Article Text

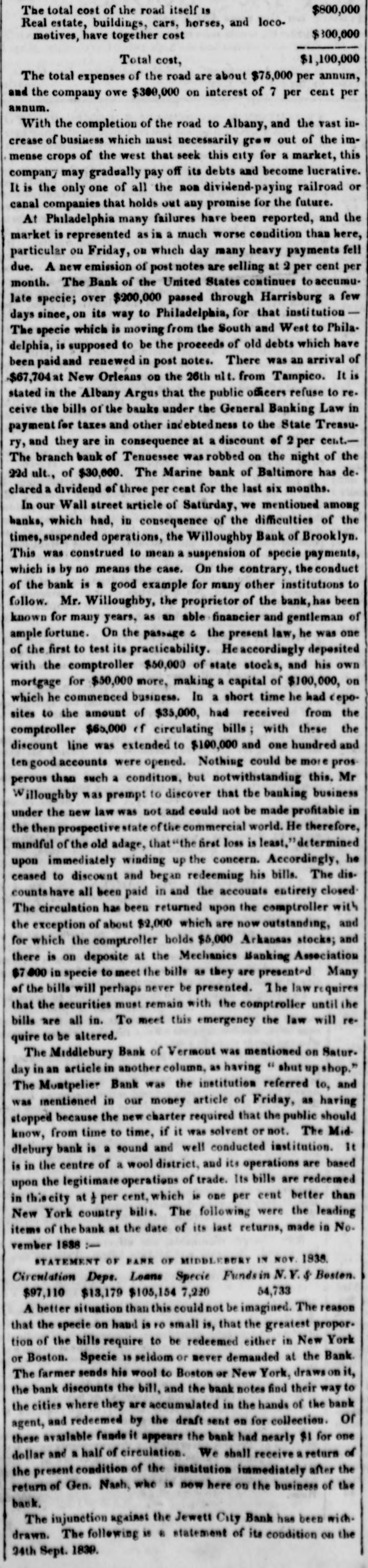

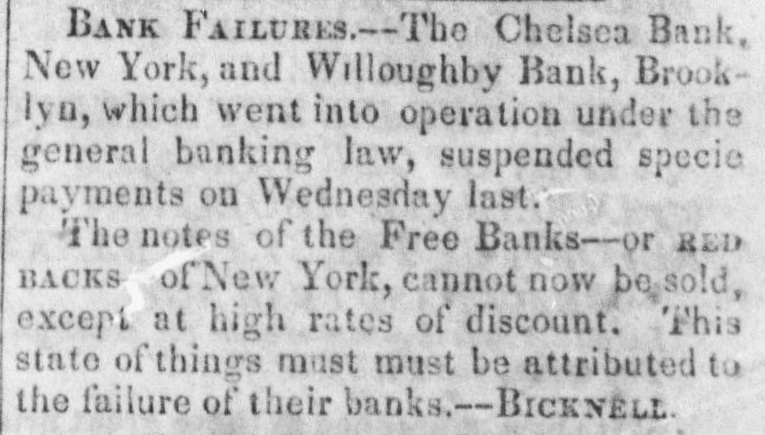

$800,000 The total cost of the road itself IS Real estate, buildings, cars, horses, and loco$300,000 metives, have together cost $1,100,000 Total cost, The total expenses of the road are about $75,000 per annum, and the company owe $300,000 on interest of 7 per cent per annum. With the completion of the road to Albany, and the vast increase of business which must necessarily grew out of the immense crops of the west that seek this city for a market, this company may gradually pay off its debts and become lucrative. It is the only one of all the non dividend-paying railroad or canal companies that holds out any promise for the future. At Philadelphia many failures have been reported, and the market is represented as is a much worse condition than here, particular on Friday, ou which day many heavy payments fell due. A new emission of post notes are selling at 2 per cent per month. The Bank of the United States continues to accumulate specie; over $200,000 passed through Harrisburg a few days since, on its way to Philadelphia, for that institutionThe specie which is moving from the South and West to Phila. delphia, is supposed to be the proceeds of old debts which have been paid: and renewed in post notes. There was an arrival of $67,704 at New Orleans OD the 26th ult. from Tampico. It is stated in the Albany Argus that the public officers refuse to re. ceive the bills of the banks under the General Banking Law in payment for taxes and other indebtedness to the State Treasury, and they are in consequence at a discount of 2 per cent.The branch bank of Tenuessee was robbed on the night of the 22d ult., of $30,600. The Marine bank of Baltimore has de. clared a dividend of three per cent for the last six months. In our Wall street article of Saturday, we mentioned among banks, which had, in consequence of the difficulties of the times, suspended operations, the Willoughby Bank of Brooklyn. This was construed to mean a suspension of specie payments, which is by no means the case. On the contrary, the conduct of the bank is a good example for many other institutions to follow. Mr. Willoughby, the proprietor of the bank, has been known for many years, as an able financier and gentleman of ample fortune. On the passage c the present law, he was one of the first to test its practicability. Heaccordingly deposited with the comptroller $50,000 of state stocks, and his own mortgage for $50,000 more, making a capital of $100,000, on which he commenced business. In a short time he had ceposites to the amount of $35,000, had received from the comptroller $65,000 of circulating bills ; with these the discount line was extended to $100,000 and one hundred and tengood accounts were opened. Nothing could be more pros perous than such a condition. but notwithstanding this. Mr Willoughby was prempt to discover that the banking business under the new law was not and could not be made profitable in the then prospectives of the commercial world. He therefore, mindful of the old adage, that "the first loss is least," determined upon immediately winding up the concern. Accordingly, he ceased to discount and began redeeming his bills. The dis. countshave all been paid in and the accounts entirely closed The circulation has been returned upon the comptroller with the exception of about $2,000 which are now outstanding, and for which the comptroller holds $5,000 Arkansas stocks; and there is on deposite at the Mechanics Banking Association 67000 in specie to meet the bills as they are presented Many of the bills will perhaps never be presented. The law requires that the securities must remain with the comptroller until the bills are all in. To meet this emergency the law will require to be altered. The Middlebury Bank of Vermout was mentioned on Satur. day in article in another column. as having " shut up shop." The Montpelier Bank was the institution referred to, and was mentioned in our money article of Friday, as having stopped because the new charter required that the public should know, from time to time, if it was solvent or not. The Mid. diebury bank is a sound and well conducted institution. It is in the centre of a wool district. and its operations are based upon the legitimate operations of trade. Its bills are redeemed in thiscity at , per cent. which is one per cent better than New York country bills. The following were the leading items of the bank at the date of its last returns, made in No. vember 1888 :STATEMENT OF PARK OF MIDBLEBURY IN NOT 1938. Circulation Deps. Loans Specie Fundsin N.V.& Besten. 54,733 $97,110 $13,179 $105,154 better situation than this could not be imagined. The reason that the specie on hand is to small is, that the greatest proportion of the bills require to be redeemed either in New York or Boston. Specie 18 seldom or never demanded at the Bank The farmer sends his wool to Boston or New York, draws on it, the bank discounts the bill, and the bank notes find their way to the cities where they are accumulated in the hands of the bank agent, and redeemed by the draft sent on for collection. or available funds it appears the bank had nearly $1 for one a half of circulation. receive a of dollar these and of the institution We shall immediately return after the present condition the return of Gen. Nash, who is now here on the business of the back. The injunction against the Jewell City Bank has been wich. drawn. The following is . statement of its condition on the 24th Sept. 1839.