopted in many states. "Holiday" Extended The holiday had been declared for period of two days. but 48 hours and the period was extended the new Federal Government took hold the situation On March situation was somewhat alleviated when supply cash for payrolls, food and medicine released by order the Treasury WilSecretary H. first break in the was the Mark cloud the banking crisis. Sound Banks Open rife fever of expectancy as on March throughout the city Roosevelt announced President 100 cent solonly those banks per would open their doors. Speculation among depositors of the various banks institutions would be the fortunate ones. Two days later local banks were preparing applications open forerunner their transmission Hope grew on Washington. March sound institutions in New York City threw open their doors. institution in New The first unlatch sealed portals chelle Bank for Savings the People's with permission to March $25. It was grant up the New Roclosely followed by and the Cenchelle Trust Company National Bank the 15th. Two days this the Huguenot Trust Company threw open its Wait Hopefully The depositors National City Bank waited confithat the financial center in dent had their would which they money resume business soon officers had gone through the mosions of certain technicalities. But March 18 the National City Bank was operating only on restricted basis, and on March 20 Robert R. Rennie, its president conservator according telephonic communifrom Washington, and the following day all banking this Institution suspended until plan could be formuHis appointment confirmed, Mr. Rennie resigned his position president of National Bank, order "to devote his ento task of reorganization of the National City Bank". to be submitted to plan, ington for commenced undergo process of formulation.

Committee Gathers The first meeting deposttors' committee, the harbinger of scores depositors meetings which were to follow and which to result in the opening of the new institution because the indefatigibility its members. was held March 24 Members the late W. M. Roy Frantz, Dr. Guion Edwin Knapp Mayor Walter Otto, James McDonald. Dr. Marino, William Merrill Frederick L. Moran. the late John H. Ranges, former Mayor Harry Scott, McDonald and Raymond Mr. Mullaney later was replaced by Mr. Frantz chairman of the and former Mayor Scott succeeded to the latter while he absent during the months Frantz served up the time of the opening of the Work On Reorganization Shortly policy of censured publicity was adopted while work went ahead plan. Between March 24 and May 26 there was little given the anxiously waiting depositors. That did not that nothing was being done later six reorganization plans were up within that space of time and presented

Washington. The Federal Govto ernment turned down all of them. On May 26, Conservator Rennie and William vice-president of the closed institution, went Washington personally to take to up the matter acceptable reorganization plan. The condition the bank had been to large drain cash period days and economic conditions which securities pledged for loans and other collatthe Prodigious shrinkage in deposits shown by published statements the City Bank. The peak on Dec. when records showed total 1928, Twelve deposits months later they had maintained almost the level,

Depression Takes Toll The took its of depression Oct. 1932 the by deposits been reduced to The last state1933 showed time deposits of certified deposits and cashiers checks, government total of The most severe blow of with public ment from Washington RFC loans. sustained run the bank brought total deposits down to although exact figures had ever been made public. The leakage of more than five millions cash more than bank which had three millions frozen in mortgages could stand. In adopting reorganization plan was necessary to find out that which would give ready amount of cash and yet slowly liquidate the assets of the old institution The "Spokane plan" of subsidizing an entirely new bank, with depositors of the old institution pledging 10 per cent of their deposits stock, the total amount of $450.000. gradually effecting the amortization of the assets, was adopted

S. Accepts Plan On June Federal Government accepted the program, and the following day letters went out to depositors and were printed in newspapers. By June several workers had volunteered their services sell stock. Within days 1.310 shares had been pledged. the result of general gathering of depositors in Columbus School. Within the space of single month. total amount stock subscriptions had leaped 6,500. interim Mr. Rennie had publicly announced he would not officer in the new bank, but would in the best intearests of the depositors conservator. and open letter had gone out and list directors Soon after William C. Merrill pledged take 1,000 shares of the and large corporations they supporting the "Spokane were by subscribing to stock. Bar Group Acts On July the New Rochelle Bar Association the United States Government for more information that its members could instruct and advise clients plans to form First National Bank New By July 7½ per cent of the depositors had subscribed more than per the stock open the proposed bank. Ten later Rennie signed conservator. was said the depositors' committee felt resignation do much instill confidence among depositors new plan. Former Mayor Scott was named replace LeRoy Frantz, who had labored of the deposisince its inception and who at the end of July leaving the city vacation The On July 27 and 28 the Chamber of Commerce and 33 merchants threw their support behind the depositors which enlarged by more members. few days the Bar Association, through Judge Jacob Ruskin, reported that the the proposed bank and the release of 30 per cent of more than half of the total number needed open. On Aug. Edward D. Loughman. New York City attorney, appointed by the Federal government to occupy the position vacated by Mr. Rennie. At the time of the announcement was pointed out that Mr. Loughman had had no connection with the never been shareholder depositor, and never legal pacity officer depositor shareholder of the bank. Cordial Leads Campaign Soon the depositors committee sought old Liberty Loan campaigner would the drive for 15,000 shares successful conclusion. Edward Cordial named chairman of the camcommittee. Only two days after he named. Aug. were apparent and the total had leaped Aug. 8,631. Reports the West Side branch sent the total soaring above the mark. In order culminate the campaign with one final drive cityplanned toward the close of August, with the closing of the West Side branch. A plan devised the idity of subscription by asking merchants to receive stock cash.

Pass 10,000 Mark As plans gigantic meeting being

Sept. the total stock subscription over the 10,000 mark. mass meeting held the auditorium Albert Leonard Junior High and sult thermometer outside the bank building bubbled over after Supreme Justice William Bleakley, Kuvenal MarchMayor Otto Mr. Cordial The curtain had scarcely been lowered enthusiastic scene when second rally at Columbus School Oct. shares taken by subscribers summed than 13,000. final drive "Open the New Bank Before ThanksgivOn Oct. 26. volunteer and representatives !raternal organizations civic associations gathered in the National City Bank building. and circular letters askink additional help from previous subscribers already taken 10 per cent of their original deposit mailed out. Within short time shares totalled more than 13,500, with letters flooding the bank from point in including Hawaii, response to the plea for further succor.

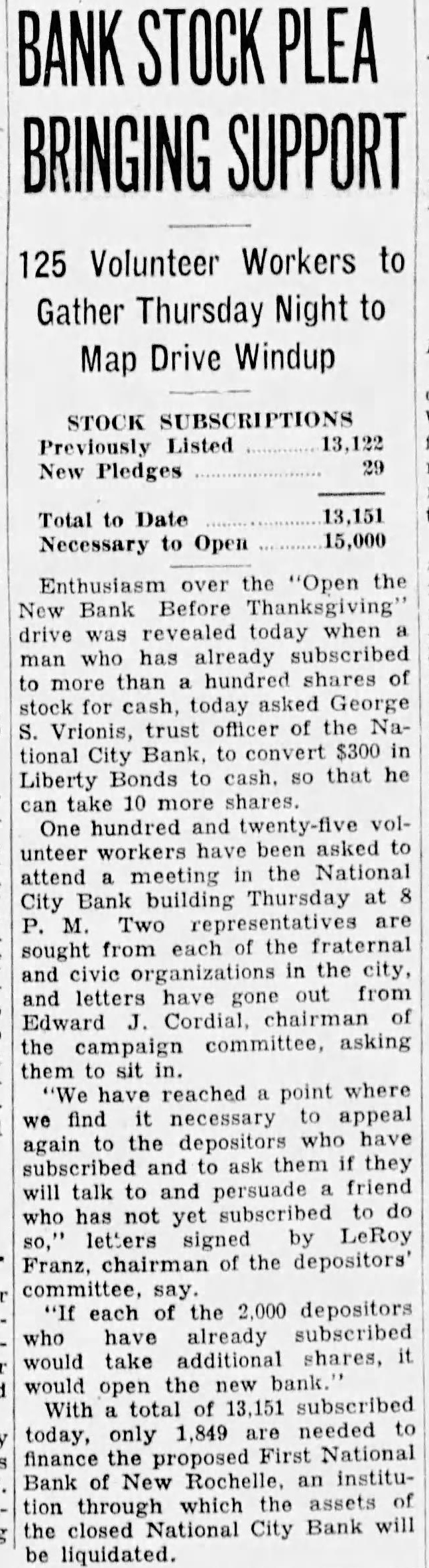

Pass 14,000 Mark On Nov. shares from 2,022 subscribers. 565 of which were for and 41 partly for cash and partly for had been signed On Nov. the total hurdled up. the 14,000 mark. With stock subscriptions still 14.314. and more than 600 needed complete the stock sub scription 15,000 the ganization committee Nov. 18. announced that the would be closed 10 days later. adding that bank will be open humanly thereafter organization committee at that time formed of William Merrill, William Daly, Harry Scott. Dr. C. Guion and LeRoy Frantz, its chairman Five days later. although stock were virtually standstill, only having been recorded in the hours. developments began to come rapidly filed with the Comptroller of in Washington an application for

Hearing On Lease Another of the hearing the lease the National City Bank to the institution. the District filed. At the same time

WILLIAM DALY application powers made to the Federal Reserve Bank. only required three days for the name "First National Bank Rochelle be approved. Next came the end drive with 14,382 shares subscribed. The deficit made the following day Noteman. signed his name block of shares sent the total soaring the mark. the total necessary back projected institution which liquidate the assets of the old tional

Watson Named President Immediately attaches the bank began work the necespapers forward to the Capital. While hearing the lease was adjourned, the organizacommittee that Ernest H Watson Nutley officer Reconstruction Finance had been named president of the new bank. the same time the organization committee expressed the hope that the new would throw open its doors before Christmas, but this hope was later dissipated On Dec. depositors began flocking in to sign proofs claim. procedure necessary before funds could transferred from the old bank to meet their per Three days later LeRoy Frantz named viceserve year while William Shea, an officer the old bank was named trust officer. and E. Milton Berry, cashier

Lease Approved The directors named following Daly Guion and all whom with the exception of Watson, had been instrumental from the first the struggle release the frozen Simultaneous with this came the approval the lease by Alfred Coxe. Federal Judge. From the beginning stockholders of the old bank been sented by commit- including Humphrey J. its chairman. Lester Albertson Robert Forbes, Dorothea Kreit Henry M Edward Baker and Frank Shrenkeisen. signed petition to review the lease, claiming the option for purwas not fair amount. Despite this protest from the stockholders committee. the lease, had been approved by Judge Coxe. While pleas went out from Federal Conservator Loughman for depositors come in and sign up their proofs of there amount of paper work to be effected by attaches of his staff in connection with reorganization of the insti- tution

Hope Runs High triangularly placed offices the Comptroller the office RFC and headquarters of the Federal Reserve Bank. Finally late Saturday afternoon the application for Charter and reorganization first suggested by William Shea trust officer the institution became none other than Raymond McGovern director of the new member the law Dunlap Otto counsel for bank. made public the that the charter had granted and that bank open today. Mr. McGovern had spent many frequently far the hours, working the legal tech nicalities connected getting the Commendation for indefatigible effort in the bank opening must be given to citizens volunteer committee working under which Mr. personnel included: Albert Salerno Harry Abraham George Oscar Maxwell Katz. Jack Harry Sydney Magnus, Ruskin, Edward Boettner. John GunthThomas William Arthur Dealy, Ben-

Christmas and the bank did not open, but hope high as Shea McGovern and Watto Washington two later. The returned New Rochelle reported that details of opening the bank had approved and the new president stayed in the Capital receive blanks for formal application for Charter and other necessary He flew back New Rochelle soon after with the data On Jan. had returned the Capital again with the necesarticles signed. One National First National officials went termined to charter for the they had to go fore President Technicalities held the immediate granting the cause the office of the Comptroller of were certain sufficient had been left for Loughman liquidation of assets National City Needed More "Cushion" Conferences resulted the opinion by the Comptroller Currency that the National City Bank have apply for further RFC loan of to give the For several days were shuttled back and forth

Fannie Lejamin William George Kirch Charles Arthur and Lewis James Dandri and Galgano. Old Employes Work Hard Attaches the staff of Federal Conservator all the old also workployes ed assiduously to work out mountains data connection with of the old bank the liquidation the reorganization the new. William BenThey Martin Butti, George Vrionis, Charles George Shufelt and the bookkeepand former employes the National City kept on by