Article Text

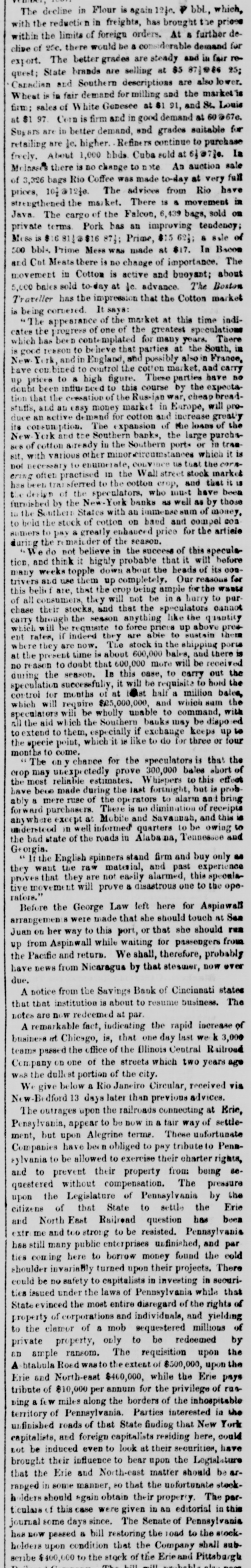

The decline in Flour is again 12jc. P bbl, which, with the reduction in freights, has brought the prices within the limits of foreign orders. At & further decline of 25c. there would be a considerable demand for export. The better grades are steady and in fair re:se S$ TH Jugges are spound treat Canadian and Southern descriptions are also lower. Wheat is in fair demand for milling and the market's firm; sales of hite Genesee at $1 91, and St. Louis 10 pusment poor as pus ming 18 used 26 IS 18 Sugars are in better demand, and grades suitable for retailing are le. higher. Refine rs continue to purchase freely. About 1,000 hbds Cuba sold at j@7&. In Molasses there is no change to n note An auction sale of 3,326 bags Rio Coffee was made to-day at very full prices, 101 @12fe. The advices from Rio have strengthened the market. There 18 & movement in Java. The cargo of the Falcon, 6,439 bags, sold on private terms Pork has an improving tendency; 10 et's 8 189 918 Print 1148 9110118 918 ST *** 500 bbls. Prime Mess was made at $17. In Bacon and Cot Meats there is no change of importance. The shoots pus eages si Conor m more 5,000 bales sold to-day at 1c. advance. The Boston Traveller has the impression that the Cotton market is being cornered. It says: "The appearance of the market at this time indicates the progress of one of the greatest speculations which has been contemplated for many years. There m the 10 parties this here 9 01 nosses pood 81 New York, and in England, and possibly also in France, have COD bined to control the cotton market. and carry up prices to & high figure. These parties have no doubt been influe need to this course by the expectation that the cersation of the Russian war, cheap breadstuffs, and an easy money market in Europe, will produce an active demand for cotton and increase greatly eys Jo loves one Jo uoisaudx ell #11 New York and the Southern banks, the large purchaSe8 of cotton already in the Southern ports or in tram81 " your JOHNUI request SOOUBA qua '118 not necessary to enumerate, convince us that the cornering often practised in the Wall street stock market has been tral sferred to the cotton erop, and that it is the design of the speculators, who must have been 4q se IIPM SR shows the sq paqsroms Jo was required ne que STATES Security 971 01 UOD jedmoo pus pasq no conor 30 store am prog 01 article on 10J could enhauced 8 And 01 8490108 during the re mainder of the season. We do not believe in the success of this speculetion, and think it highly probable that it will before many weeks topple down about the heads of its 002trivers and use them up completely. Our reasons for FIREA eq: JOJ apdure Dateg doso 'are The sign of all consumers, they will not be in a hurry to purchase their stocks, and that the speculators cannot Amounb en "WII Supplier eq: 48001q; Cust which will be requisite to force prices up above premony subjections 03 are They peoput I! Terrer que used Buiddiqe the up stock 91L *MOU 0.18 Lang M 51 puu 'sareq 000'009 10008 " auris quesent am 18 no ason to doubt that 600,000 more will be received during the season. In this case, to carry out the on prog 03 eq IIIM " speciality control for months of at last half a million bales, which will require $25,000,000, and which sum the speculators will be wholly unable to command, with all the aid ich the Southern banks may be dispo ed 01 dn beeps II especially them 01 moj 10 the JOJ op 07 "Ill at 1! quick 'sagod staads en months to come. The on chance for the speculators is that the 30 who below 000'00£ You doio seege sign 01 reliable 1800 am have been made during the last fortnight, but is prob. Suinq pus UNITED 01 the JO area R Sign individual Jo contraing on 81 pressare . RTU7 pue Statement pus 900W 18 on Suimo eq 01 Quarters IIAM 00 program the bad state of the roads in Alaba Tennessee and Georgia. 11 the English spinners stand firm and buy only as they want the raw material, and past experience proves that they are not easily alarmed, this specula-odo ent 04 auo R Drove IIIM 10 ean rators." Before the George Law left here for Aspinwall arrangements were made that she should touch at See Juan on her way to this port, or that she should run up from Aspinwall while waiting for passengers from the Pacific and return. We shall, therefore, probably 33A0 MOU that &q underwoin шод smed bave due. A notice from the Savings Baok of Cincinnati states that that institution is about to resume business. The notes are now redeemed at par. jo incomes the 'gony required V business it Chiesgo, is, that one day last we k 3,000 teams passed the office of the Illinois Central Railroad Company on one of the streets which two years age WAS the dulle st portion of the city. We give below a Rio Janeiro Circular, received via New-Bedford 13 days later than previous advices. 'oug 18 the uodn saferino "IL Pensylvania, appear to be now in a fair way of settlement, but upon Alegrine terms. These unfortunate Companies have bee n obliged to pay tribute to Pennlvania to be allowed to exercise their charter rights, and to prevent their property from being sequestered without compensation. The pressure upon the Legislature of Pennsylvania by the citizens of that State to settle the Erie and North East Railread question has been extr me and too strong to be resisted. Pennsylvania has still many public enterprises unfinished, and par ties coming here to borrow money found the cold shoulder invariably turned upon their projects. There could be no safety to capitalists in investing in securities issued under the laws of Pennsylvania while that State evinced the most entire disregard of the rights of Supplets puu pus JO Product 30 millions qour U jo the 01 private property, only to be redeemed by an ample ransom. The requisition upon the A btabula Road was to the extent of $500,000, upon the Erie and North-east $400,000, while the Erie pays tribute of $10,000 per annum for the privilege of run-