Article Text

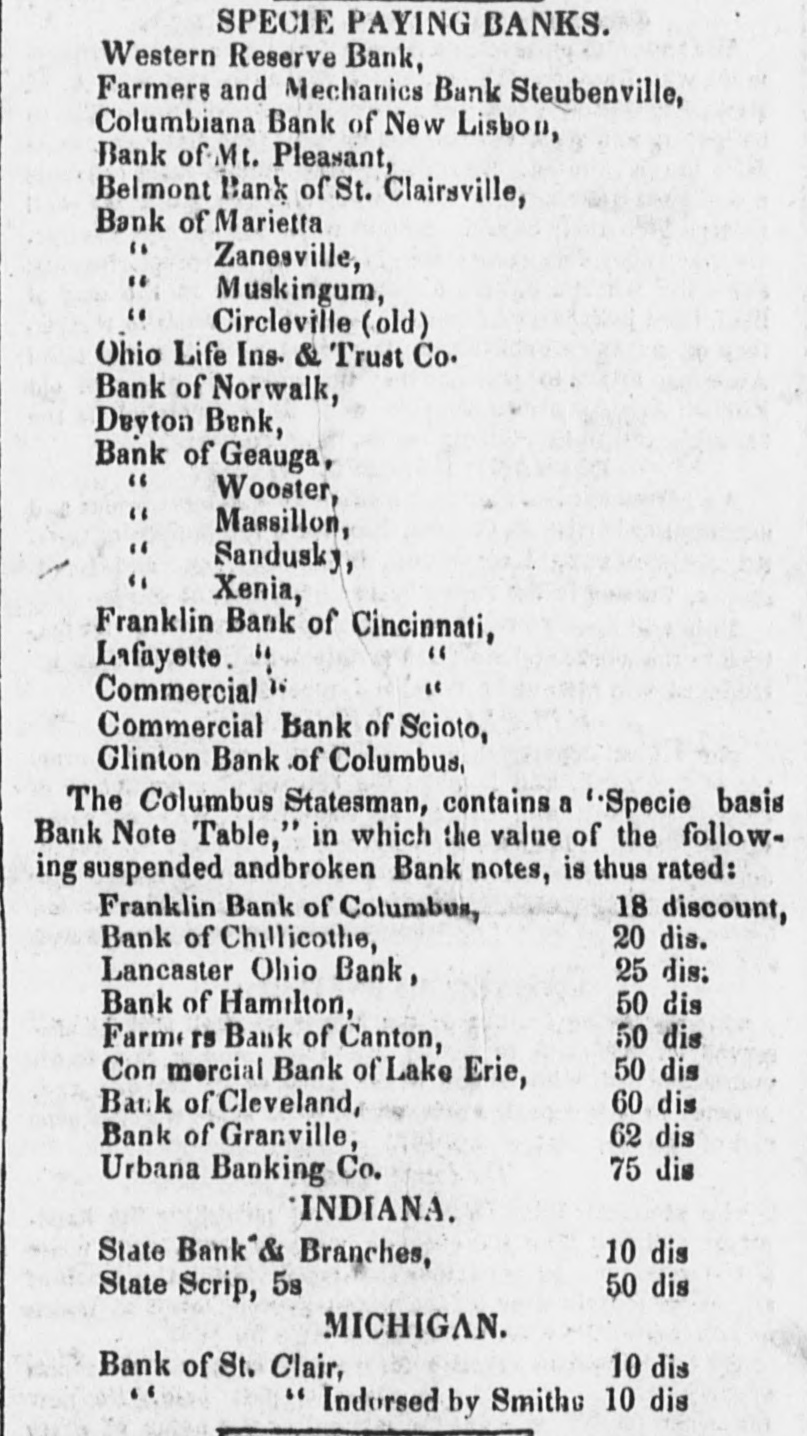

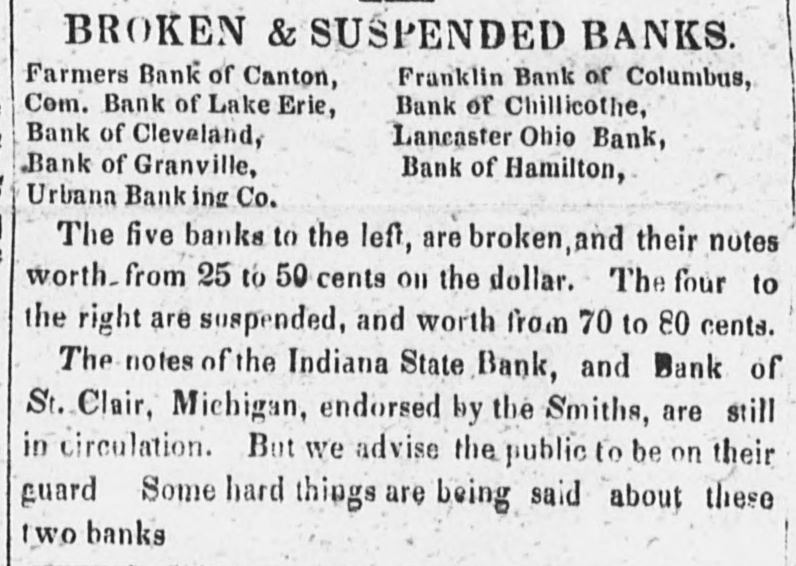

### 1,000 do.s 15 days 19 The market is very quiet for Foreign Exchanges, but firm and with a tendency to improve. Leading Sterling we quote at 8 a 84, and some drawers demanding 84. Francs 5.283. The Havre packet, in consequence of the injury to her stern received in the gale last night, did not sail to-day. She will probably be detained several days. She takes a considerable amount of specie. The notes of the State Bank at Buffalo are selling to-day at 50 per cent discount. The Inland Bills are without much change. Philadelphia and Virginia are improving. We quote Philadelphia 54: Baltimore 34: Virginia 73 a 81; North Carolina 5 a 51: Charleston 14 a 12: Savannah 2 a 21; Augusta 24 a 2: Macon 13: Columbus 15; Mobile 184: Montgomery 14: Tuscaloosa 14; New-Orleans 64 a 61: Nashville 15 a 16; Louisville 9 a 91: St. Louis 17 a 17; Cincinnati 15 a 16: Interior Ohio 17: Indiana 19: Illinois 25. Treasury Notes are dull to-day at a discount. A supply of some five millions is expected within a few days. The Bank bill was still under discussion in the Senate of Pennsylvania. It was not improbable that another Bank bill would be introduced, so that three or four bills would be under consideration at once, each conflicting with the other. An immediate resumption meeting is to be held this evening in Philadelphia. A memorial is in circulation praying the Legislature to adjourn. A proposition was introduced into the House to establish an Independent Treasury for the State and to separate entirely the fiscal concerns of the commonwealth from any connection with banking institutions. An examination of the assets of the Bank of Hamilton, Ohio, has been had, which shews it is stated the Bank to be in as good condition as the general run of Banks. The Bank has made an assignment. Its notes will probably be soon paid The Urbana Citizen states that the Bank of Urbana re-deems its notes and all its promises regularly, excepting to brokers and others who have apparently been speculating upon them. The Bank is winding up its business. The St. Louis New Era of the 1st iast, says that Illinois money continues to flow into that market from the East, and that it the demand for exchange from abroad continues, the credit of the paper there must give way. There is no exchange now to be had on any city East of that place, and the merchants there were suffering in consequence, and would be compelled to let the paper depreciate, as they could not afford to pay fifteen to twenty per cent for exchange. On the 1st instant the House of Representatives of Louisiana concurred with the Senate in the passage of the "Compromise Bank Bill." This bill is intended to provide for the immediate resumption of specie payments by the banks. By the official report of the Bank of Cape Fear, North Carolina, it appears that its circulation was $962,197, Deposits $217,209, due Banks $21,115, Specie $365,648, due from Banks $288,343, Bank Notes $238,698. Several of the stockholders of the Hawkinsville Bank of Georgia, upon which institution there had been a run, have pledged their private property to protect its bill-holders. The Georgian states that the assets of the Bank amount in round numbers to $453,000-the liabilities to $273,000. Allowing $20,000 (which is believed to be a fair amount) of the notes to be unavailable, they will still cover all liabilities and leave the capital stock (160,000) unimpaired. The joint committee on banks in the Kentucky Legislature, have recommended that the 1st of November be the day fixed for resumption by the banks, contingent upon the resumption of the banks in New-Orleans. According to the message of Governor Call, the Bonds issued by the Territory of Florida amount to 3,909,000 dollars, of which 3,000,000 were to the Union Bank, 480,000 to the Southern Life and Trust Company, and 500,000 to the Bank of Pensacola. The Governor argues that the Territory is not liable for the interest on these bonds until recourse has been exhausted to the Banks and each stockholder. As the Territory has now no circulation but of the suspended banks, the Governor recommends the chartering of a new bank which shall pay specie under all circumstances.