Article Text

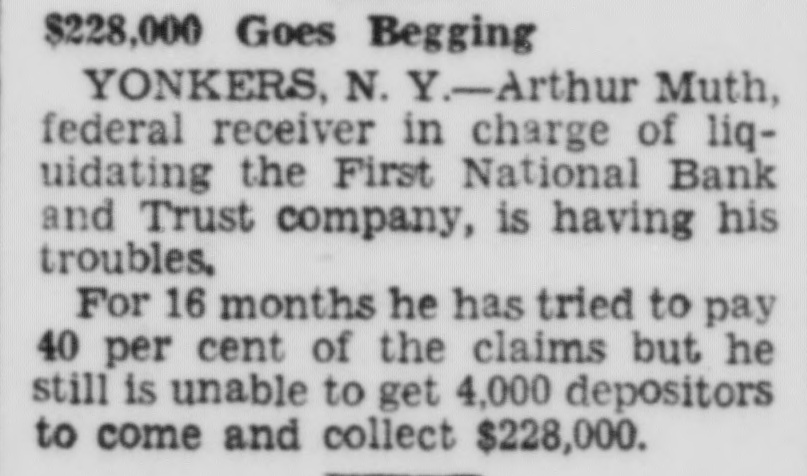

YONKERS NATIONAL RESUMES reopening of the Yonkers National Today's Bank and Trust full pre-moraCompany torium basis reflects another successful step on the of the City of Yonkers in emerging part from the most complete bank in the history of the United States. the rehabilitation of the First National Only Bank and Trust Company is yet necessary to have at all of the financial institutions. And the plans for that already have been drafted and await approval the federal authorities. Perhaps the major reason for the success of Yonkers bank officials and and depositors in cooperating to restore the large institutions to their former prestige and power has been due to the almost complete absence of fear and panic, such as were experienced in other communities. When the city awoke four weeks ago to discover that all of its banks had been closed and that the money they had saved was temporarily beyond their control, they obtained and extendcredit freely and worked hand in hand to hurdle the difficulties. The rift in the dour clouds soon arrived with the opening of two savings and two commerical banks. The remaining two commercial largest and oldest in the themselves disadvantage partly because of their complex scope of operations. By good judgment and excellent the 18,000 depositors of the Yonkers National have passed through the trying crucible of stringent federal regulation and today they find their bank restored complete power. is noteworthy that the leaders in that project, meritoriously rejoicing in their accomplishment, are not resting on their laurels but are now joining to shoulder with the 31,000 depositors of the First National to bring that institution back to maximum usefulness and service. Under the searching scrutiny of the Controller of the Currency and the Federal Reserve System, the readjustment is no light process task, particularly when several hundred banks in other parts of the country are crowding upon the federal officials for similar attention and aid. obvious that careful planning and farsightedness are more essential than speed, and that there must be less concern for how quickly the wheels turn than that the be resumption as completely sound and solvent institution, safe against all future vicissitudes of modern ecokey to the solution of the Yonkers National's temporary will be the case in First been widespread willingness on the part of depositors to pump new financial blood into the veins. tution, which had suffered from "frozen" assets, due to the depression. no time has there been breath of complaint that the readjustment has been due to or inefficiency, since the government itself named principal officials of the institution to the important office of conservator in each case. not difficult to understand that the Yonkers National opens today stronger than was when closed. sets out with no losses, no doubtful these have been written off replaced with new funds. It starts from scratch, its capital and surplus unimpaired, its assets fully secured and liquid. There is another potent reason. Under the conditions of the readjustment, collateral accepted for loans has been pared fraction of its true value by the depression. Much this collateral was Yonkers real estate and Yonkers industrial and mercantile operations, all fundamentally sound but temporarily depreciated. Those values will come back, and when they do, the assets of the banks will increase The "frozen" assets will once more be liquidated. In other words, values, though now removed from the bank's books, remain within the vaults of the institution, to become revitalized in better times. The present improvements in Yonkers bank. should bear fruits for many years to come, helping this city to retain and enhance its envious place in the Our banking institutions have passed through rigorous moratorium crucible and have not been found wanting. This is the beginning of the end of our financial difficulties, with the next step in full sight of realization.