Article Text

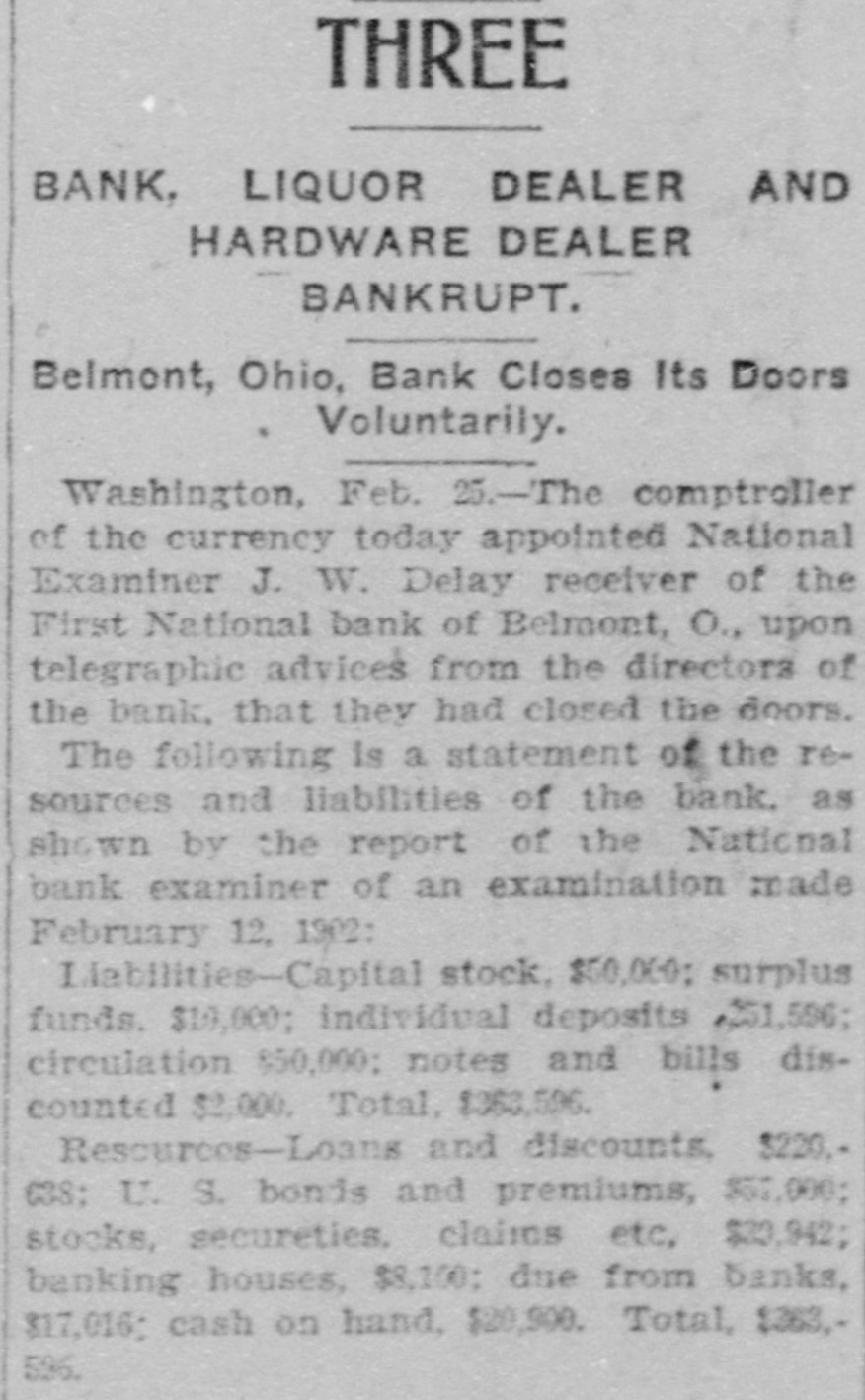

A BANK RECEIVER IS APPOINTED The First National Bank at Belmont, Ohio, This Morning Closed Its Doors by Order of Its Directors. THE DEPOSITS ARE $251,596. CASH ON HAND $20,900 Washington, Feb. 25.-The comptroller of currency appointed National Bank Examiner J. W. Delay receiver of the First. National Bank of Belmont, Ohic, upon telegraphic advice from the directors that they closed their doors. The deposits are $251,596;loans and discounts $220,638; cash on hand $20,900.