Article Text

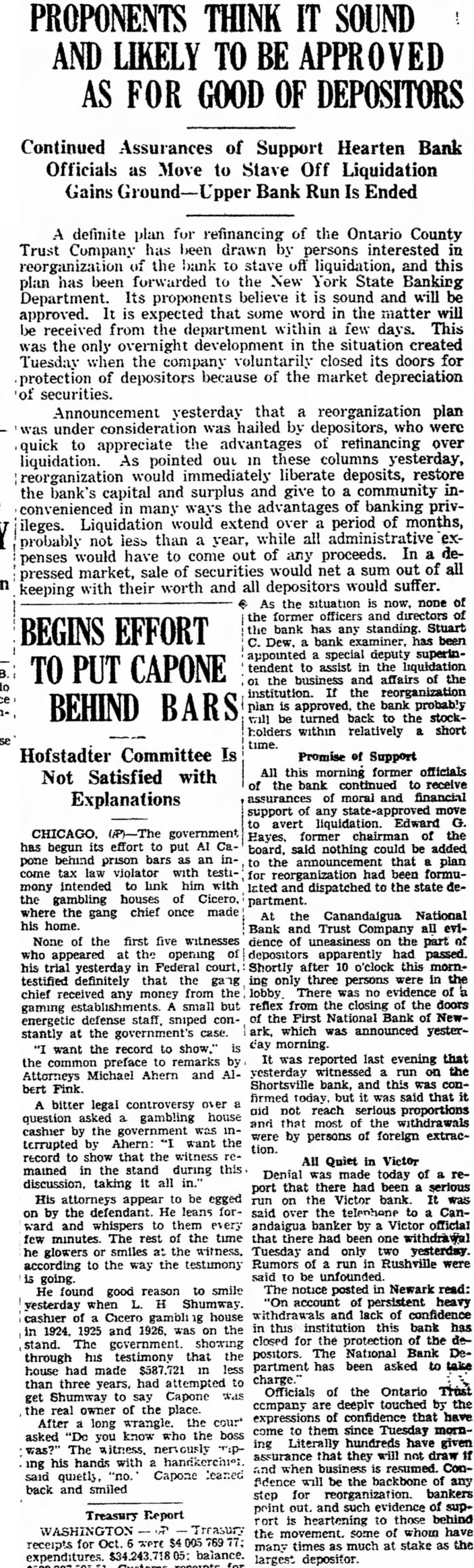

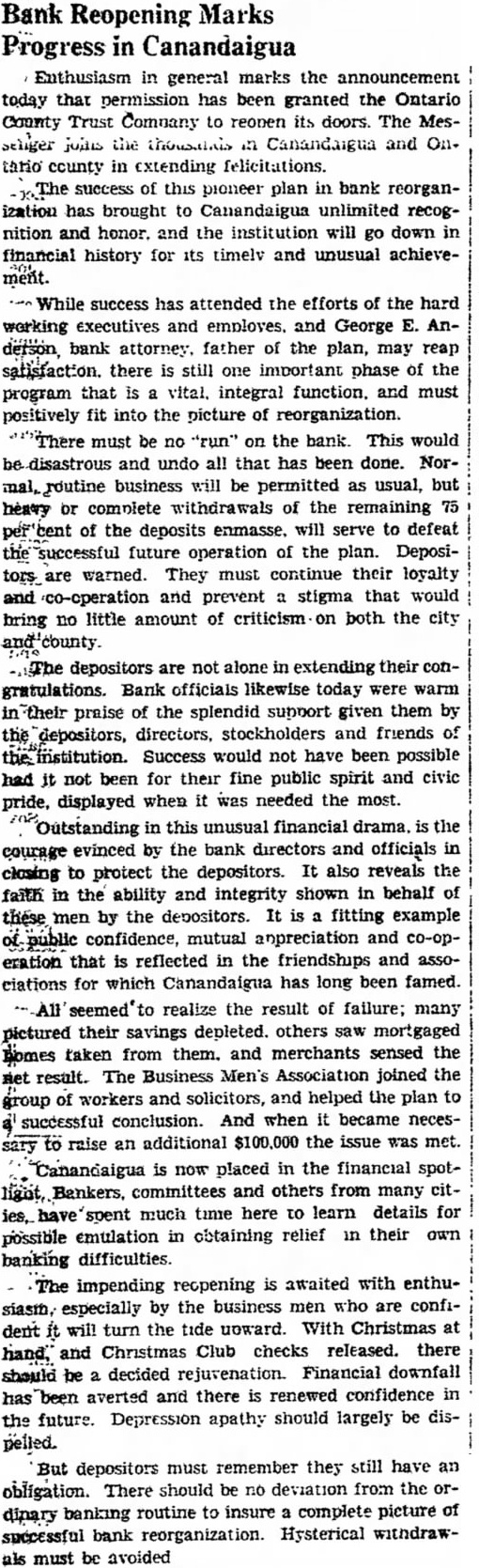

PROPONENTS THINK IT SOUND AND LIKELY TO BE AS FOR GOOD OF DEPOSITORS Continued Assurances of Support Hearten Bank Officials as Move to Stave Off Liquidation Gains Bank Run Is Ended A definite plan for refinancing of the Ontario County Trust Company has been drawn by persons interested in reorganization the bank to stave off liquidation, and this has been forwarded to the New York State Banking plan Department. Its proponents believe it is sound and will be approved. It is expected that some word in the matter will be received from the department within a few days. This was the only overnight development in the situation created Tuesday when the company voluntarily closed its doors for protection of depositors because of the market depreciation of securities. Announcement yesterday that a reorganization plan was under consideration was hailed by depositors, who were to the advantages of refinancing over quick appreciate liquidation. As pointed out these columns yesterday, reorganization would immediately liberate deposits, restore the bank's capital and surplus and give to a community inin many ways the advantages of banking privileges. Liquidation would extend over period of months, probably not less than a year, while all administrative exof In dewould have to come out any proceeds. penses pressed market, sale of securities would net a sum out of all worth and all depositors would suffer. keeping with their the situation none of As the former officers and directors EFFORT the bank has any standing. Stuart Dew. bank examiner, been appointed special deputy superintendent to assist in the liquidation the business and affairs of the institution. If the reorganization BEHIND plan is approved. the bank probably will be turned back to the stockholders within relatively short time. Promise Support All this morning former officials the bank continued to receive assurances of moral and financial support any move avert Edward Hayes. former chairman the board. said nothing could be added that plan reorganization had been formudispatched to the state department. At the Canandaigua National Bank Trust Company all evidence of the part of depositors apparently had passed. Shortly after 10 o'clock this ing only three persons were in the lobby There no reflex from the closing the of the First Bank Newwhich announced yesterday morning. was reported last evening that yesterday witnessed run on the Shortsville bank, and this was confirmed but was said that aid not reach serious proportions and that most of the withdrawals were by persons of foreign extraction. All Quiet in Victor Denial made today of port that there had been serious on Victor bank was said over the Canbanker by Victor official that there had been withdrawal Tuesday and only two yesterday. Rumors Rushville were said to be The notice posted Newark read: account persistent heavy and of confidence in this institution this bank has closed for the protection of the positors. The National Bank partment has been asked to take charge." Officials of the Ontario Trust company deeply touched by the expressions of confidence that have come them since Tuesday morning Literally hundreds have given assurance that they will not draw when business resumed ConAdence will the backbone step for reorganization bankers point and such evidence is heartening to those behind the some of whom have times as much at stake the many largest