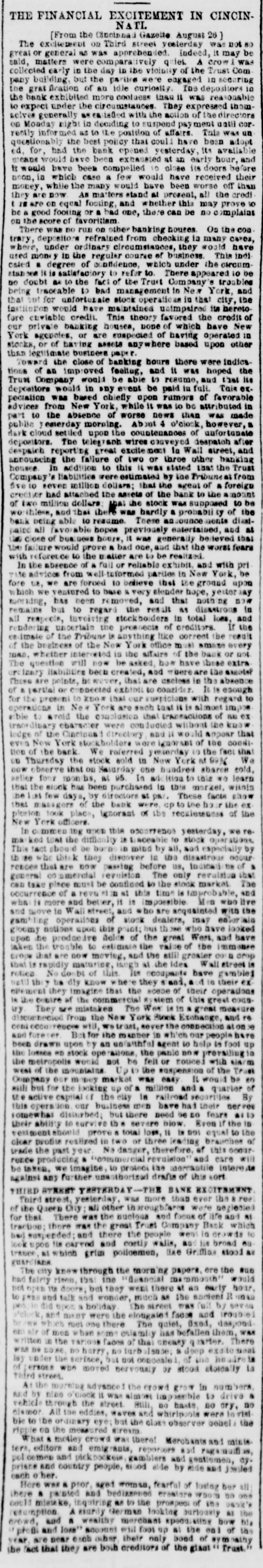

Article Text

THE FINANCIAL EXCITEMENT IN CINCINNATL [From the Cincinnal Gazette August 26] The excitement on Third street vesterday was not 80 great or general as was apprebended. Indeed, it may be sald, matters were comparatively quiek A crow was collected early in the day in the vioinity of the Trust Com pany building but the parties were engaged in securing the grat fleation of an idle curiosity. The depositors 10 the bank exhibited more cooluess than it was reasonable to expect under the circumstances. They expressed themselves generally as isfled with the action of the directors on Monday night in deciding to suspend ment until correctly informed as to the position of affairs. This was un questionably the best policy that couli have been adopt ed, for, had the bank opened yesterday, its available means would bave been exhausted at an early hour, and It would have been compelled 10 close its doors be are noon, in which case a few would have received their money, while the many would have been worse off than they are now As matters stand at present, all the credi t is are on equal footing, and whether this may prove to be a good fooling or a bad one, there can be no complaint on the score of favoritism There was no run on other banking houses. On the con trary, depositors refrained from checking in many cares, where, under ordinary circumstances, they would have used money in the regular course of business. This indi cated a degree of confidence, which under the curcum 14 is satisfactory to refer to. There appeared 10 be no doubt as to the fact of the Trust Company's troubles being traceable to bad management in Ne York, and that but for unfortunate stock operations in that city, the institution would have maintained unimpaired its heretofore enviable credit. This theory favored the credit of our private banking houses, none of which have New York agencies, or are suspected of having operated in stocks, or of having assets anywhere based upon other than legitimate business paper. Toward the close of banking hours there were indications of an improved feeling, and it was hoped the Trust Company would be able to resume, and that its depositors would in any event be paid in full. Tais ex. pectation was based chiefly upon rumors of favorable advices from New York, while it was to be attributed in part to the absence of worse news than was made public esterday morning. About 4 o'clock, however, a dark cloud settled upon the countenances of unfortunate depositors. The wires conveyed despatch after despatch reporting great excitement la Wall street, and assouncing the failure of two or three other banking houses In addition to this it was stated that the Trust Company's liabilities were estimated by the Tribune at from five to seven million dollars; that the ageat of a foreign creditor had attached the assets of the bank to the amount of two million dollars that the stock was supposed to be wo thlews, and that there was hardly a probabli ty of the bank being able to resume. These sounce ments disaipated all favorable hopes previously entertained, and at close of business hours. it was generally believed that Limits ure would prove a bad one, and that the worst fears with reference to the alter are to be realized. In the absence of a full or reliable exhibit, and with pri vite advices from well informed parties in New York, be fore us, we are forced to believe that the ground upon which we ventured to base % very stender hope, yester ay morning, has been removed, and that noth ng now remains but to regard the result as disastrous in all respects, invoiving stockholders in total loss, and renderin uncertain the prossects of creditors. If the 08 imate of the Tribune is anything like correct the result of the business of the New York office m 181 amaze every man. whether interested in the affairs of the bank or not The question will now be asked, how have these extra reinary liabilities been created, and where are the assets? Chese are points, be wever, that are useless in the absence of A partial or connected exbibit to consider. It 18 enough for the present to know that our suspicions with regard to operations in New York are such that it is almost impos sible to avoid the conclusion that transactions of au ex traordinary obaracter were Incled without the kno lodge of the Cincissa directory and 11 would appear that even New York stockbolders were ignorant of the condinon of the bank We referred yesterday to the fact that DD Thursday the stock sold in New York at 99% We DOW observe that on Saturday one hundred shares cold. seller four months, as 95 In ad Islon to this 10 learn that the stock has been purchased in this market, within be 1:01 few days, by directors at par. These facts show that masagers of the bank were up to the be If the ex plusion took place, ignorant of the recklessness of the New York officers. In commen IDE upon this occurrence yesterday, we re. - ked that the difficulty is aceable to stock stions. This fact should be born in mind by all, and especially by th se who think they discover in the disastrous occur remoer that are now passing before us, indicati DE of & general 00 umercial revulsion The only revulsion that CBD take pince must be confined to the stock market The occurrence of a revu *1 ID at this time is improbable, and wha is more and better, it is impossible Men who live and move in Wall street, and who are acquainted with the gambling operations of stock dealers, may eater lain gloomy notions upon this point; but th are who have looked upon he produe live helds of the great West. and have taken the trouble to estimate the value of the immense Drops that are now moving, and the still greater 00 a drop that is rapidly maturing, laugh at the idea Wall street is roties No doubt of this Tim occupants have gamble: nett they be diy know where they Fand, a 4 to their ex effection they imagine that the scene of their operations is the course of the commercial By stem of this great counwy They se mistaken The Wes 18 in a great measure disconnected from the New York Stock Exchange, and re will, trust, sever the connection at on e and forever for the manber in which our people have been drawn upon by an un/aithful agent to help to foot up the losses en stock allons the panic now prevailing in the metropolis would not be felt or couce with Marm west of the mountains Up to the suspension of the Trust Company our m pey market was easy It would be 50 will but for the looking up of a million and a quarter of the active capital of the city in railroad securities By this operation our business men have had their nerves tomewhas disturbed: but there need be no fears Bito their ability to survive the severe blow Even if the ID vesiment should prove a total loss, 11 is DOI equal to the clear profits realized in two or three leading branches of trade the past year No danger, therefore, of this occur rence producing a "commere revulation' and care will be taken. we imagine, to protect the mercantile interests against any further unacthorized drafts of this kort THIRD STREET YESTERDAY -THE BANK EXCITEMENT Third street, yesterday, was more than ever the R ree of the Queen City: all other thoroughfares were neglested for that There was the nucleus and focus of life and as traction: there was the great Trust Company Bank which had suspended: and there the people went in or 18 to look upon its carved and costiy walls, ao 118 broad on trader at which grim policemen, like Griffins stood as guardians The city know through the morning papers, ere the sun had fairly risen. tbs: the "despoial me mmouth would not open its doors, but they went there at an early hour. to 2020 and talk and wonder, much as the ancient R TOTAL per le did upon a holiday the street was full by seven and many were the elongated faces and troubled be we which rues one there The quiet, Oxed, despond em air of men when some entamity has befallen them, was ritten LIC the various faces of that uneasy carter. There was be DOSE no harry, no turb isabe: a deep exate meat Isy under the surface, but not concealed of the houdre is of errors who moved nervously or stood stoically La Third street. A: the murning advance the crowd grow in numbers. and by nine Pelock 11 was almost impossible to drive a vehicle through the street Bull, 00 haste. no ory, no clamor All the eddies, waves and whirlpoots were to visi bie to the ordinary eye: but the close observer benel the ripple on the measured stream What . motley crowd was there! Merchants and minis. ters, editors and emigrants, reporters and mufi is, pol comen and pickbookess, gamblers and gentlemen, ey. prisse and country people, stood side by Ride and jossled each her. Here was a psor, aged Toman, fearful of lostog ber all there a painted and bedizzened creatore whom 00 one could miswke, inquiring as to the prospect of the bank's