Article Text

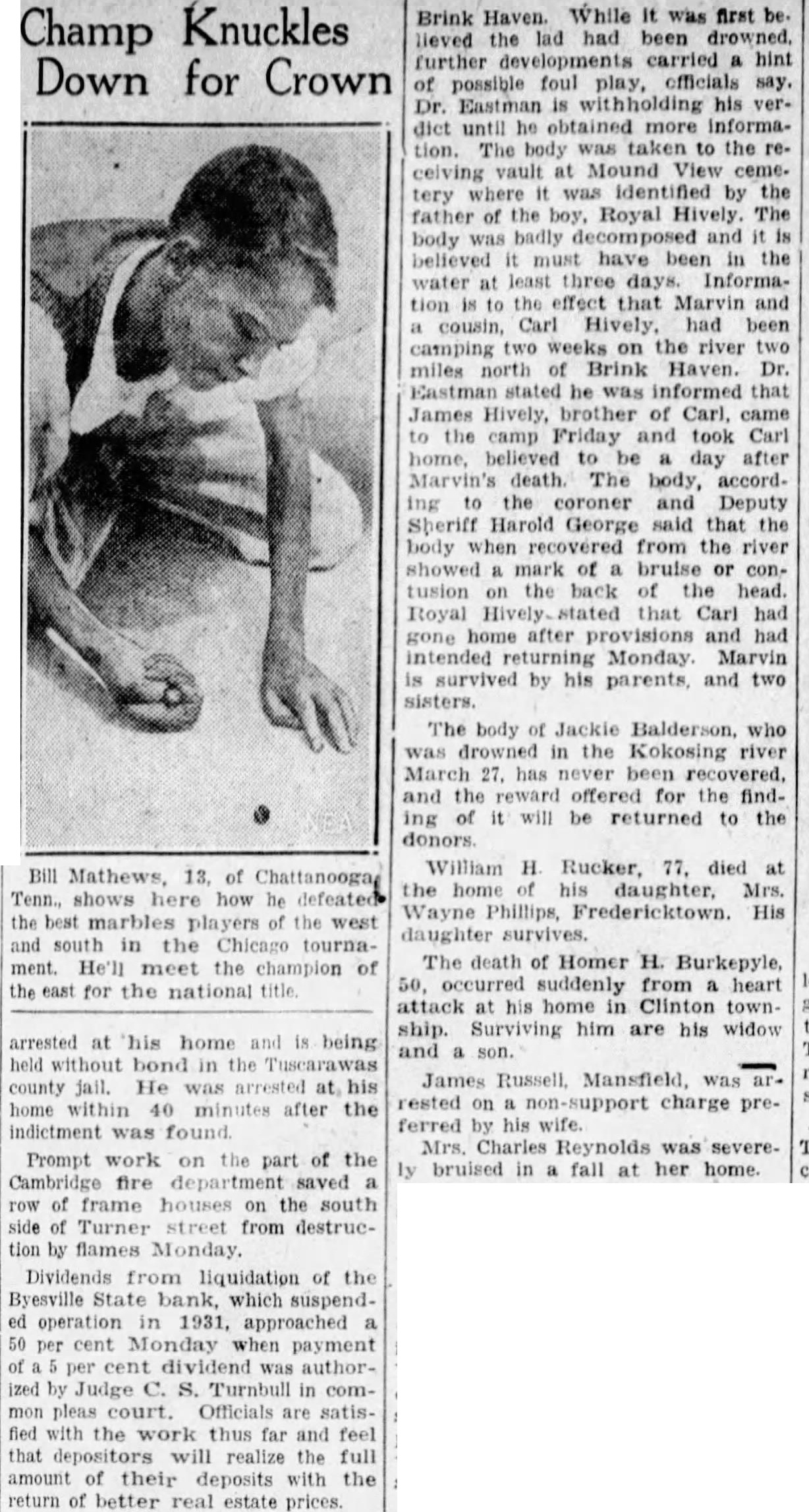

Champ Knuckles Down for Crown Bill Mathews, 13, of Chattanooga Tenn., shows here how he defeated the best marbles players of the west and south in the Chicago tournament. He'll meet the champion of the east for the national title arrested at his home and is being held without bond in the Tuscarawas county jail. He was arrested at his home within 40 minutes after the indictment was found Prompt work on the part of the Cambridge fire department saved row of frame houses on the south side of Turner street from destruction by flames Monday. Dividends from liquidation of the Byesville State bank, which suspended operation in 1931, approached 50 per cent Monday when payment of per cent dividend was authorized by Judge C. S. Turnbull in common pleas court. Officials are satisfied with the work thus far and feel that depositors will realize the full amount of their deposits with the return of better real estate prices. Brink Haven. While It was first be. lieved the lad had been drowned. further developments carried a hint of possible foul play, officials say. Dr. Eastman is withholding his verdict until he obtained more information. The body was taken to the receiving vault at Mound View ceme. tery where It was identified by the father of the boy, Royal Hively The body was badly decomposed and it believed it must have been in the water at least three days. Information is to the effect that Marvin and a cousin, Carl Hively, had been camping two weeks on the river two miles north of Brink Haven. Dr. Eastman stated he was informed that James Hively, brother of Carl, came to the camp Friday and took Carl home, believed to be day after Marvin's death. The body, accord. ing to the coroner and Deputy Sheriff Harold George said that the body when recovered from the river showed mark of a bruise or contusion on the back of the head. Royal Hively stated that Carl had gone home after provisions and had intended returning Monday. Marvin is survived by his parents, and two sisters. The body of Jackie Balderson, who was drowned in the Kokosing river March 27. has never been recovered, and the reward offered for the finding of it will be returned to the William H Rucker, 77. died at the home of his daughter, Mrs. Wayne Phillips, Fredericktown. His daughter survives The death of Homer H. Burkepyle, 50, occurred suddenly from heart attack at his home in Clinton town. ship. Surviving him are his widow and son. I James Russell, Mansfield, was rested on non-support charge preferred by his Mrs. Charles Reynolds was severe. ly bruised in a fall at her home.