Article Text

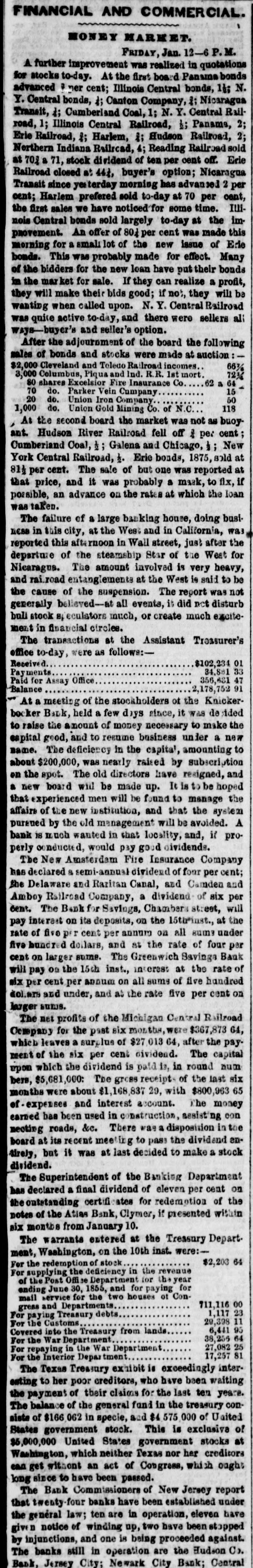

FINANCIAL AND COMMERCIAL. # MONEY MARKET. FRIDAY, Jan. 12-6 Р. М. A further improvement was realized in quotations for stocks to-day. At the first board Panama bonds advanced per cent; Illinois Central bonds, 14; N. Y. Central bonds, ; Canton Company, 1; Nicaragua Transit, 1; Cumberland Coal, 1; N. Y. Central Rail- road, 1; Illinois Central Railroad, Panama, 2; Erie Railroad, ; Harlem, ; Hudson Railroad, 2; Northern Indiana Railroad, 4; Reading Railroad sold at 70 a 71, stock dividend of ten per cent off. Erie Railroad closed at 444, buyer's option; Nicaragua Transit since yesterday morning has advanced 2 per cent; Harlem prefered sold to-day at 70 per cent, the first sales we have noticed for some time. Illi- nois Central bonds sold largely to-day at the im- provement. An offer of 80 per cent was made this morning for a small lot of the new issue of Erie bonds. This was probably made for effect. Many of the bidders for the new loan have put their bonds in the market for sale. If they can realize a profit, they will make their bids good; if not, they will be wanting when called upon. N. Y. Central Railroad was quite active to-day, and there were sellers ali ways buyer's and seller's option. After the adjournment of the board the following sales of bonds and stocks were made at auction:- $2,000 Cleveland and Toledo Railroad incomes.. 66% 3,000 Columbus, Piqua and Ind. R. R. 1st mort. 72% 80 shares Excelsior Fire Insurance Co62 a 64 70 do. Parker Vein Cumpany.. 15 20 do. Union Iron Company.. 50 1,000 do. Union Gold Mining Co. of N.C... 118 At the second board the market was not as buoy- ant. Hudson River Railroad fell off per cent; Cumberland Coal, Galena and Chicago, New York Central Railroad, . Erie bonds, 1875, sold at 814 per cent. The sale of but one was reported at that price, and it was probably a mask, to fix, if possible, an advance on the rates at which the loan was taken. The failure of a large banking house, doing busi- ness in this city, at the West and in California, was reported this afternoon in Wall street, just after the departure of the steamship Star of the West for Nicaragus. The amount involved is very heavy, and railroad entanglements at the West is said to be the cause of the suspension. The report was not generally believed at all events, it did not disturb bull stook speculators much, or create much excite- ment in financial circles. The transactions at the Assistant Treasurer's office to-day, were as follows:- Received... $102,234 01 Payments. 34,881 33 Paid for Assay Office. 356,681 47 Balance 2,178,752 91 At a meeting of the stockholders of the Knicker- bocker Bark, held a few days since, it was desided to raise the amount of money necessary to make the capital good, and to resume business under a new name. The deficiency in the capital, amounting to about $200,000, was nearly raised by subscription on the spot. The old directors have resigned, and a new board wil be made up. It is to be hoped that experienced men will be found to manage the affairs of the new institution, and that the system pursued by the old management will be avoided. A bank is much wanted in that locality, and, if pro- perly conducted, would pay good dividends. The New Amsterdam Fire Insurance Company has declared a semi-annual dividend of four per cent; the Delaware and Raritan Canal, and Camden and Amboy Railroad Company, a dividend of six per dent. The Bank for Savings, Chambers street, will pay interest on its deposits, on the 15tir'inst., at the rate of five per cent per annum on all sums under five hundred dollars, and at the rate of four per cent on larger sume. The Greenwich Savings Bank will pay on the 15th inst., interest at the rate of mix per cent per annum on all sums of five hundred dollars and under, and at the rate five per cent on larger sunjs. The net profits of the Michigan Central Railroad Company for the past six months, were $367,873 64, which leaves a surplus of $27,013 64, after the pay- ment of the six per cent oividend. The capital upon which the dividend is pald is, in round num- bers, $5,681,000: The gross receipt of the last six months were about $1,168,837 29, with $800,963 65 of expenses and interest account. The money earned has been used in construction, assisting con- necting roads, &c. There was a disposizion in toe board at its recent meeting to pass the dividend en- tirely, but it was at last decided to make a stock dividend. The Superintendent of the Banking Department bas declared a final dividend of eleven per cent on the outstanding certificates for redemotion of the notes of the Atias Bank, Clymer, if presented within six months from January 10. The warrants entered at the Treasury Depart- ment, Washington, on the 10th inst. were:-- For the redemption of stock.... $2,203 64 For supplying the deficiency in the revenue of the Post Office Department for the year ending June 30, 1856, and for paying for mail service for the two houses of Con- gress and Departments.. 711,116 00 For paying Treasury debts.. 1,117 23 For the Customs 29,398 11 Covered into the Treasury from lands. 6,441 95 For the War Department.. 38,255 64 For repaying in the War Department. 27,082 25 For the Interior Department... 17,257 81 The Texas Treasury exhibit is exceedingly inter- esting to her poor creditors, who have been waiting the payment of their claims for the last ten yeare. The balance of the general fund in the treasury con- siste of $166 062 in specie, and $4,575,000 of Uaited States government stock. This is exclusive of $5,000,000 United States government stocks at Washington, which neither Texas nor her creditors can get witaont an act of Congress, which ought ong since to have been passed. The Bank Commissioners of New Jersey report that twenty-four banks have been established under the general law; ten are in operation, eleven have given notice of winding up, two have been stopped by injunctions, and one is being proceeded against. The banks still in operation are the Hudson Co. Bank, Jersey City; Newark City Bank; Central