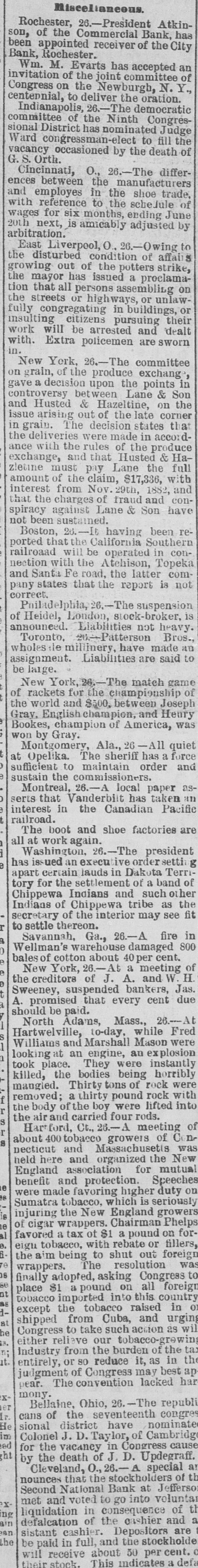

Article Text

niscelianeous. Atkin26.-President Bank, has Rochester, Commercial the City son, been of appointed the receiver of an Bank, Rochester. M. Evarts has comm accepted smmittee of Congress on the invitation Wm. of the the Newburgh, joint oration. N.Y., of the centennial, Indianapolis, to deliver 26.-The Ninth democratic Congres- Judge committee District has nominated to fill the sional Ward congressman- occasioned by the death of between shoe G.S. Ortl. vacancy Cincinnati, O., the 26. manufacturers The differ- trade, employes the 20th and with ences reference months, in to the ending scheJule June by of wages next, for six is amicably adjusted to Owing the arbitration. East Liverpool, condition 0 of strike, affairs growing disturbed out of issued the potters a proclama- on has assembling the mayor persons unlawtion the streets that congregating all or in or their fully pursuing dealt with. insulting work will Extra citizens be policemen arrested and are sworn on in. New York, 26.-The produce committee exchang in of the the points gave a controversy grain, decision bet & upon ween Hazeltine, Lane late & on corner Son the and Husted out of the states that grain. made issue arising The decision in accordin deliveries were of the produce and Lane the exchange, ance the with the rules pay that Husted $17,336, & with Ha- full z!etine must claim, and from fraud and conamount interest of the Nov. of 29th, 1882, have that the against charges Lane & Son spiracy not been sustained. having Southern been reBoston, 26.-It the California in conrailroaad ported that with will the be Atchison, operated latter Topeka com nection Fe road, the is not and pany states Santa that the report suspension correct. Philade Jphia, 26. -The stock broker, is Heidel, London,Sign Liabilities not heavy. made of announced. -Patterson Bros. an assignment. wholes Toronto. le millinery, Liabilities have are said to be New large. York, 26. the The championship match Joseph game of rackets for $500, between Henry Bookes, of Gray, the world English cha champion and champion, of America, and was won Montgomery, by Gray. The Ala., sheriff 26 has All a quiet force and at Opelika. maintain order sufficient sustain the to 26.-A commissioners. local paper taken as- an interest in serts Montreal, that Vanderbilt the Canadian has Pacific railroad. The boot and shoe factories are all at work again. The president Washington, issued an execut in Dakuta ordersetti Terri- of tory has certain lauds of a band Indians apart for the settlement and such other as the secretary Indians Chippewa of of Chippewa Cheinterior the tribe may see fit in to Savannah, settle thereon. Ga., 26.-A damaged fire 800 warehouse cent. of Wellman's cotton about 40 meeting bales New of York, J. A. a and W H Jas. the creditora suspended of bankers, cent due Sweeney, that every A. promised should be Adams, paid. Mass., while 26.-A Fred Hartwelville, North to-day, Mason were and Marshall an explosion an were looking at Williams place. They engine, being instantly horribly were took the bodies rock killed, Thirty tons of rock with mangled. removed; a thirty boy pound were lifted into the body and of the carried four rods. meeting of the Hartford, air Ct., 26.- growers of C was n about tobacco Massachusetis Decticut here 400 and and organized for the mutual New e held England association protection. Speeches on were benefit made and tobacco, favoring which higher is seriously duty growers Sumatra England injuring e al e. of cigar wrappers. the tax New ot $1 Chairman a pound Phelps on tillers, for favored a with rebate or foreign being to 08 eign the aim tobacco, The shut resolution out was to Congress on all at country 88 finally place wrappers. $1 adopted, imported a pound asking into this foreign in o dtobacco tobacco raised urgin at WI be except shipped the to from take Cuba, such accion and as 3 Congress our tobacco-grow the tax n; it. either the burden in the or SO best ap entirely, industry relieve from Congress reduce it, may as of har judgement The of convention lacked x er Ir. pear. mony. Bellaine. Ohio, 26. -The congre republi He cans of the seventeenth have nominate im ed sional district J. D. Taylor, of Cambridge cause ht for the vacancy J. D. Colonel by the death of in Congress A Updegraff. special a nounces Bank Cleveland, that 0., the stockholders at Jefferso of X ing Second and National voted to go into voluntar of ain met liquidation of in the consequence cashier and ean the defalcation cashier. Depositors stockholder are their will receive stock. This indicates a sistant be paid in full, about and the 50 per cent. defa