Article Text

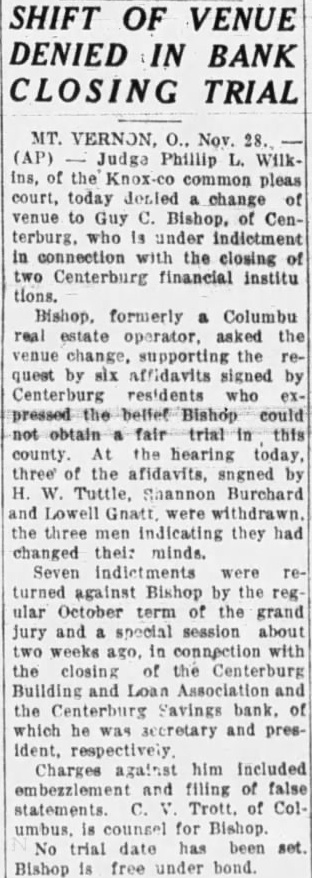

SHIFT OF VENUE DENIED IN BANK CLOSING TRIAL MT. VERNON, Nov. (AP) Judge Phillip L. Wilkof the pleas court, today deried change venue to Guy Bishop, of Centerburg. who under indictment in connection with the closing two Centerburg financial institu tions. Bishop. formerly Columbu real operator, asked the change, supporting the quest by six affidavits signed by Centerburg residents who pressed belief Bishop could not obtain this county. the hearing today three the afidavits, sngned Tuttle, Shannon Burchard and Lowell Gnatt were withdrawn. the three men indicating they changed their minds. Seven indictments were turned against Bishop by the reg ular October term of the grand jury and special session about two weeks connection with closing of the Centerburg Building and Loan Association and the Centerburg Savings bank. which he secretary and presrespectively Charges against him included embezzlement and filing of false statements Trott. of Columbus. for Bishop. No trial date has been set. Bishop free under bond.