Click image to open full size in new tab

Article Text

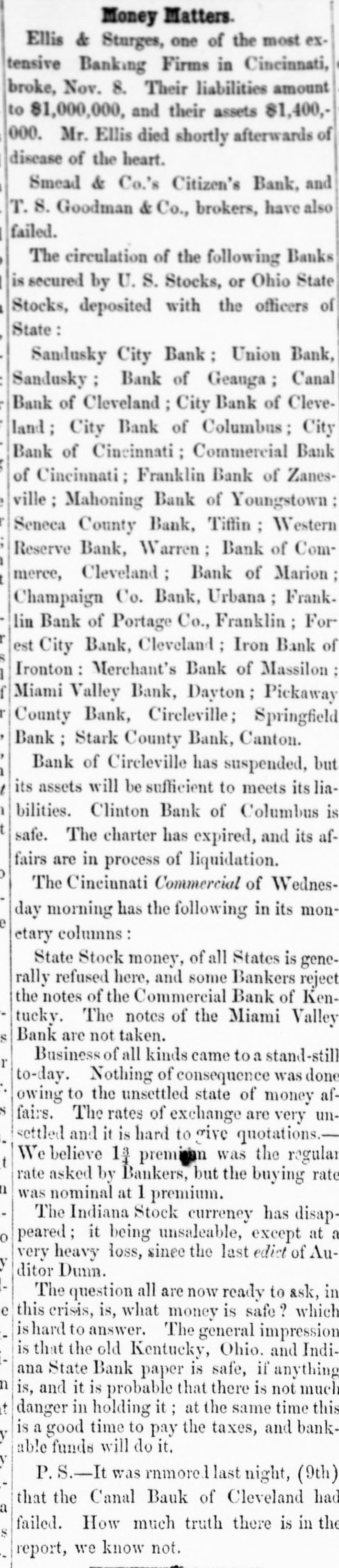

Financial Troubles at Cincinnati. (From the Cincinnati Commercial, Nov. 9] It is the true course to be coase vative conservative of an ex isting condition of things when the is no immediate prospect of change except for the worse; but when the worst has come, it equally the part prudence to look it fairly in the face, meet its vicisaltudes with fortitude, and to hope, through the that is wisdom 10 . taught reverses, by inaugurate more propitions future. It is useless attempt to conceal that we are in the midst of a financial revoJution; and although it is impossible at this moment the how and indus predict commercial entirely trial interests of the city are to be prostrated, there already enough to justify the most serious fore boding Like the traveller in Alpine regions, when has the been stirred of sudden atmosphere by explosion, who sees the avalanche sliding from every into and summit sensi : are dashing every valley, bie of shock after shock in quick succession, and moment the of an of the brings lapse every report other tower, or the toppling of another pinnasle. From turret stone, was the language of the curse and the prediction, and the measure of their fulfilment Like its edifices, the business interests of a city are builded together, and to great extent, support and hang upon each other. The flames of a conflashock the and to another. one from pile gration which one creates in falling tries the stability of all its neighbors. Besidestne numerous links which est interest is perpetually creating among business men of city, there is an aggregate spirit, sentiment and tendency in which all are partakers, and of extent 3 the some is individual reprewhich every sentative. The primary causes, to which the prehave for the natural the sequence, attendition time being produced their effects upon the popular of that the character events popular the past few days are the legitimate offspring. all and Ohio have developed a condition general bank bankruptcy, in the production of which it is difficult to say that one order of men have been more instrumental than another. That its features case in the of more are bankers private prominent than others, is the consequence of the character their business, full as much as of any especial error which they have committed. The disease perv pervides the whole system, choosing, perhaps, the weakes place to its ravages. has been observed for several days that the condition of pecuniary affairs has been growing more and more gloomy. Since the middle of last month, when several the banks of this city were foreed to suspend, although the outward manifestations of run upon those which continued to stand were suppressed, is is undoubtedly true that deposiand their ters funds, were prewithdrawing quietly paring for storm, while the banks were growing that was It known amounts weaker. large daily bills were returning from the East, protested for non-payment, and the reported failure of several institutions heretofore reported to be sound, in other the to divest of of the served parts State, public what little remains of confidence it had hitherto that FREE It several of known retained. our private bankers, departing from the line of legitimate basiin invested railroad securities, now largely ness, a melancholy state of depression, and in real 08 Date, whose tendency is the reverse of upward and no one was assured that the others had not equally ConfiIves involved similar themselves in speculations. dence was at an end, and the law of self preservation become peramount to all others. The social bond gave way before the individual necessity, and the became the rule of action, and must continue to be so for a time to come. The closing of the banks will have a tendency to give a rapid increase to the number of among business men of all kinds. The banks have turned the keys upon their money. They cannot pay, much less afford relief. Whatever may be the character and extent of the ultimate security exhibited by the bankers, the process of suspension will it and sequent render unavailliquidation able for an indefinite period. It has the charao ter of money, and become merely assets, whose value is jet to be ascertained. Still will not do pronour of d oed too sweeping an anathema against the dealers in money The business owes its existence, as well as its sins, to legislative error -error error-error that has had its influence over others, as well as thembut been have not selves. actors, only They acted upon. That course of legislative action which drove capital from the State, and deprived the businees community the counterbalance of its conserdisat: also vative influence, has placed integrity count -thrown obstacles in the way legitimate business- speculation the rule, instead of the exception, in trade, and struck staggering blow of let that mercantile the character at which, alone, would have been one of the soundest and most truly energetic of all industrial communities. But while the eky, in almost every quarter, looks dark and threatening, it will not do to indulge in despondency. Amid the first depression incident to such events, things almost alw sys appear worse than they really are. There an immensity of the Cincinnati in and of real wealth in elements Ohio, are young and energetic people, and time, the mighty mediciner in all human difficulties, will, in many ways, produce relief and compensation. Toe character of a people improves under misfortunes, and wisdom is learned in the hard school of adver in financial reform have our legis We may sity. lation, or we shall learn better to adapt ourselves to the tyrannical provisions of a system foreign to the popular character. Besides, men do not lose thei Identity; if they are men, they do not lose thei courage. There is glory in overcoming diffical ties; and strife against adverse circumstances ances is calculated to develope the noblest and best attributes of manhood. In the light of a false system we shall learn to place correct estimate upon true; and in view of the inevitable consequences of un sound practice, the value of real integrity will be more apparent. We Wo are are inclined to believe, from what we have been able learn, the that at the conc ition of monetary affairs in this city is not quite as desperate as was represented by rumor yesterday In times of and knows one how, reports originate, panic, grow with great rapidity. The stoppage of bank assumed, for the time being, to bea total loss to all its creditors, of all their claims. While no bank of loan and deposit can be expected to stand sudden demand for the payment of its liabilities, the business, when prudently and legitimately conducted is one of the safest description. Its char acter is such, and sush is the nature of its transactions, shat- unlike that-unlike a bank of issue- with many of creditors itors ultimate security is all that requir ed. So far as is a depository of savings, this security is by LO means to be despised, and is in sufficient. Its debts are represented by its bills receivable; and experience has hown that these, even in times of great pecuniary depression, constitute one of the safes species of property. These our banks, therefore, that have not diverted their than ther of the demands into channels means made, have in their tands the means, at DO distant day, to make final settlement with their creditors. Nor is this city totally unprepared for the approach of a financial collapse. S me have foreseen, and many have felt, its approach, and for months past much has been done in the way of retrench ment. Purchases have been light, tewer debts have been created, and the process of taking in sall preparatory to a storm, his been entered upsn by many. is true that much yet remains to do; but 40 trust the warning has been sufficient to reach the deafest has practice necessity mercan already In ears. some extent, instituted new rules of orbearance. Where the failure to pay becomes universal patience must be the rule, instead of the exception, as 16 is in better times; and the sooner the great law of mutual interest, which is the bond of business 80siety, is fully recogn recognized, the better for all. When the bottom DS. been fairly reached, the time to build will have arrived: and it is not necessary for us to say, that is all the mate ials for a brious structure, we have an abund nce. We refer to our sommercial columns for a more full detail of the condition of things as developed yesterday. From that it will appear that some the materials of which the panic was composed were of false. We have a-surance in the new whose charac ters and business ability have been customed to confide, that the Clinton Bank Columbus is ready and able to pay its issues on and there demand, reason the $ CI that zens Bank, Ellis Sturges, and Messre. Goodman have means to make their depositors safe. speak of these concerns without intending to from of the detract reputation ultimate of solvency any; and merely be ause our means informati have been more full in their cases than in others. the meantime is the duty, and for the interest incresse useless of to the of against all, guard present panic through the circulation of patiful reports. Lord Dunkellin's Capture-The Post Master General England. Your historical sketch of the capture of Lord DunThe correction. some &c. Marquis requires kellin,