Article Text

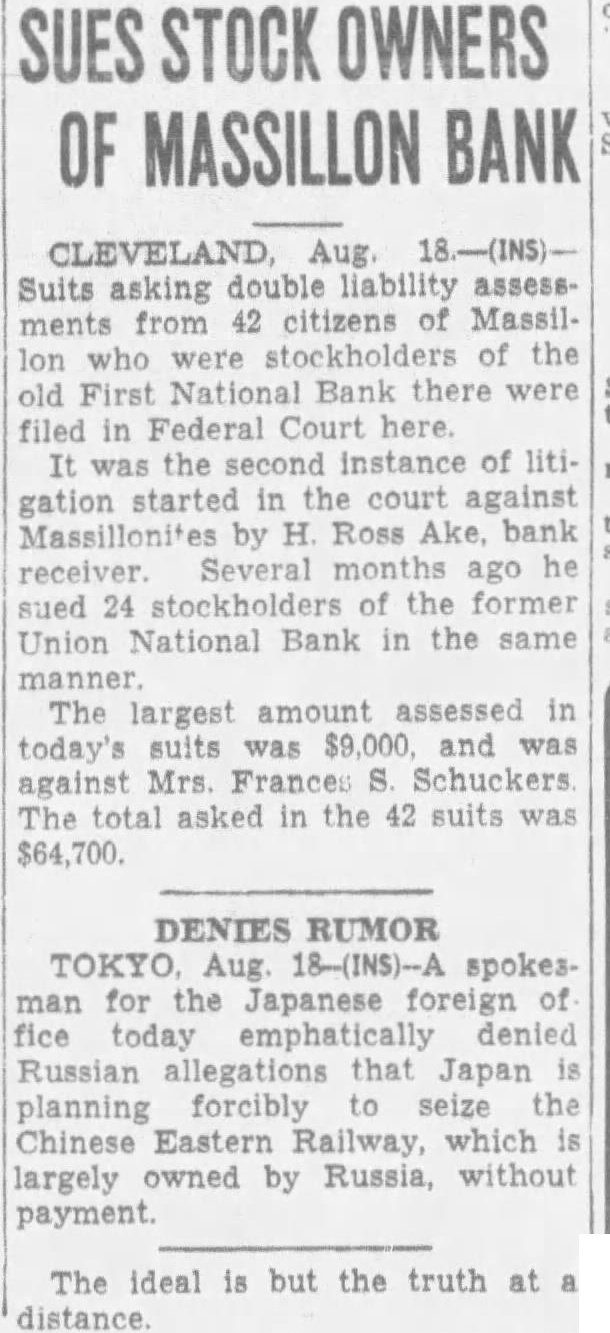

SUES STOCK OWNERS OF MASSILLON BANK Suits asking double liability assessments from 42 citizens of Massillon who were of the old First National Bank there were filed in Federal Court here. It was the instance of litigation started in court against Massillonites by H. Ross Ake, bank receiver Several ago he sued 24 stockholders of the former Union National Bank in the same manner. The largest amount assessed in today's suits was $9,000. and was against Mrs. France S. Schuckers The total asked in the 42 suits was $64,700. DENIES RUMOR for the Japanese foreign of today emphatically denied Russian allegations that Japan is planning forcibly to seize the Chinese Eastern Railway, which is largely owned by Russia, without The ideal is but the truth at distance.