Click image to open full size in new tab

Article Text

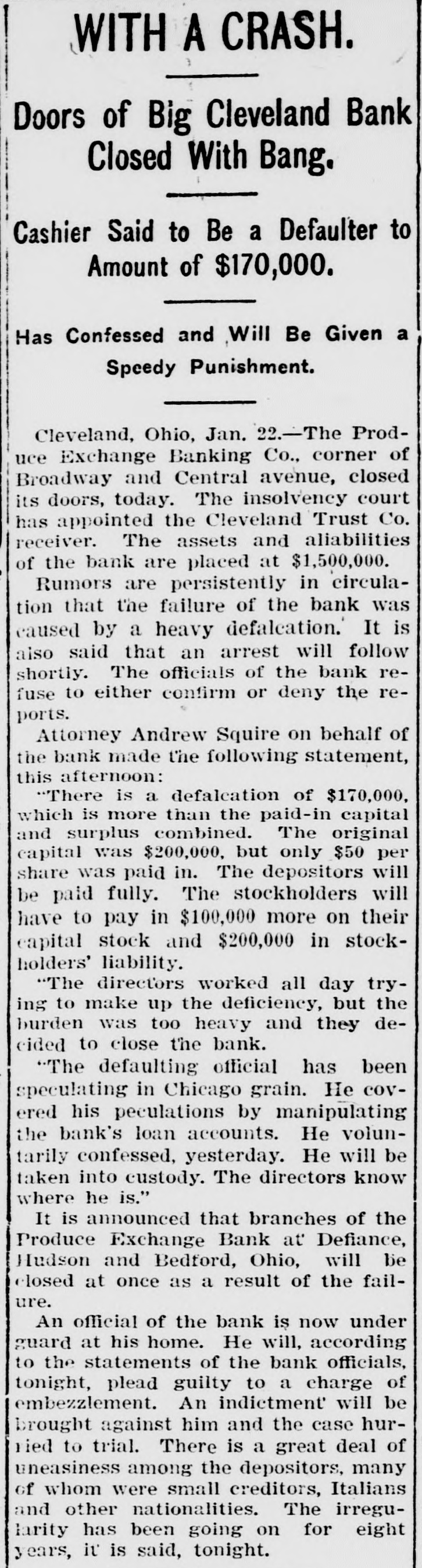

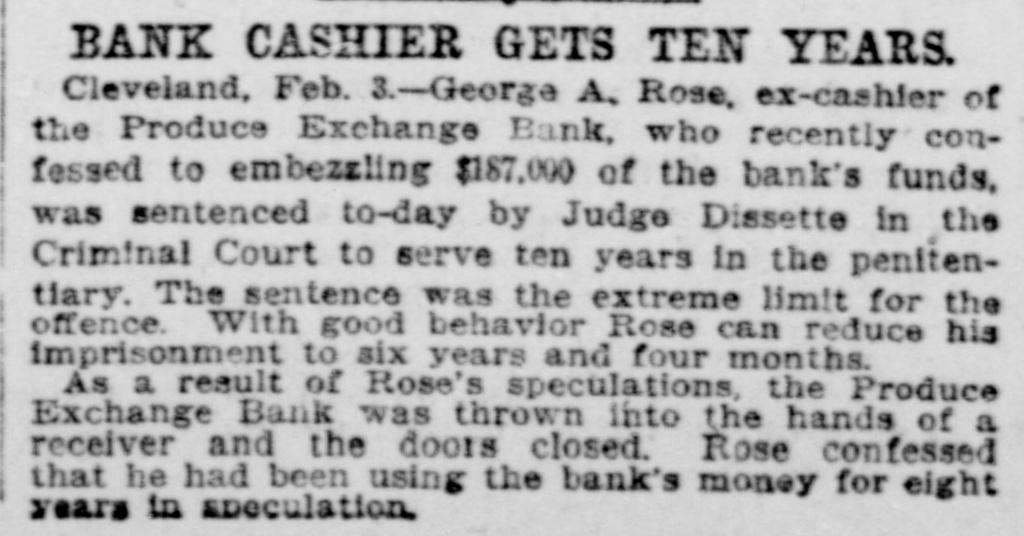

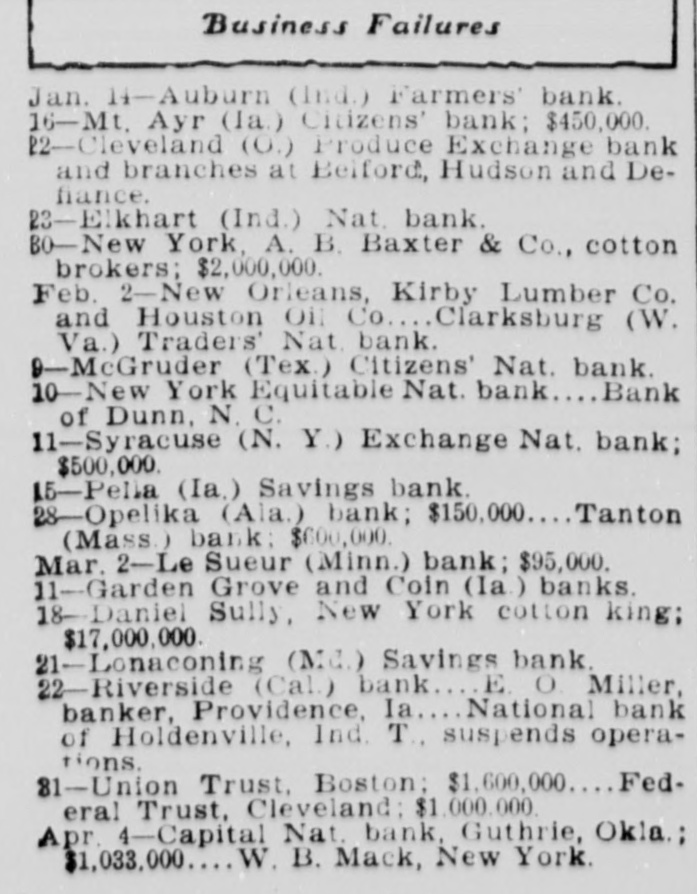

IC4 A the Fire at Springfield, Ill., which originated in a lumber yard, destroyed business property valued at $75,000. A movement has been started at Atlanta, Ga., for the erection of a monument to the late Gen. John B. Gordon. Many members of the theatrical profession have been forced to seek other means of earning a living by the closing of Chicago theaters. A bill has been introduced in the lower house of congress giving a pension of $12 per month to every surviving union soldier of the civil war. Fire at San Antonio, Texas, destroyed store of the L. Wolfson. mammoth The department building and stock were valued at half a million dollars. The Japanese legation at Washington has received numerous apventuresome plications from Americans for commissions in the Mikado's army. All railroads centering in Chicago, have decided to forbid passengers to ride on freight trains, whichewill be a hard blow to commercial travelers. The Japanese have landed over 14,000 troops at a strategetic point and threatens to seize Korea at the first demonstration of actual war on the part of Russia. / The coroner's jury, after an in vestigation lasting several weeks, has placed the blame for the Iroquois theater disaster at Chicago on the managers and builders. 1 The Produce Exchange bank at Cleveland, Ohio, has suspended, and G.A. Rose, the cashier, has been indicted on the charge of squandering $150,000 of the bank's funds. The little town of Moundsville, Ala., was almost completely wiped out by a cyclone. Five white people and thirty-two negroes were killed and over 100 injured. The town is located on the Alabama Great Southern railroad. The storm struck about midnight, and'à heavy rain following prevented the rescue work for some time. Fire in the Masonic Temple in Chicago caused a panic among the 4,000 occupants of the building, and damaged the stock and fixtures of tenants to the extent of $20,000. All occupants of the building escaped without serious injury through the bravery of their elevator men, who remained at their posts, operating their cars while dense clouds of smoke filled the building. The urgent deficiency appropriation bill reported to the house carries a total of $11,251,308, based on estimates of the various departments aggregating $12,488,209. Some of the larger items in the bill are: $2,000,000 for armament and armor for new ships; $200,000 for the naval station at Guantanamo, Cuba; $100,000 for Alaskan boundary survey; $570,000 for construction of a new office building for the house of representatives; $145,000 for mileage for members and senators: $300,000 for rural free delivery, and $2,400,000 for collecting the customs revenues. The Mississippi legislature has re-elected United States Senators Money and McLaurin. The republican state central committee of Tennessee has indorsed President Roosevelt's candidacy. The United Mine Workers have