Click image to open full size in new tab

Article Text

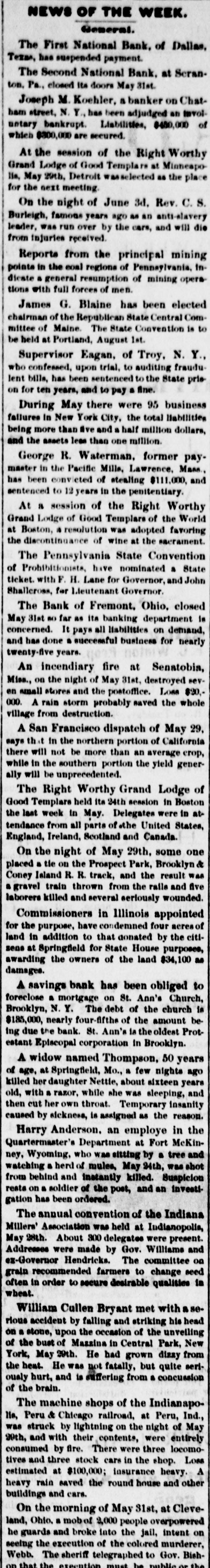

NEWS OF THE WEEK. General. The First National Bank, of Dallas, Texas, has suspended payment. The Second National Bank. at Scranton. Pa., closed Its doors May 31st. Joseph M. Koehler, a banker on Chatham street, N. Y., has been adjudged an Involuntary bankrupt. Liabilities, $450,000 of which $300,000 are secured. At the session of the Right Worthy Grand Lodge of Good Templars at MinneapoHa, May 29th, Detroit wasselected as the place for the next meeting. On the night of June 3d, Rev. C. S. Burleigh, famous years ago as an anti-slavery leader, was run over by the cars, and will die from injuries received. Reports from the principal mining points in the eoal regions of Pennsylvania, Indicate a general resumption of mining operations with full forces of men. James G. Blaine has been elected chairman of the Republican State Central Committee of Maine. The State Convention is to be held at Portland, August 1st. Supervisor Eagan, of Troy, N. Y., who confessed, upon trial, to auditing fraudu lent bills, has been sentenced to the State prieon for ten years, and to pay a fine. During May there were 95 business failures In New York City, the total liabilities being more than live and a half million dollars, and the assets less than one million. George R. Waterman, former paymaster in the Pacific Mills, Lawrence, Mass. has been convicted of stealing $111,000, and sentenced to 12 years in the penitentiary. At a session of the Right Worthy Grand Lodge of Good Templare of the World at Boston, a resolution was adopted favoring the discontinuance of wine at the sacrament. The Pennsylvania State Convention of Prohibitionists, have nominated a State ticket. with F. H. Lane for Governor, and John Shalleross, for Lieutenant Governor. The Bank of Fremont. Ohio, closed May 31st so far as its banking department is concerned. It pays all liabilities on demand, and has done a successful business for nearly twenty-five years. An incendiary fire at Senatobia, Miss., on the night of May 31st, destroyed seven emall stores and the postoffice. Loss $20,000. A rain storm probably saved the whole village from destruction. A San Francisco dispatch of May 29, says that in the northern portion of California there will not be more than an average crop, while in the southern portion the yield generally will be unprecedented. The Right Worthy Grand Lodge of Good Templare held its 24th session in Boston the last week in May. Delegates were in attendance from all parts of the United States, England, Ireland, Scotland and Canada. On the night of May 29th, some one placed a tie on the Prospect Park, Brooklyn & Coney Island R. R. track, and the result was a gravel train thrown from the rails and five laborers killed and several seriously wounded. Commissioners in Illinois appointed for the purpose, have condemned four acres of land in addition to that donated by the citisens at Springfield for State House purposes, awarding the owners of the land $34,100 as damages. A savings bank has been obliged to foreclose a mortgage on St. Ann's Church, Brooklyn, N. Y. The debt of the church is $185,000, nearly four-fifths of the amount beIng due the bank. St. Ann's la the oldest Protestant Episcopal corporation in Brooklyn. A widow named Thompson, 50 years of age, at Springfield, Mo., a few nights ago killed her daughter Nettle, about sixteen years old, with a razor, while she was sleeping, and then cut her own throat. Temporary insanity caused by sickness, is assigned as the reason. Harry Anderson. an employe in the Quartermaster's Department at Fort McKinney, Wyoming, who was sitting by a tree and watching a herd of mules, May 24th, was shot from behind and instantly killed. Suspicion rests on a soldier of the post, and an investigation has been ordered. The annual convention of the Indiana Millers' Association was held at Indianopolis, May 28th. About 300 delegates were present. Addresses were made by Gov. Williams and ex-Governor Hendricks. The committee on grain recommended farmers to change seed often in order to secure desirable qualities is wheat. William Cullen Bryant met with a serious accident by falling and striking his head on a stone, upon the occasion of the unveiling of the bust of Mazzina in Central Park, New York, May 29th. He had grown dizzy from the heat. He was not fatally, but quite seriously hurt, and is suffering from a concussion of the brain. The machine shops of the Indianapolie, Peru & Chicago railroad, at Peru, Ind., was struck by lightning on the night of May 29th, and with their contents, were entirely consumed by fire. There were three locomotives and three stock cars in the shop. Loss estimated at $100,000; insurance heavy. A heavy rain saved the round house and other buildings and cars. On the morning of May 31st, at Cleveland, Ohio. a mobof 2,000 people overpowered he guards and broke into the jail, intent on seeing the execution of the colored murderer, Webb. The sheriff telegraphed to Gov. Bishthat the execution must be public.or the