Article Text

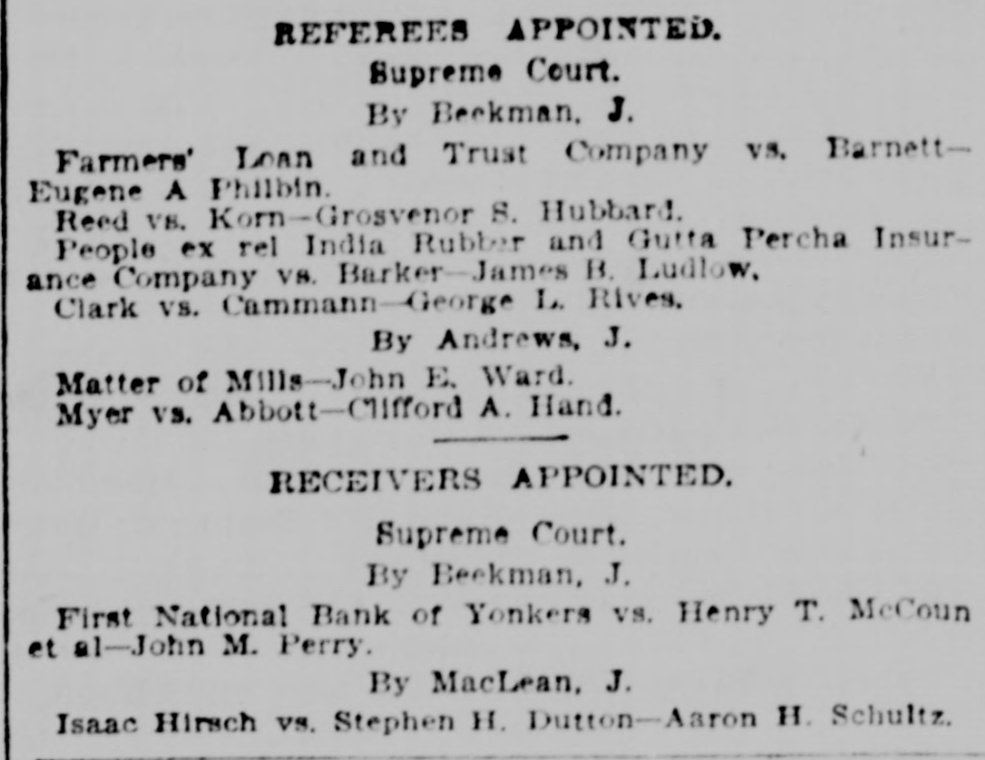

REFEREES APPOINTED. Supreme Court. By Beckman. J. Farmers' Loan and Trust Company vs. BarnettEugene A Philbin. Reed VS. Korn-Grosvenor S. Hubbard. People ex rel India Rubber and Gutta Percha Insurance Company vs. Barker-James B. Ludlow, Clark vs. Cammann-George L. Rives. By Andrews, J. Matter of Mills-John E. Ward. Myer vs. Abbott-Clifford A. Hand. RECEIVERS APPOINTED. Supreme Court. By Beekman, J. First National Bank of Yonkers vs. Henry T. McCoun et al-John M. Perry. By MacLean, J. Isaac Hirsch vs. Stephen H. Dutton-Aaron H. Schultz.