Article Text

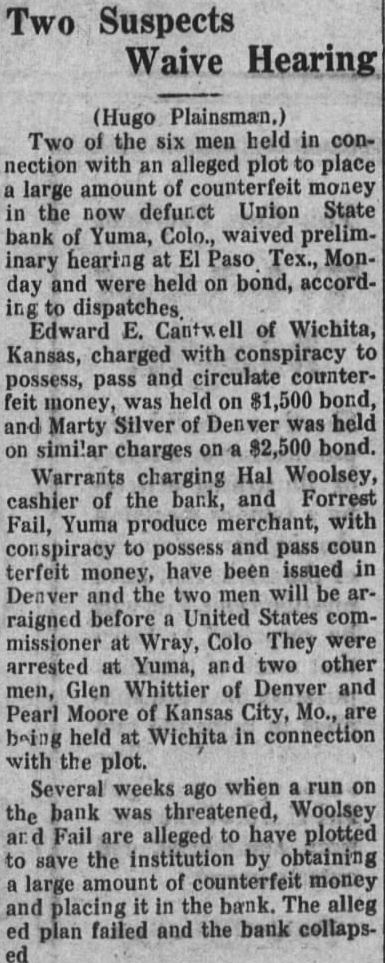

CASHIER OF DEFUNCT YUMA BANK HELD IN LAW SUITS TO A COUNTERFEIT PLOT FOLLOW A CUT IN VALUATION Said to Have Tried to Obtain Bogus Money in Old Mexico to Avoid Run Which Closed Bank; Six Under Arrest Includes Colorado Men (Associated Press Leased Paso, Oct. men under arrest in three states were charged here today with conspiracy to import, possess and pass counterfeit United States money They were Martey Silvers, 38. Denver, Edwin Cantwell. 40. Wichita. Kansas, Hal E. Woolsey Colo., and Glenn Whittier and Pearl Moore, of Denver and Kansas City. Silvers and Cantwell were arrested in El Paso several days ago after hot pursuit through the crowded streets. Silvers was wounded twice, not seriously. Woolsey. former cashier of the failed Union State bank of Yuma, and Fail. produce were held Wray. Colo. and Moore were in custody Secret service agents said vers told them the six ned to purchase counterfeit money for Woolsey in an effort vent closing of the Yuma bank. The plan originated in according to the agents, where Silvers and Moore met told them he knew where could buy counterfeit The information was passed to Silvers said Fail became quainted with them at Lamar. Colo., and told them would pur chase some counterfeit for an official of Yuma bank to stave Silvers and Fail came to Paso airplane, Silvers said, while Cantwell and lowed by automobile. He declared with which to buy in and he passed the money but the latter did not deliver Officers sought another man and woman El Paso in connecwith the A Number of County Assessors to Join With Denver in Resisting Recent Board Action (Associated Press Leased Denver, Oct. will not have to fight lone battle against action of the board of equalization, sentiments expressed by various county assessors to the tax commision are carried through Various assessors, It was reported today. are sending their counattorneys to Denver to aid the local municipal government in its proposed legal proceedings against the equalization board. Because of reductions previously made by the various county the per reduction in farm property and imand the five per cent cut in lots and by the board, have resulted in wide range of values from 20 per cent 25 per in valuations. It was pointed out that the of corporations of public utility are based on the capitalized earnings and the and bonds The real estate of the corporations not assessed directly, its value being reflected through the stocks and Under the law. the state tax commission sets the valuation railroads and other corporations. The various county assessors set the value the real estate ownby corporation and this value deducted from the final figure arrived at by the tax commission. Thus It was indicated today that corporations would forced to taxes, under the new rates, despite real property Fred Harrison. deputy attorney general. preparing list instructions to be mailed to all county assessors today. He said the assessors would be forced to make only five changes in their schedules at the most. These would be on farm property. farm improvements, city lots, city Improvements and the total The tax commission. he said would to revaluate state corporations,