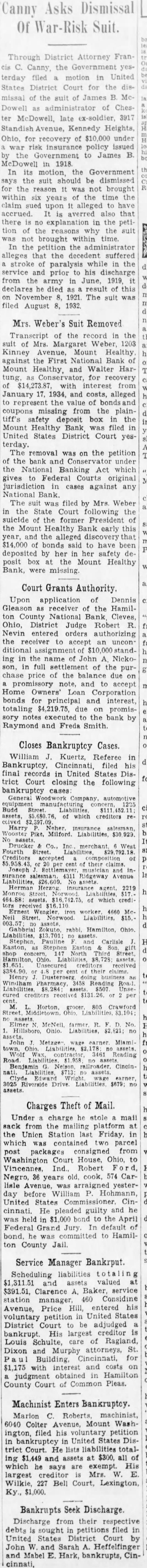

Article Text

Asks Dismissal Canny Of Suit. Through District Attorney Canny, the terday filed in United States District for the missal the of James Dowell of Chester McDowell, late x-soldier, 3917 Kennedy Heights, Ohio, for of $10,000 under risk policy issued to James In its Government the suit should be dismissed the reason not brought within six years the time the claim upon alleged accrued. averred also that there explanation the petition of the reasons why the suit not brought within time. the petition the administrator alleges the decedent suffered stroke paralysis while in the prior his discharge from the June, 1919, this 1921 The suit was filed August Mrs. Weber's Suit Removed Transcript the record in the of Mrs. Margaret 1203 Kinney Mount Healthy against the First National Mount and Walter Harfor 1934, and alleged the from the plaintiff's safety the Mount Healthy filed United States District Court yesterday. The removal on the petition bank under the National Act which Federal Courts original jurisdiction cases against any Bank. The filed by Mrs. Weber State Court the suicide former President the Mount Healthy Bank early this the that bonds to have been deposited her her safety box Mount Healthy Bank, Court Grants Authority Upon application of Dennis Gleason receiver the HamilCounty National Cleves, Ohio, District Judge Robert Nevin entered orders authorizing the receiver accept ing John Nickofull of the the due promissory accept Home Owners' Corporation bonds and interest, due on promisexecuted the bank by Raymond and Freda Smith. Closes Bankruptcy Cases. William Kuertz, Referee filed United States DisCourt closing the following bankruptcy General creditors insurance Street. Avenue which Ohio. Carlisle Charges Theft of Mail. Under mail the Union Friday. in parcel consigned Washington Court House, Ohio, to Robert Negro, years old, cook, 574 Caryesterday before United Cincinnati, He pleaded guilty and he $1,000 bond the April Federal Grand Jury. default committed to Hamilton County Jail. Service Manager Bankrput. Scheduling liabilities valued Clarence Baker, service station manager, 460 Considine Avenue, Price Hill, entered voluntary petition in United States District Court be adjudged largest creditor Louis Ragland, Dixon Murphy attorneys, for interest and costs on County Court of Pleas. Machinist Enters Bankruptcy. Marion machinist, Colter Avenue, Mount Washington, filed his petition United States trict Court. He lists liabilities totaling and assets $300, which says are exempt. His largest creditor Wilkie, Bell Court, Lexington, $1,000. Bankrupts Seek Discharge. Discharge from their debts filed United States District Court by John and Sarah Heffelfinger and Mabel Hark, bankrupts, Cincinnati,