Article Text

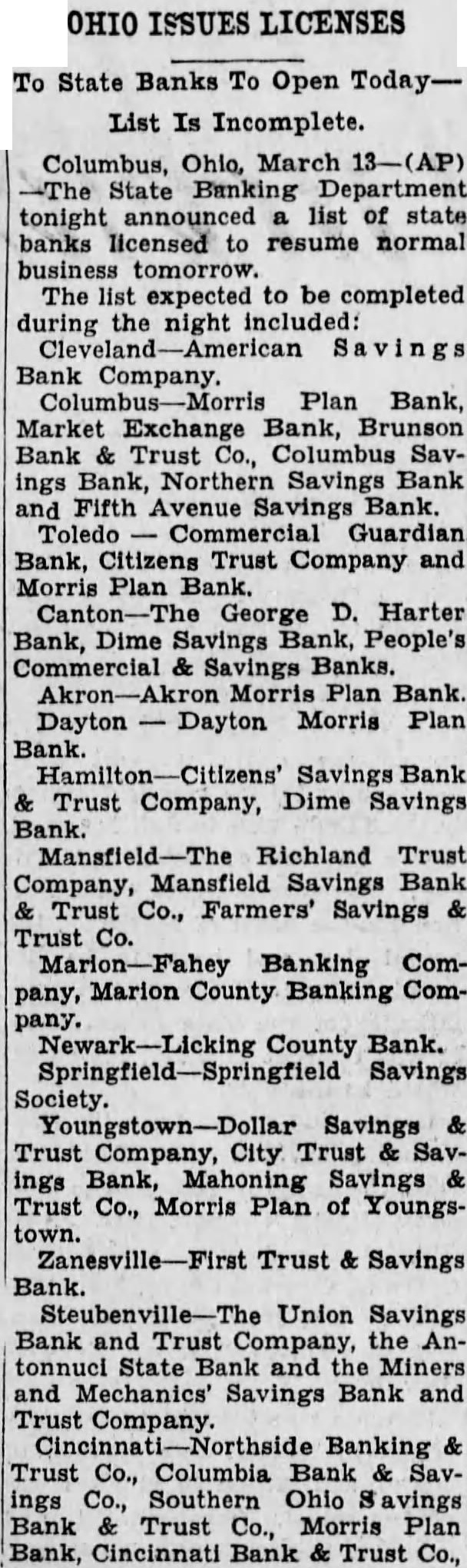

OHIO ISSUES LICENSES State Banks To Open List Is Incomplete. Columbus, Ohio, March Banking Department tonight announced list state banks licensed resume normal business tomorrow. The list expected to be completed during the night included: Bank Company. Plan Bank, Market Exchange Bank, Brunson Bank Trust Columbus Savings Bank, Northern Savings Bank Fifth Bank. Toledo Guardian Bank, Trust Company and Morris Plan George Harter Bank, Dime Savings People's Banks. Morris Plan Bank. Dayton Morris Plan Savings Bank Trust Company, Dime Richland Trust Company, Mansfield Savings Bank Trust Co., Farmers' Savings Trust Co. Banking ComMarion County Banking ComCounty Bank. Savings Society. Savings Trust Trust Bank, Mahoning Savings Trust Co., Morris Plan of Youngstown. Trust Savings Union Savings Bank Trust Company, the tonnuci State Bank the Miners and Mechanics' Savings Bank and Company. Banking Trust Co., Columbia ings Southern Ohio Bank Trust Morris Plan Bank, Cincinnati Bank Trust Co.,