Click image to open full size in new tab

Article Text

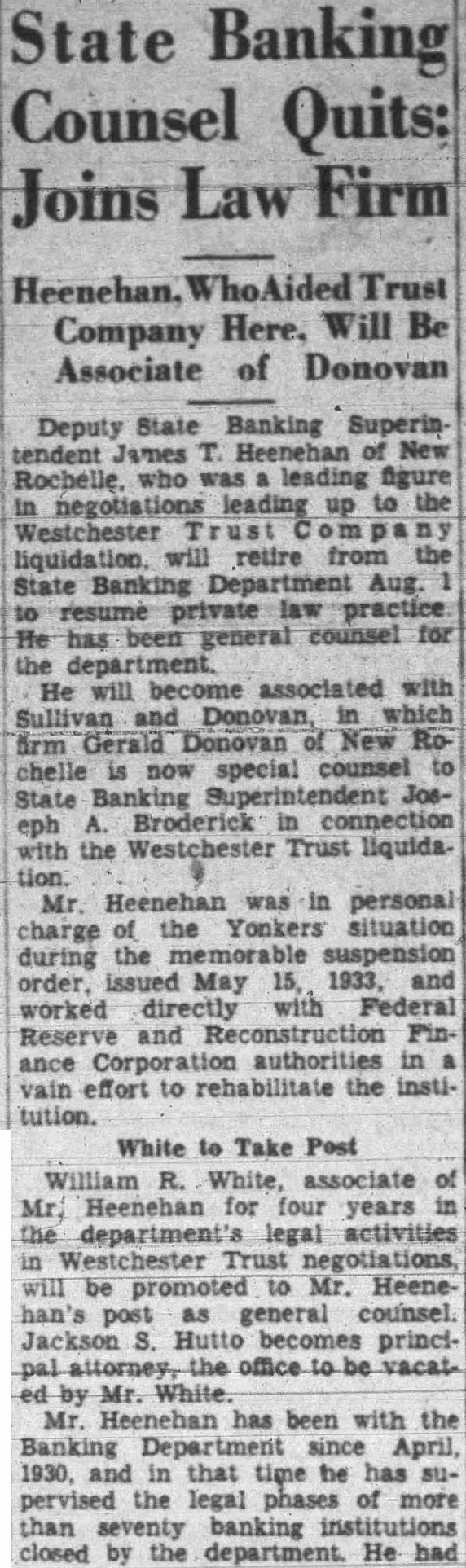

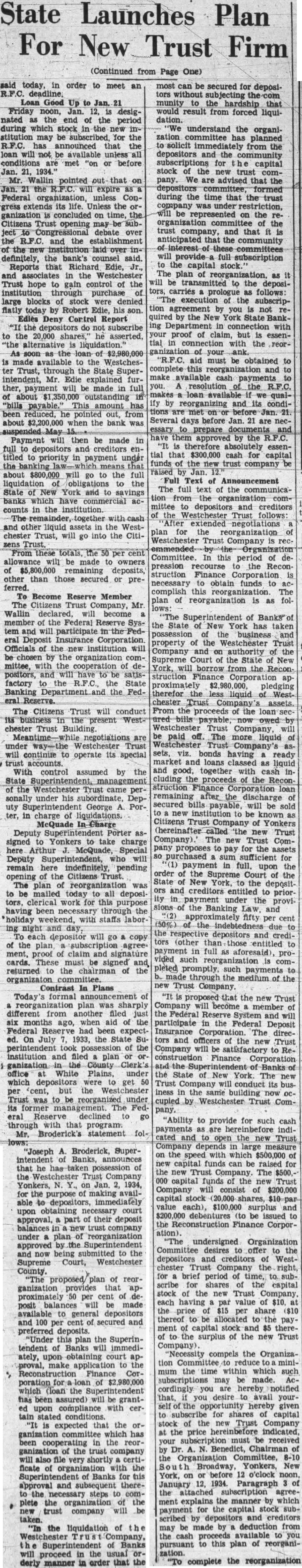

State Launches Plan For New Trust Firm

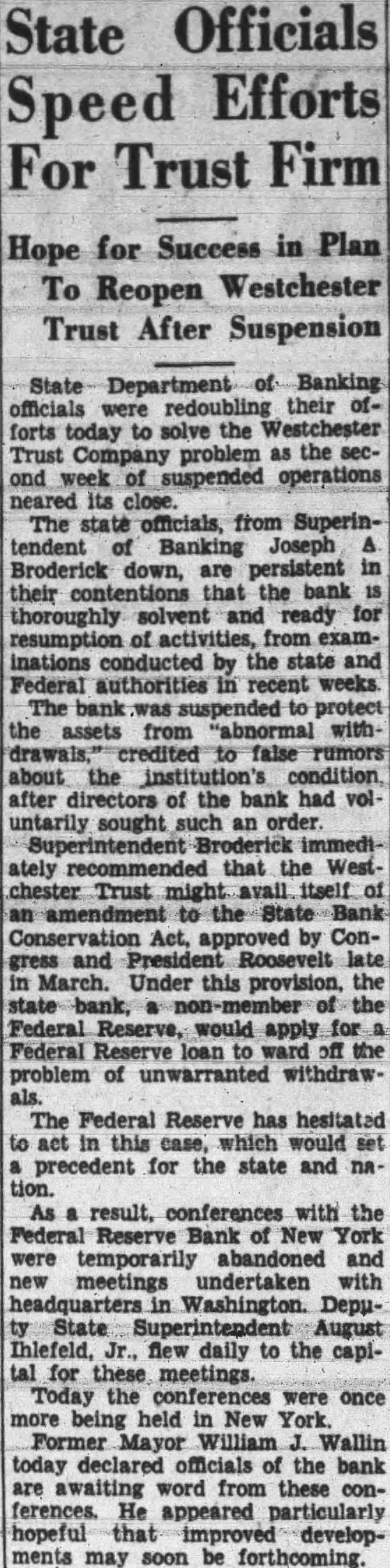

(Continued from One) said today, in order to meet deadline. Loan Good Up to Jan. Friday noon, Jan. designated the end the period during which stock the may subscribed, for the R.F.C. announced that the loan not unless conditions are met or before Wallin pointed out that on the expire Federal organization, unless Conextends its life. Unless the ganization concluded on time, Citizens Trust opening may be Congressional debate over the R.F.C. the establishment the institution laid over definitely, the bank's counsel said. Reports that Richard Edie, associates in the Westchester Trust hope gain control of the institution through purchase large blocks stock were denied flatly today by Robert Edie, his son Edies Deny Cortrol Report the do subscribe the 20,000 shares,' he alternative liquidation." the loan made available the WestchesTrust, through the State Superintendent, Mr. Edie explained further, payment will made in full about $1,350,000 outstanding "bills This amount has been reduced, he pointed out, from about when the bank was Payment will then be made in to depositors and creditors titled to priority in payment under the banking about $800,000 will go to the full liquidation obligations the State New York and to savings banks which have commercial counts the institution. The together other liquid assets in the Westchester Trust, will into the CitiTrust. From these allowance will be made owners remaining deposits, other than those secured or preferred. To Become Reserve Member The Citizens Trust Company, Mr. Wallin declared, become member of the Federal Reserve tem will participate Deposit Insurance Corporation Officials of the new institution will chosen by the organization mittee, with the positors, and will satisfactory the the State Banking the FedReserve.

The Citizens Trust will conduct chester Trust negotiations under Westchester Trust will continue operate its special trust accounts. With control assumed by the the Westchester Trust came perunder his Deputy George Porter, in charge of McQuade In Charge Deputy Porter signed to Yonkers to take charge Arthur Special Deputy who will remain here indefinitely, pending opening the Citizens Trust. The plan mailed today all depositors, clerical work for this purpose having been the holiday with staffs laborand each depositor will copy ment, proof claim and signature cards. These must be signed returned the of the Contrast In Plans Today formal plan was different from another filed just ago, when aid the had expectOn July 1933, the State Suthe institution and plan ganization office White Plains, under depositors cent, but the Trust was to be under The Feddeclined to through with that program. Mr. Broderick's statement

"Joseph Broderick, Superannounces he Trust Company Jan. 1934, depositors, immediately court approval, part their deposit balances trust company under plan reorganization the Superintendent now being to the Supreme Court, Westchester County. "The of reorganization that proximately per cent posit made to general depositors 100 cent secured and preferred deposits. "Under this plan the Superintendent of Banks immediately, upon court make application Reconstruction Finance Corporation of which (loan the Superintendent has been assured) grantupon compliance with cerconditions. expected that the which has cooperating the reorganization the trust company also file very shortly ficate of organization with the Banks for this and subsequent theresteps plete the the trust company will taken. the liquidation of Superintendent Banks proceed in the usual manner order that most can be secured for depositors without munity to hardship that would result from forced liquidation. understand the organization committee planned solicit immediately from the depositors and the community for capital stock the new trust company. advised that the formed during the time that the trust under represented on the the trust company, and that the community interest provide subscription the capital The plan of be to the deposifollows: execution the subscription not by the New State ing with proof of but tial with aid must obtained this and make cash you. the ify by reorganizing and its condiSeveral days before are necthe tial that $300,000 cash for funds the new trust company raised Full Text The full text the communication from mittee and creditors the follows: extended for the Trust Company Committee. In this period pression the Reconstruction Finance necessary obtain funds to complish this The plan of is Superintendent of Banks the State New York the business property of the Westchester Trust Company and authority the Supreme Court the State New York, will borrow from the Reconstruction Finance proximately pledging therefor liquid chester Trust assets. From the the Westchester Trust Company, paid off. The liquid Trust Company's bonds having ready market and loans classed liquid good, together with cash cluding the Reconstruction Corporation remaining after the secured will be institution be known Citizens Trust of Yonkers (hereinafter called 'the Trust Company new Trust Company proposes pay for purchased sufficient for upon the order the Supreme Court the State to the depositors and creditors entitled to priorunder the provisions the Banking and approximately fifty per cent due the respective depositors and creditors (other than those to in full provided reorganization pleted promptly. made through the medium the Trust Company. proposed that the new Trust will become member the Federal System and will participate in the Federal Deposit Insurance The directors and officers of the Trust Company will to Finance Corporation the the State New The new Trust will conduct iness the cupied Westchester Trust Company.

"Ability to provide for such cash payments hereinbefore indiand open new Trust Company depends large measure speed which $500,000 capital funds raised for Trust Company. The capital funds the Trust Company consist $200,000 capital stock shares, value each), $100,000 surplus and debentures be issued the Reconstruction Finance Corporation). undersigned Organization Committee desires offer the depositors creditors chester Trust Company brief period time, subscribe for shares capital stock of the new Trust each having value of the price $15 share thereof allocated to the payment capital stock and $5 theresurplus of the new Trust Company). "Necessity compels the Organization Committee reduce mum time within which subscriptions made cordingly hereby notified that, desire avail yourhereby given subscribe shares capital stock the Company the price hereinbefore your must received Benedict, Chairman the Organization Committee, Broadway Yonkers, York, on before o'clock January 1934. Paragraph the attached subscription ment explains the manner which for capital stock scribed depositors and creditors be made deduction from available you pursuant this plan zation. complete the reorganization