1.

February 1, 1908

The Topeka State Journal

Topeka, KS

Click image to open full size in new tab

Article Text

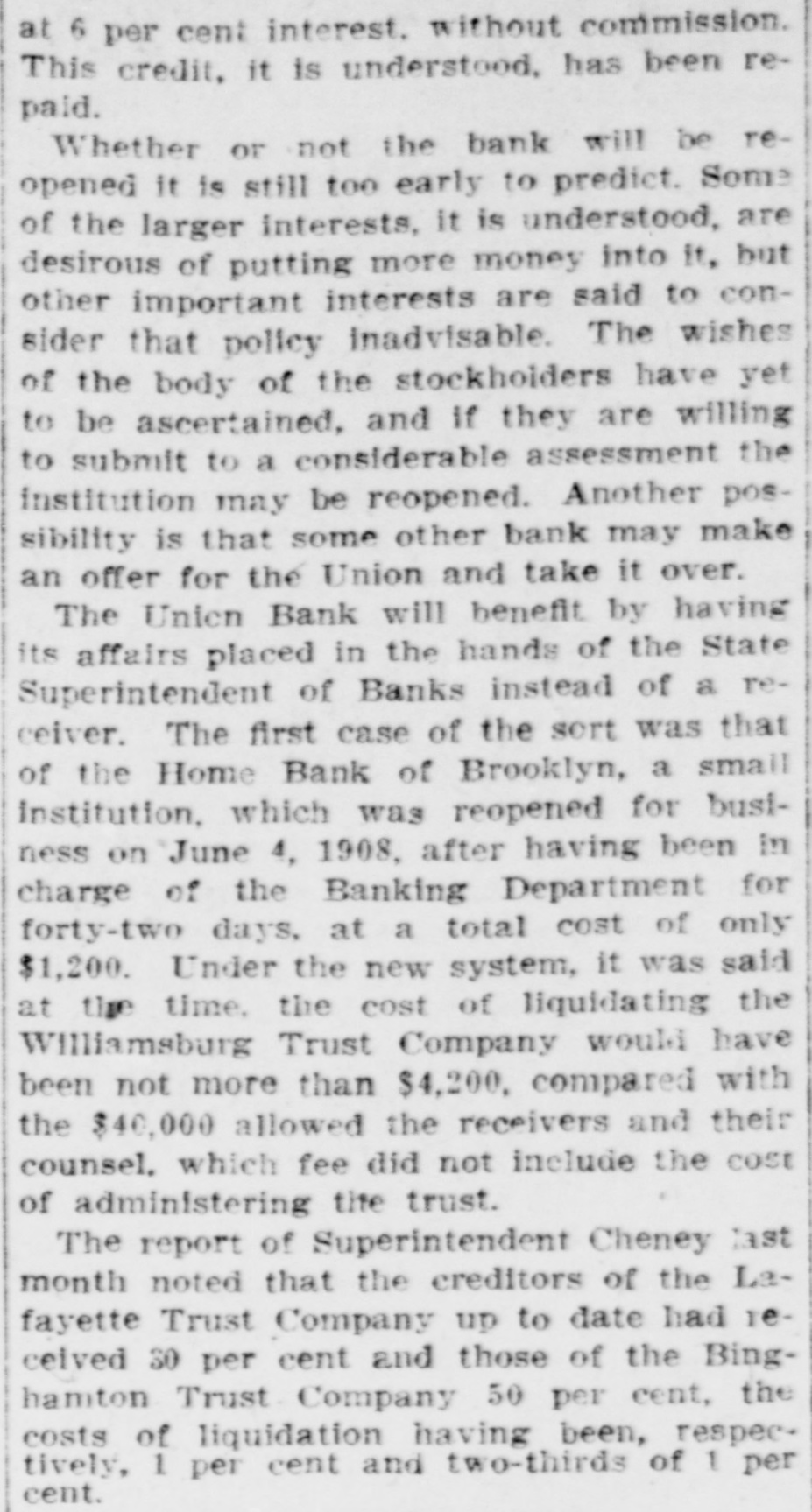

Home Bank of Brooklyn Closes. New York, Feb. 1.-The Home bank of Brooklyn, a state institution on which a run was started yesterday, did not open for business today. The Home bank is a small institution located in South Brooklyn. It has a capital stock of $100,000 and a surplus and undivided profits amounting to $53,670. Its closing is without bearing upon the general financial situation. The deposits which formerly averaged about $500,000, ave been reduced greatly since the October panic.

2.

February 1, 1908

Perth Amboy Evening News

Perth Amboy, NJ

Click image to open full size in new tab

Article Text

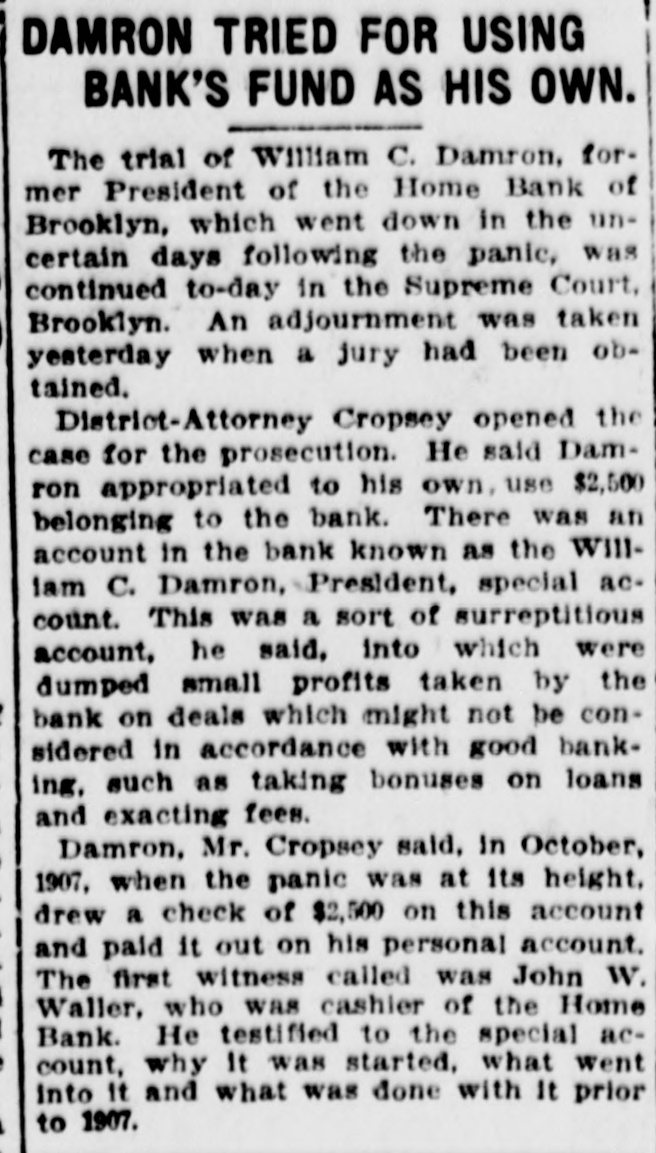

HOME BANK OF BROOKLYN CLOSED Special by United Press Wire: NEW YORK; Feb. 1:-The Home Bank of Brooklyn failed to open its doors today. A run has been in progress for several days. The bank officials announced that the State Banking Department has taken charge. It has a paid up capital of $100,000 with deposits estimated at $389,000.

3.

February 1, 1908

Evening Times-Republican

Marshalltown, IA

Click image to open full size in new tab

Article Text

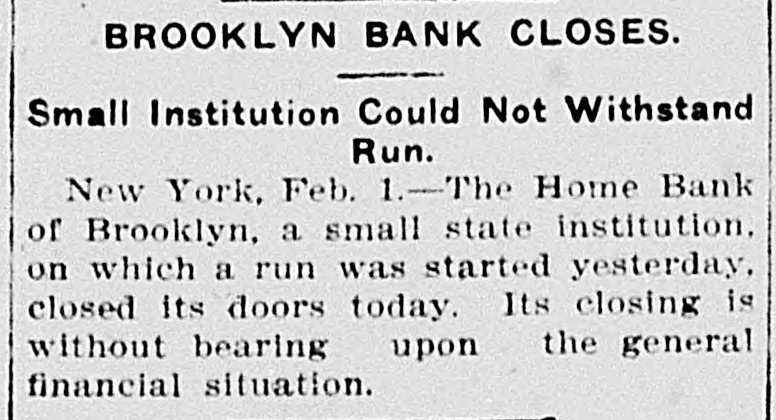

BROOKLYN BANK CLOSES. Small Institution Could Not Withstand Run. New York, Feb. 1.-The Home Bank of Brooklyn, a small state institution. on which a run was started yesterday, closed its doors today. Its closing is without bearing upon the general financial situation.

4.

February 1, 1908

Rock Island Argus

Rock Island, IL

Click image to open full size in new tab

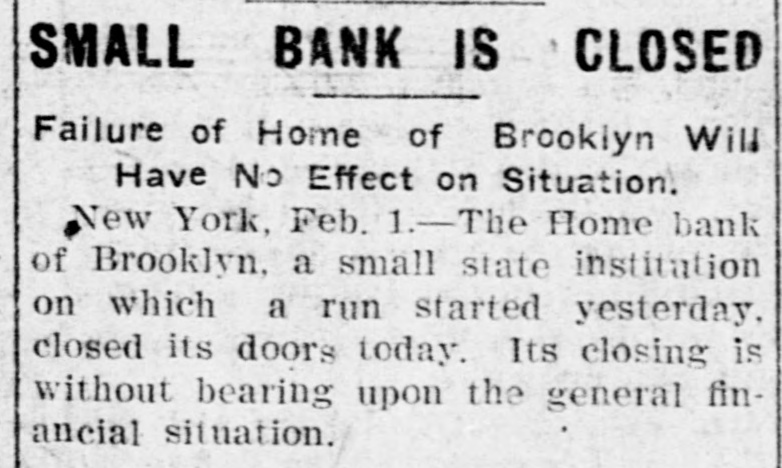

Article Text

SMALL BANK IS CLOSED Failure of Home of Brooklyn Wild Have No Effect on Situation. New York, Feb. 1.-The Home bank of Brooklyn, a small state institution on which a run started yesterday. closed its doors today. Its closing is without bearing upon the general financial situation.

5.

February 1, 1908

The Laramie Republican

Laramie, WY

Click image to open full size in new tab

Article Text

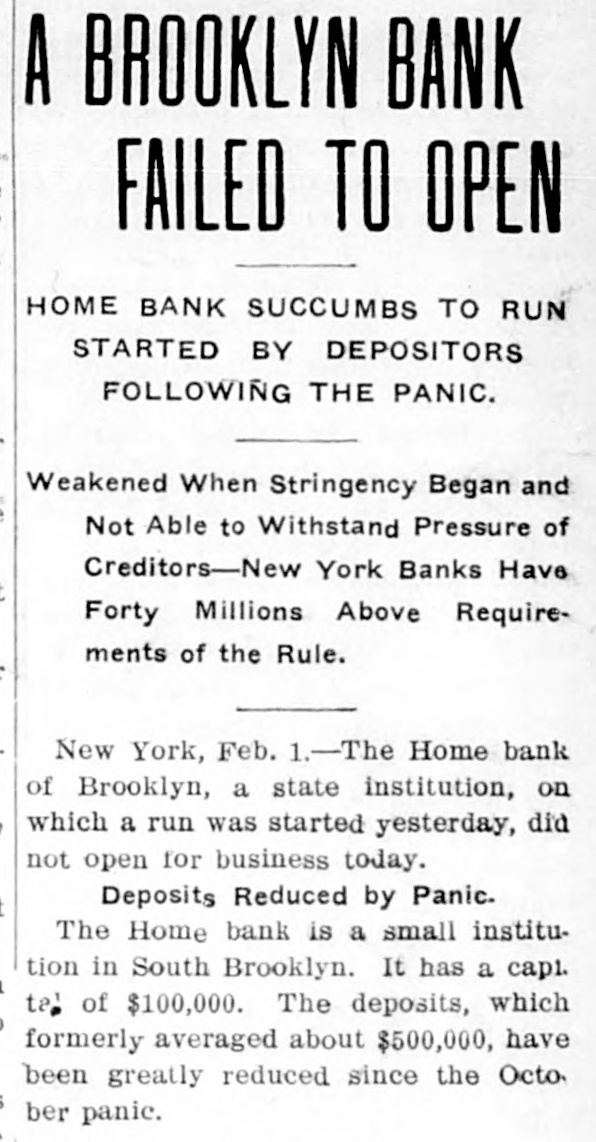

A BROOKLYN BANK FAILED TO OPEN HOME BANK SUCCUMBS TO RUN STARTED BY DEPOSITORS FOLLOWING THE PANIC. Weakened When Stringency Began and Not Able to Withstand Pressure of Creditors-New York Banks Have Forty Millions Above Requirements of the Rule. New York, Feb. 1.-The Home bank of Brooklyn, a state institution, on which a run was started yesterday, did not open for business today. Deposits Reduced by Panic. The Home bank is a small institution in South Brooklyn. It has a capi. tal of $100,000. The deposits, which formerly averaged about $500,000, have been greatly reduced since the Octo. ber panic.

6.

February 1, 1908

Alexandria Gazette

Alexandria, VA

Click image to open full size in new tab

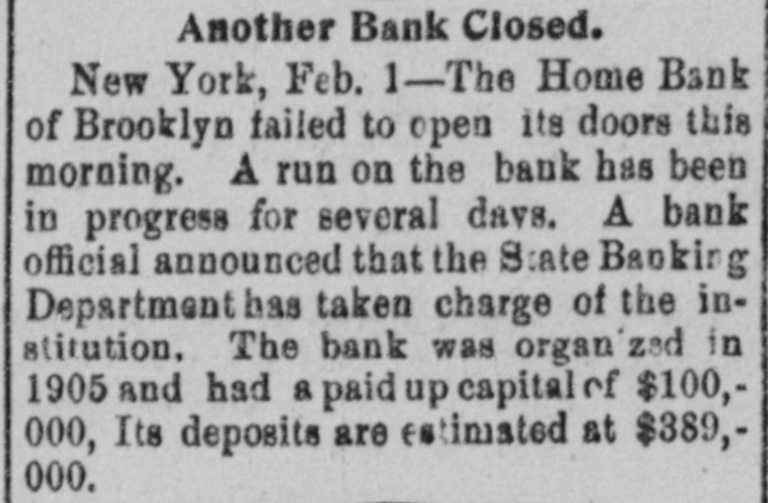

Article Text

Another Bank Closed. New York, Feb. 1-The Home Bank of Brooklyn failed to open its doors this morning. A run on the bank has been in progress for several davs. A bank official announced that the State Banking Departmenthas taken charge of the institution. The bank was organ'zed in 1905 and had a paid up capital of $100,000, Its deposits are estimated at $389,000.

7.

February 1, 1908

Evening Journal

Wilmington, DE

Click image to open full size in new tab

Article Text

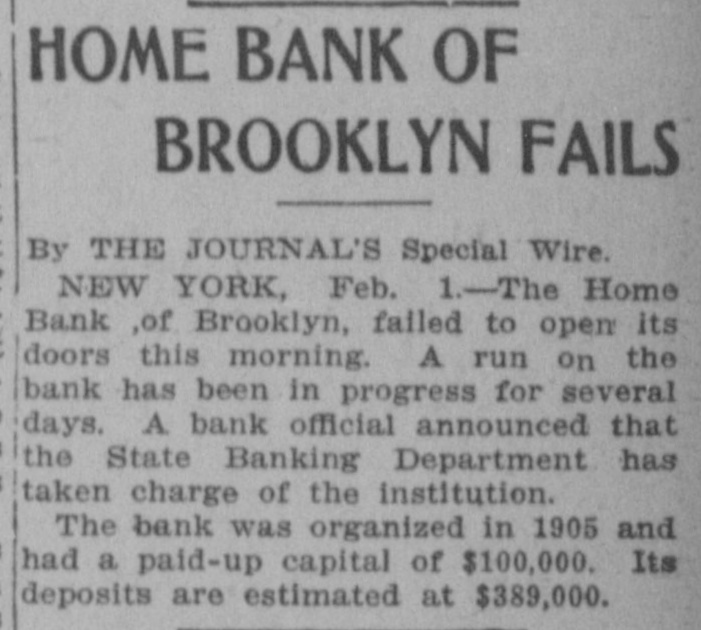

HOME BANK OF BROOKLYN FAILS By THE JOURNAL'S Special Wire. NEW YORK, Feb. 1.-The Home Bank ,of Brooklyn, failed to open its doors this morning. A run on the bank has been in progress for several days. A. bank official announced that the State Banking Department has taken charge of the institution. The bank was organized in 1905 and had a paid-up capital of $100,000. Its deposits are estimated at $389,000.

8.

February 1, 1908

The Detroit Times

Detroit, MI

Click image to open full size in new tab

Article Text

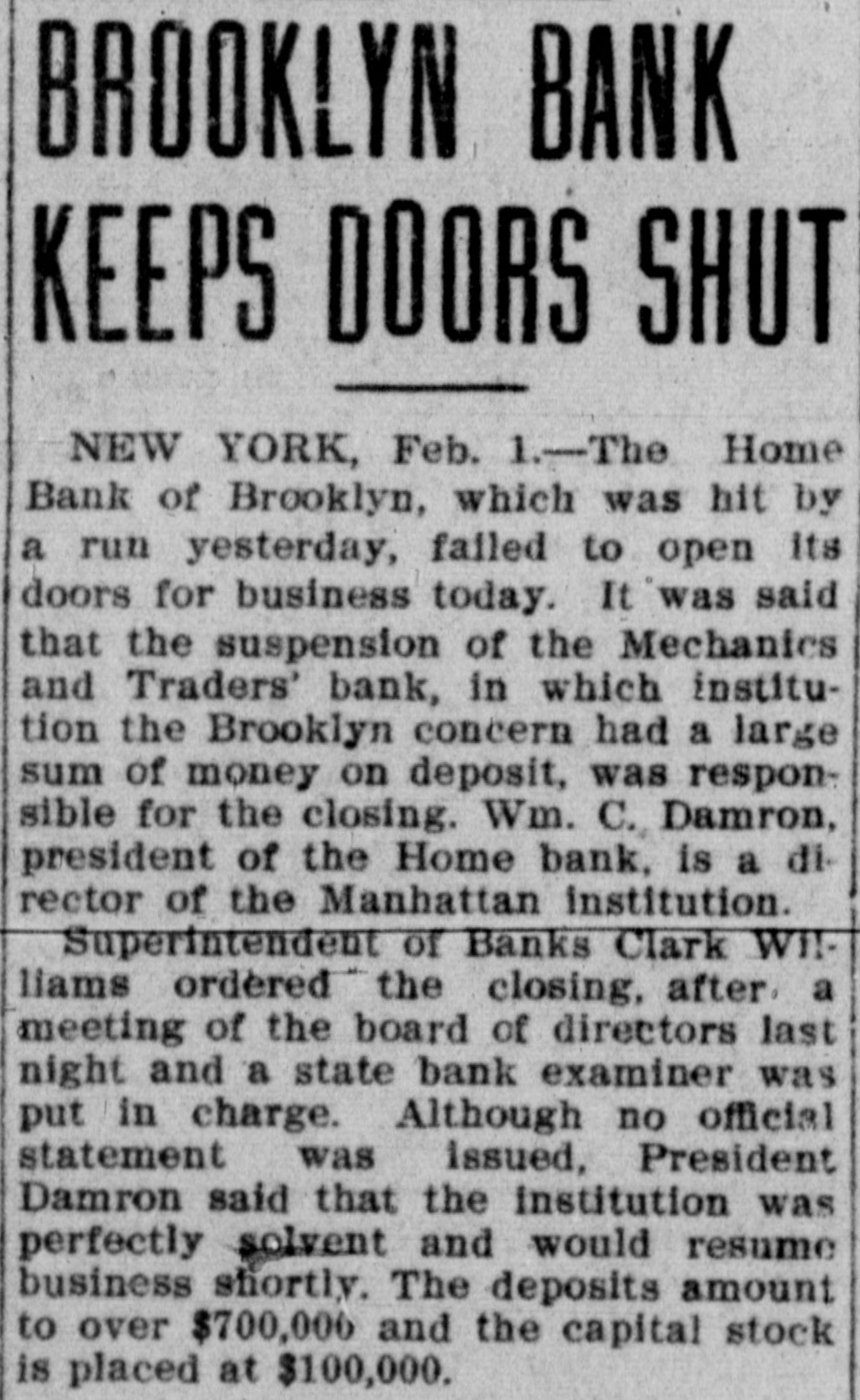

BROOKLYN BANK KEEPS DOORS SHUT NEW YORK, Feb. 1.-The Home Bank of Brooklyn, which was hit by a run yesterday, failed to open its doors for business today. It was said that the suspension of the Mechanics and Traders' bank, in which institution the Brooklyn concern had a large sum of money on deposit, was responsible for the closing. Wm. C. Damron, president of the Home bank, is a director of the Manhattan institution. Superintendent of Banks Clark Williams ordered the closing, after. a meeting of the board of directors last night and a state bank examiner was put in charge. Although no official statement was issued, President Damron said that the institution was perfectly solvent and would resume business shortly. The deposits amount to over $700,000 and the capital stock is placed at $100,000.

9.

February 1, 1908

Deseret Evening News

Salt Lake City, UT

Click image to open full size in new tab

Article Text

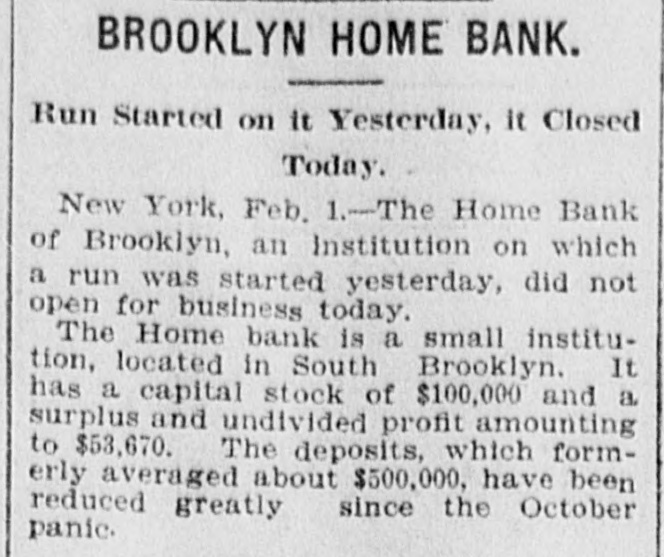

BROOKLYN HOME BANK. Run Started on it Yesterday, it Closed Today. New York, Feb. 1.-The Home Bank of Brooklyn, an Institution on which a run was started yesterday, did not open for business today. The Home bank is a small institution, located in South Brooklyn. It has a capital stock of $100,000 and a surplus and undivided profit amounting to $53,670. The deposits, which formerly averaged about $500,000, have been reduced greatly since the October panic.

10.

February 2, 1908

Omaha Daily Bee

Omaha, NE

Click image to open full size in new tab

Article Text

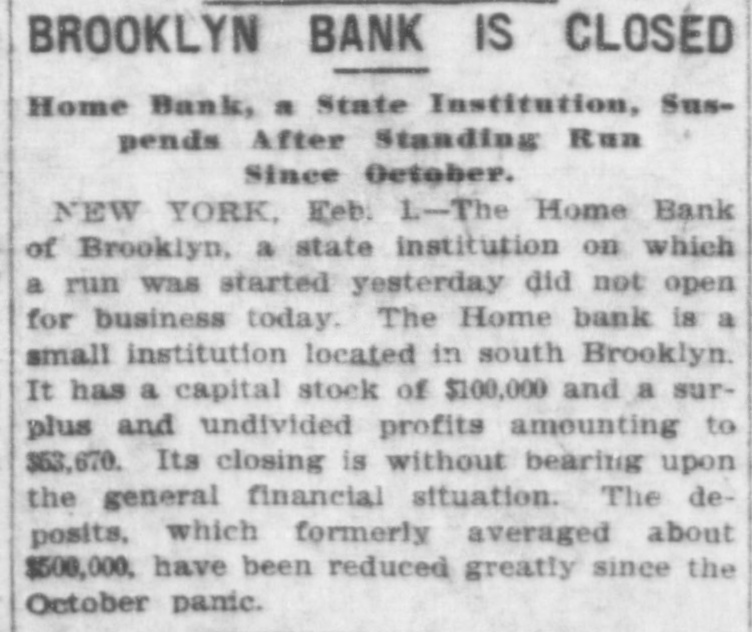

BROOKLYN BANK IS CLOSED Home Bank, a State Institution, Suspends After Standing Run Since October. NEW YORK, Feb. -The Home Bank of Brooklyn, a state institution on which a run was started yesterday did not open for business today. The Home bank is a small institution located in south Brooklyn. It has a capital stock of $100,000 and a surplus and undivided profits amounting to $53,670. Its closing is without bearing upon the general financial situation. The deposits, which formerly averaged about $500,000, have been reduced greatly since the October panic.

11.

February 2, 1908

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

Small Bank Closes Ry Associated Press. NEW YORK, Feb. 1.-The Home bank of Brooklyn, an institution on which a run was started yesterday, did not open for business today. The Home bank is a small institution located in South Brooklyn. It has a capital stock of $100,000 and a surplus and undivided profits amounting to $53,670.

12.

February 3, 1908

Semi-Weekly Herald

Durango, CO

Click image to open full size in new tab

Article Text

BROOKLYN BANK "PUT ON THE BUM." NEW YORK, Feb. 1.-The Home bank of Brooklyn, a state institution on which a run was started yesterday, did not open for business today. The Home bank is a small institution located in South Brooklyn.

13.

February 3, 1908

The Spokane Press

Spokane, WA

Click image to open full size in new tab

Article Text

COULDN'T STAND RUN. NEW YORK, Feb. 3.-The Home bank of Brooklyn failed to open this morning, a run having been in progress several days. The state banking department has taken charge of the institution. It organized in 1850 and had a capital of $100,000 and deposits estimated at $389,000.

14.

February 7, 1908

The Kendrick Gazette

Kendrick, ID

Click image to open full size in new tab

Article Text

NEWS OF THE WORLD SHORT DISPATCHES FROM ALL PARTS OF THE GLOBE. A Review of Happenings in Both Eastern and Western Hemispheres During the Past Week-National, Historical, Political and Personal Events. The Home bank of Brooklyn, an institution on which a run was started Saturday, has failed. David Yerkes, for years a weigher in the United States mint at Philadelphia, died at Spokane recently, at the age of 76 years. The grand jury at Kansas City returned 200 indictments against actors, actresses and theatrical managers and attaches charged with violating the Sunday law. It required $54,000 to cover the necessary bonds. Milton D. Purdy, assistant to the attorney general, "chief trust buster," and originator of the receivership innovation in trust prosecution, will shortly retire from the department of justice. Purdy is said to be slated for a circut judgeship in the eighth circuit. Gil Blas, a paper of Paris, says that Mme. Anna Gould intends to sell her property in Paris and return to America. The monthly coinage statement issued by the director of the mint Saturday shows the amount of coinage executed at the United States mints during January 1908, to have been $15,431,120, as follows: Gold, $13,044,950; silver, $2,129,000; minor coins, $257,170. Mrs. Annie Ackerly, the first woman ever convicted of arson in Brooklyn, has been sentenced to serve 14 years in prisón. It is reported important steps will be taken within the next few days in the effort to cause the removal from office of Lieutenant Governor Dunsmuir. The most disastrous blizzard of the winter passed over Chicago and vicinity Sunday. Oldtime residents of the Northwest have been astonished by the news that "Jack" Lavelle, for many years chief of police in Butte, is dying of cancer of the stomach in a Reno (Nev.) hospital. The memory of John Muir, California's writer and nature lover, will be perpetuated in a forest reservation near San Francisco, made up of giant redwoods and towering douglas firs, thousands of years old. It has been designated the Muir national forest. The trial of Mrs. Dora McDonald, widow of Chicago's millionaire gambler king, for the death of Webster Guerin, furnishes the first instance in the history of Illinois jurisprudence of a dying woman being placed in jeopardy of her life. Chief counsel for the defense of Mrs. McDonald is Colonel James Hamilton Lewis, former congressman from Washington state. The shipbuilders on the northeast coast of England have given notice that the services of all workingmen will be dispensed with on February 10. This action is an outcome of the strike inaugurated January 2, the men refusing to accept a reduction in wages. After the suspension of construction work for the last two months, the Harriman lines are to resume the building of Oregon railroads. General Manager O'Brien issued orders yesterday to assemble men and materials

15.

May 2, 1908

The Morning Journal-Courier

New Haven, CT

Click image to open full size in new tab

Article Text

NEW BANK LAW'S OPERATION. State Superintendent Takes Control of Brooklyn Bank. New York, May 1.-It was learned this afternoon that Clark Williams, superintendent of banks, had taken possession of the Home Bank of Brooklyn ,which suspended on February 1 last, under the new law which has just gone into efféct. permitting the superintendent of banks to undertake the liquidation of all closed institutions. This action by the banking department has precipitated a very intéresting situation, which will undoubtedly come as a complete surprise to Attorney General Jackson who for some reason failed to appoint a receiver for the Erooklyn bank, and has therefore been deprived of selecting a man to set the fat fees which, under the old law, could be charged in such dissolutions.

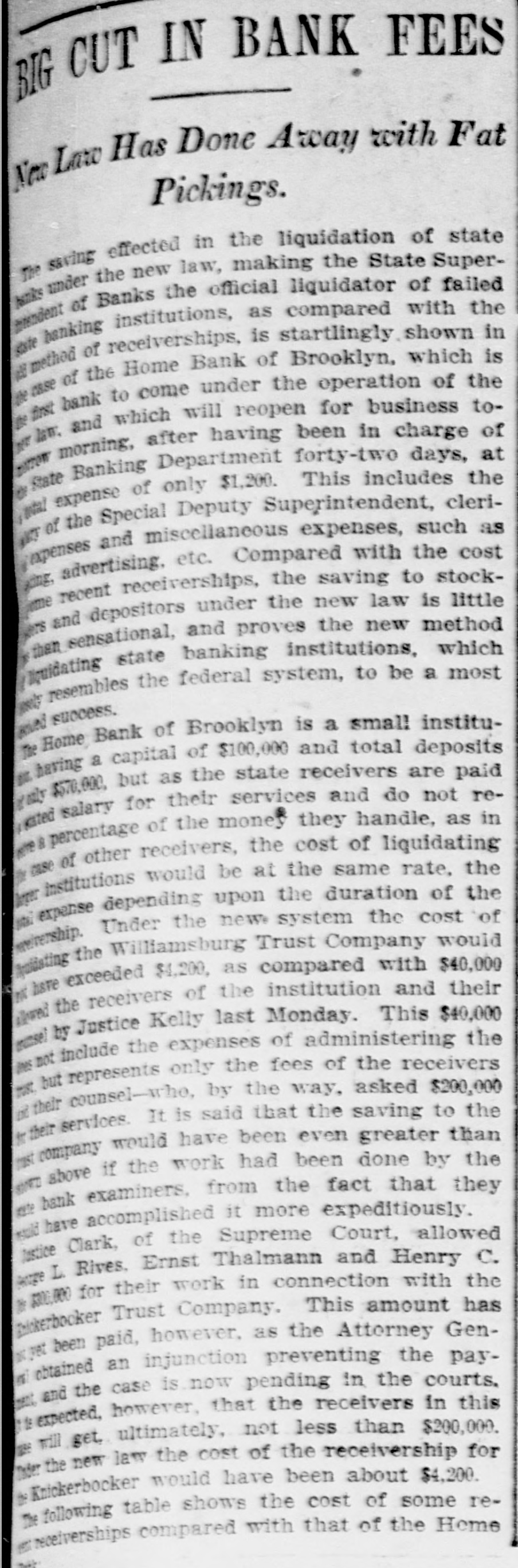

16.

June 3, 1908

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

BIG CUT IN BANK FEES New Law Has Done Away with Fat Pickings. effected in the liquidation of state law, making the State SuperBanks the official liquidator of failed institutions, as compared with the receiverships, is startlingly shown in Home Bank of Brooklyn, which is come under the operation of the which will reopen for business toafter having been in charge of Banking Department forty-two days, at of only $1,200. This includes the Special Deputy Superintendent, cleriand miscellaneous expenses, such as etc. advertising. receiverships, under Compared the the saving with law to the is stock- little cost depositors new sensational, and proves the new method state banking institutions, which resembles the federal system, to be a most of Brooklyn is a small institucapital of $100,000 and total deposits but as the state receivers are paid redo not and services their for of the money they handle, as in receivers, the cost of liquidating institutions would be at the same rate, the expense depending upon the duration of the Under the new system the cost of Williamsburg Trust Company would $4,200, as compared with $40,000 receivers of the institution and their Justice Kelly last Monday. This $40,000 include the expenses of administering the represents only the fees of the receivers counsel-who, by the way, asked $200,000 services It is said that the saving to the company would have been even greater than above if the work had been done by the examiners, from the fact that they accomplished it more expeditiously. Clark, of the Supreme Court, allowed Rives. Ernst Thalmann and Henry C. for their work in connection with the Trust Company. This amount has been paid, however, as the Attorney Genobtained an injunction preventing the paythe case is now pending in the courts, however, that the receivers in this get. ultimately, not less than $200,000. the cost of the receivership for Knickerbocker would have been about $4,200. following table shows the cost of some rereceiverships compared with that of the Home

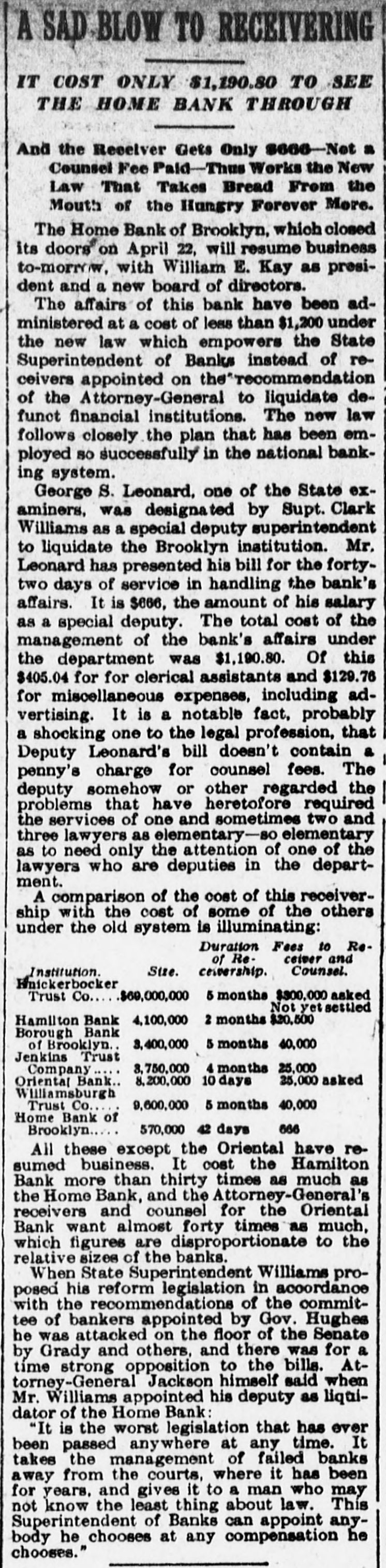

17.

June 3, 1908

The Sun

New York, NY

Click image to open full size in new tab

Article Text

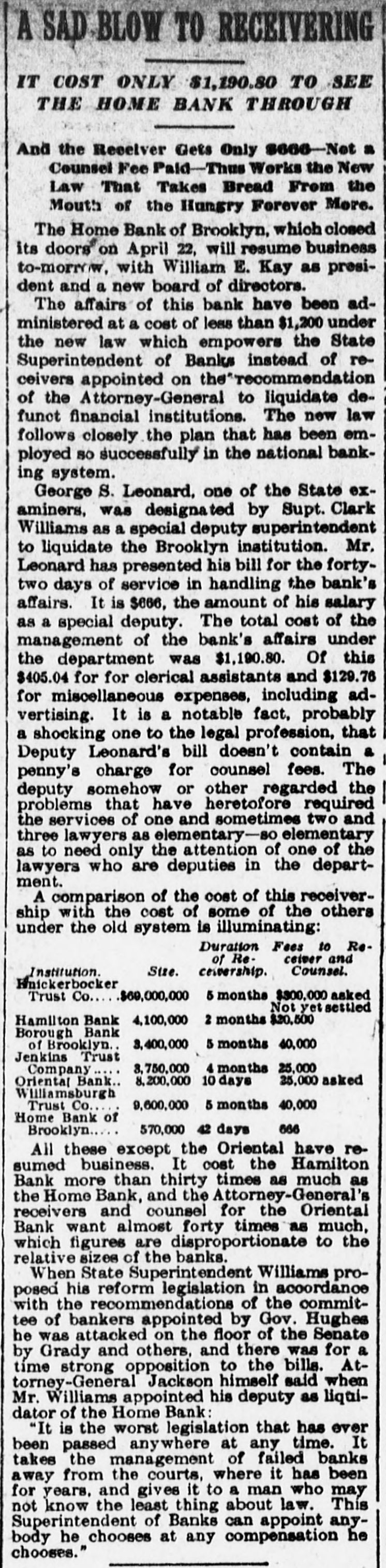

A SAD BLOW TO RECEIVERING IT COST ONLY $1,190.80 TO SEE THE HOME BANK THROUGH And the Receiver Gets Only $666-Not a Counsel Fee Paid-Thus Works the New Law That Takes Bread From the Mouth of the Hungry Forever More. The Home Bank of Brooklyn, which closed its doors on April 22, will resume business to-morrow, with William E. Kay as president and a new board of directors. The affairs of this bank have been administered at a cost of less than $1,200 under the new law which empowers the State Superintendent of Banks instead of receivers appointed on the"recommendation of the Attorney-General to liquidate defunct financial institutions. The new law follows closely the plan that has been employed so successfully in the national banking system. George S. Leonard, one of the State examiners, was designated by Supt. Clark Williams as a special deputy superintendent to liquidate the Brooklyn institution. Mr. Leonard has presented his bill for the fortytwo days of service in handling the bank's affairs. It is $666, the amount of his salary as a special deputy. The total cost of the management of the bank's affairs under the department was $1,190.80. Of this $405.04 for for clerical assistants and $129.76 for miscellaneous expenses, including advertising. It is a notable fact, probably a shocking one to the legal profession, that Deputy Leonard's bill doesn't contain a penny's charge for counsel fees. The deputy somehow or other regarded the problems that have heretofore required the services of one and sometimes two and three lawyers as elementary-so elementary as to need only the attention of one of the lawyers who are deputies in the department. A comparison of the cost of this receivership with the cost of some of the others under the old system is illuminating: Duration Fees to Receiver and of ReCounsel. Stre. Institution. ceivership. Hnickerbocker 5 months $800,000 asked Trust Co $69,000,000 Not yet settled Hamilton Bank 2 months $20,500 4,100,000 Borough Bank 5 months 40,000 of Brooklyn. 3,400,000 Jenkins Trust 4 months 25,000 3,750,000 Company 35,000 asked 10 days 8,200,000 Oriental Bank.. Williamsburgh 5 months 40,000 Trust Co 9,600,000 Home Bank of 570,000 42 days 666 Brooklyn All these except the Oriental have resumed business. It cost the Hamilton Bank more than thirty times as much as the Home Bank, and the Attorney-General's receivers and counsel for the Oriental Bank want almost forty times as much, which figures are disproportionate to the relative sizes of the banks. When State Superintendent Williams proposed his reform legislation in accordance with the recommendations of the committee of bankers appointed by Gov. Hughes he was attacked on the floor of the Senate by Grady and others, and there was for a time strong opposition to the bills. Attorney-General Jackson himself said when Mr. Williams appointed his deputy as liquidator of the Home Bank: "It is the worst legislation that has ever been passed anywhere at any time. It takes the management of failed banks away from the courts, where it has been for years, and gives it to a man who may not know the least thing about law. This Superintendent of Banks can appoint anybody he chooses at any compensation he chooses."

18.

June 6, 1908

The Barre Daily Times

Barre, VT

Click image to open full size in new tab

Article Text

RECEIVERSHIP COST LITTLE. Administration of Affairs Under New New York State Law. ,New York, June 6,-The Home Bank, in Fifth avenue South, Brooklyn, which closed its doots on Feb. 1, and has been in the hands of the state banking department since April 22, resumed business under an order handed down by Judge Dickey of the Supreme court. The papers submitted by the state banking department show the first results of the working of that part of the new state banking laws relating to the management of failed institutions which was fought through the Senate largely by the arguments of Superintendent of Banking Clark Williams. The new law empowers the state superintendent of banks instead of receivers Appointed on the recommendation of the attorney-general to liquidate defunct financial institutions. The new law follows elogely the plan that has ,been employed so suecassfully in the national banking system. George S. Leonard, one of the state examiners, was designated by Superintendent Clark Williams as a special deputy superintendent to liquidate the Brooklyn institution. Mr. Leonard has presented his bill for the forty-two days of service in handling the bank's affairs. It is $666, the amount of his salary as a special deputy. The total cost of the management of the bank's affairs under the department was $1,190,80. Of this $405.04 for clerícal assistants and $129.76 for miscellaneous expenses, including advertising. Deputy Leonard's bill does not contain & penny's charge for counsel fees. The deputy regarded the problems that have heretofore required the services of one and sometimes two and three lawyers as so elementary as to need only the attention of one of the lawyers who are deputies in the department. A comparison of the cost of this receivership with the cost of some of the others under the old system is interesting: Duration Fees to Re:

19.

June 6, 1908

The Barre Daily Times

Barre, VT

Click image to open full size in new tab

Article Text

H. C. IDE WILL GET $20,000 AND NOT $75,000. Receivers Fees in Knickerbocker Receivership Cut By New York Courts. New York, June 6.-The appellate division of the supreme court in Brooklyn yesterday handed down a decision rerelueing the fees of the receivers for the Kniekerbocker Trust company. The three receivers, Ernest Thalmann, Henry C. Ide and George L. Rivas asked for and got from the supreme court a fee of $75,000 each for their services in reorganizing the Knickerbocker Trust company. The attorney general believed the fee to be exorbitant and appealed from the award. In the decision which it handed down yesterday the appellate division reduced the fees from $75,000 each to $20,000. Special Deputy Superintendent of Banking Leonard who reorganized the Home bank of BrookIvn put in a bill of $666 for his services.

20.

June 12, 1908

The Democratic Advocate

Westminster, MD

Click image to open full size in new tab

Article Text

Receivership Fees. New York lawyers are aghast. The best thing going is going away from them. Gov. Hughes drove through the New York Legislature a bill authorizing the State Superintendent of Banking to settle the business of failed banks. Under this the Home Bank, of Brooklyn, has just reopened after forty-two days of suspension at a cost of $666 for the liquidator, nothing for lawyers and $1190.80 for other expenses. The receivers and their lawyers want $300,000 for liquidating the Knickerbocker Trust Company: $40,000 each was paid for liquidating the Borough Bank, of Brooklyn, and the Williamsburg Trust Company, and $25,000 was demanded for ten days spent in settling the affairs of the Oriental Bank. Council for a receiver of a big financial institution has been one of the great prizes of the Bar, and now deputies of the Superintendent of Banking are going to wind up failed banks without any help from lawyers.

21.

April 6, 1910

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

at 6 per cent interest, without commission. This credit, it is understood, has been repaid.

Whether or not the bank will be reopened it is still too early to predict. Some of the larger interests, it is understood, are desirous of putting more money into it, but other important interests are said to consider that policy inadvisable. The wishes of the body of the stockholders have yet to be ascertained, and if they are willing to submit to a considerable assessment the institution may be reopened. Another possibility is that some other bank may make an offer for the Union and take it over.

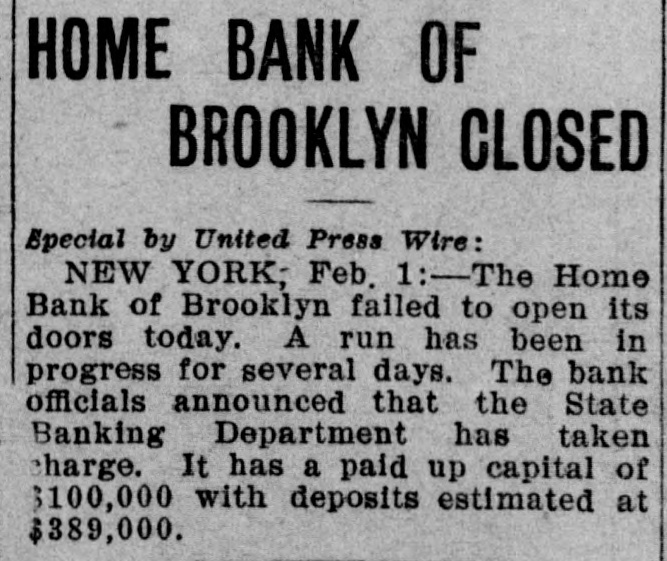

The Union Bank will benefit by having its affairs placed in the hands of the State Superintendent of Banks instead of a receiver. The first case of the sort was that of the Home Bank of Brooklyn, a small institution, which was reopened for business on June 4, 1908, after having been in charge of the Banking Department for forty-two days, at a total cost of only $1,200. Under the new system, it was said at the time, the cost of liquidating the Williamsburg Trust Company would have been not more than $4,200, compared with the $40,000 allowed the receivers and their counsel, which fee did not include the cost of administering the trust.

The report of Superintendent Cheney last month noted that the creditors of the Lafayette Trust Company up to date had received 30 per cent and those of the Binghamton Trust Company 50 per cent, the costs of liquidation having been, respectively, 1 per cent and two-thirds of 1 per cent.

22.

January 23, 1913

The Evening World

New York, NY

Click image to open full size in new tab

Article Text

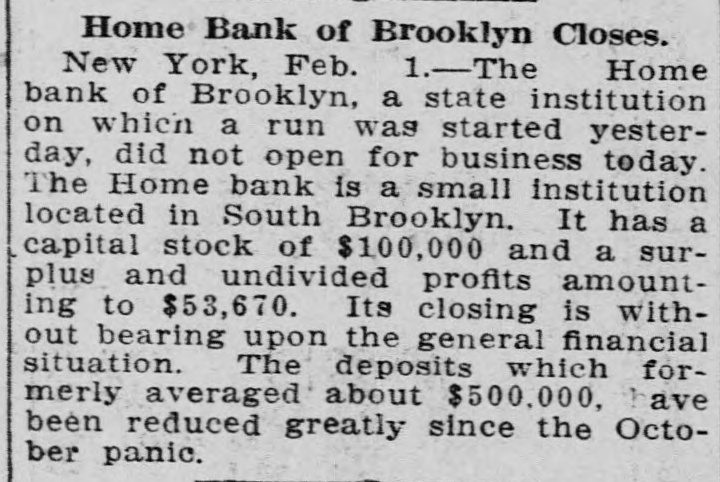

DAMRON TRIED FOR USING BANK'S FUND AS HIS OWN. The trial of William C. Damron, former President of the Home Bank of Brooklyn, which went down in the uncertain days following the panic, was continued to-day in the Supreme Court, Brooklyn. An adjournment was taken yesterday when a jury had been obtained. District-Attorney Cropsey opened the case for the prosecution. He said Damron appropriated to his own, use $2,500 belonging to the bank. There was an account in the bank known as the WillIam C. Damron, President, special account. This was a sort of surreptitious account, he said, into which were dumped small profits taken by the bank on deals which might not be considered in accordance with good banking. such as taking bonuses on loans and exacting fees. Damron, Mr. Cropsey said, in October, 1907, when the panic was at its height, drew a check of $2,500 on this account and paid it out on his personal account. The first witness called was John W. Waller, who was cashier of the Home Bank. He testified to the special account, why It was started, what went into It and what was done with It prior to 1907.