Article Text

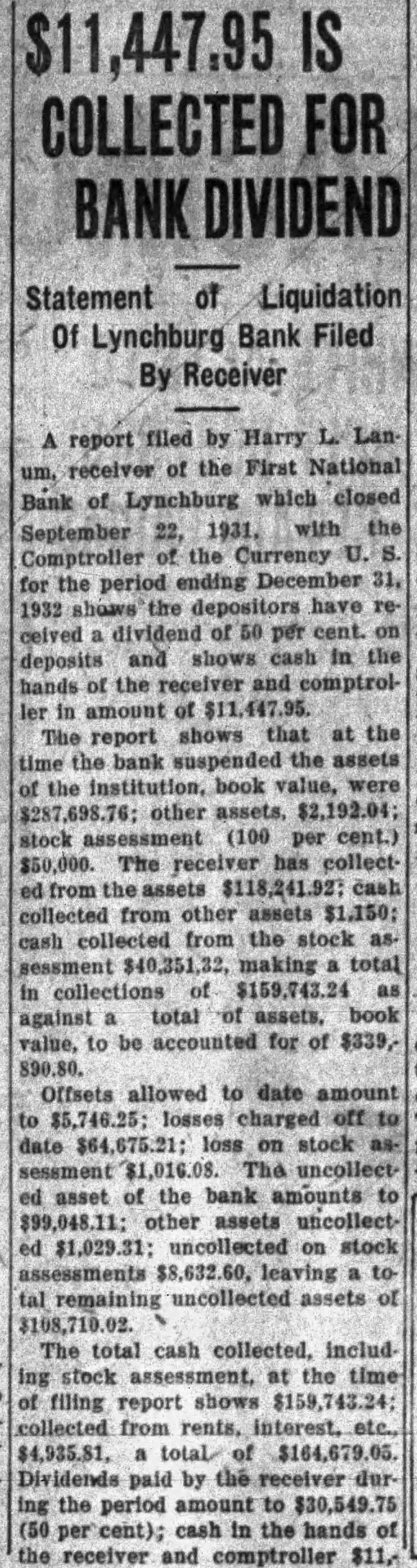

Today's Prize Winners (These hints each receive a prize of $1. Write with ink on one side of ginger. Cook two hours and seal. paper. Address contributions to HouseBucyrus. MRS BIRD BAKER. hold Editor, Plain Dealer. Prizes for week are mailed Monday of week Baked Mexican Steak. 1½ round steak Two in One Cookies. sugar shortening eggs sour cream soda. baking powder sifted flour broken nut meats vanilla Cream sugar and shortening. add eggs and beat Stir in sour cream sift all dry ingredients together and add to Drop from spoon on baking and bake for fifteen minutes. Cut up two squares of chocolate and melt After half of the mixture has been baked add melted chocolate and cup raisins and drop as before and bake Elyria. MRS. E. REISING. English Chutney. 12 large ripe tomatoes large onions peppers, green, red apples Chop through coarse food chopper and add quart vinegar, cups su- Flour Bacon drippings 1 green pepper, chopped salt and pepper Have the steak cut to 11/2 inch thickness. Pound into the meat onehalf to cupful the flour. Season with salt and pepper. Place in ba. con drippings and fry enough to well on both sides. Then add tomatoes, and green pepper Cover. Place in the and bake for two hours 302 degrees Fahrenheit. With this steak baked potatoes are good. R. S. 1217 Cleveland Heights Boulevard Named Bank Receiver by U. S. WILMINGTON, Sept. 29 Harry Lanum. receiver in charge of the Citizens National Bank here. today was appointed by the United States of currency ceiver for First National Bank at Lynchburg, near here. which closed its doors last Wednesday. Lanum immediately took charge of the Highland County institution BY WINIFRED H. GOODSELL Miss Goodsell, the Plain Dealer's is one of series of are sings she sending from there, showing the newest styles favored by the fashion PARIS will see in the accompanying illustration garments sketched the House of Molyneux. and while they are not especially intended as an ensemmode the contrasting colors has rather done away with this type of costume-st they could worn together with very effect. The coat, an model of green the top of bodice and sleeves being corded in intricate mode The collar black broadtail the fur forming an effective contrast The frock is also an afternoon mode and fashioned of brocaded green satin Note how the terminate at the back of the skirt with an tendant fullness, this effect favored mode of the Winter.