Article Text

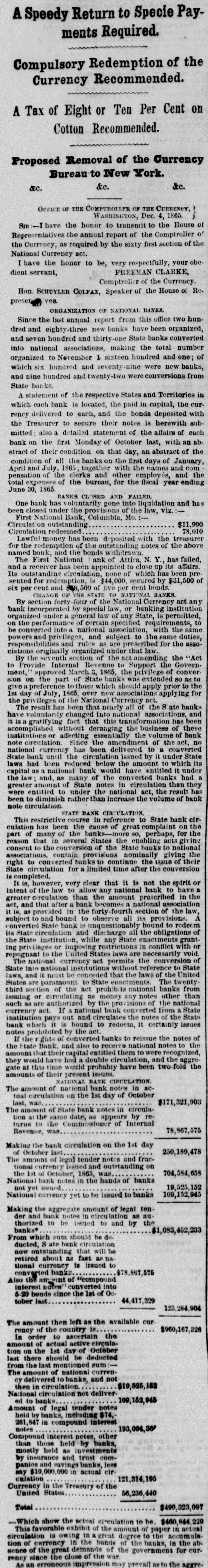

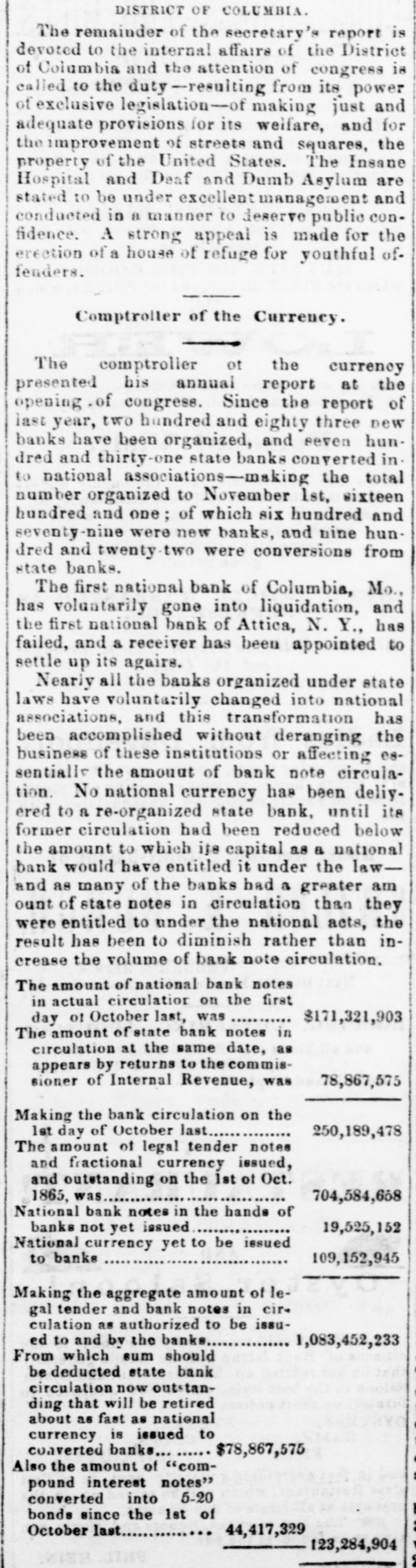

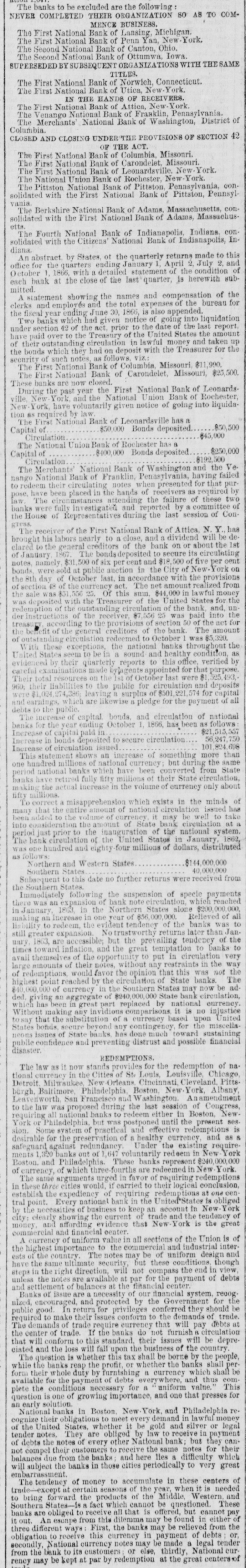

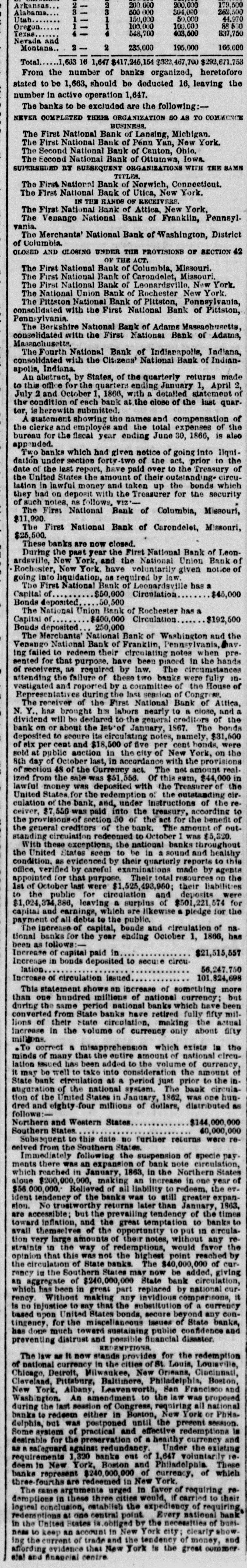

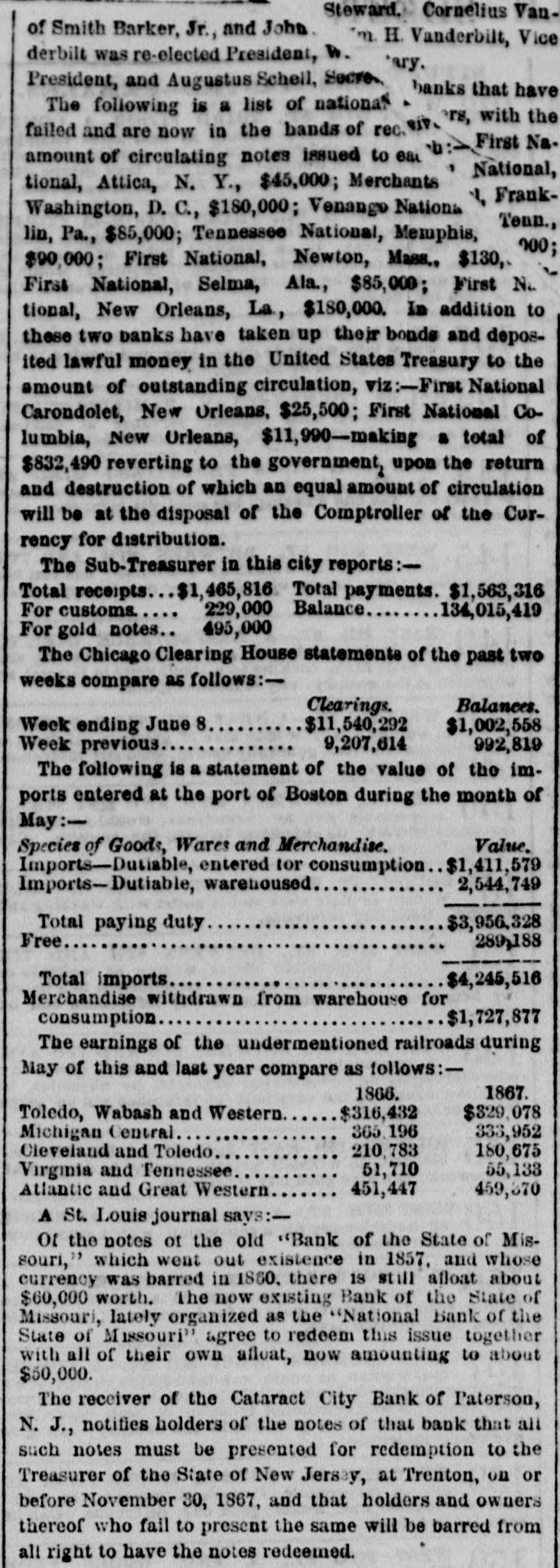

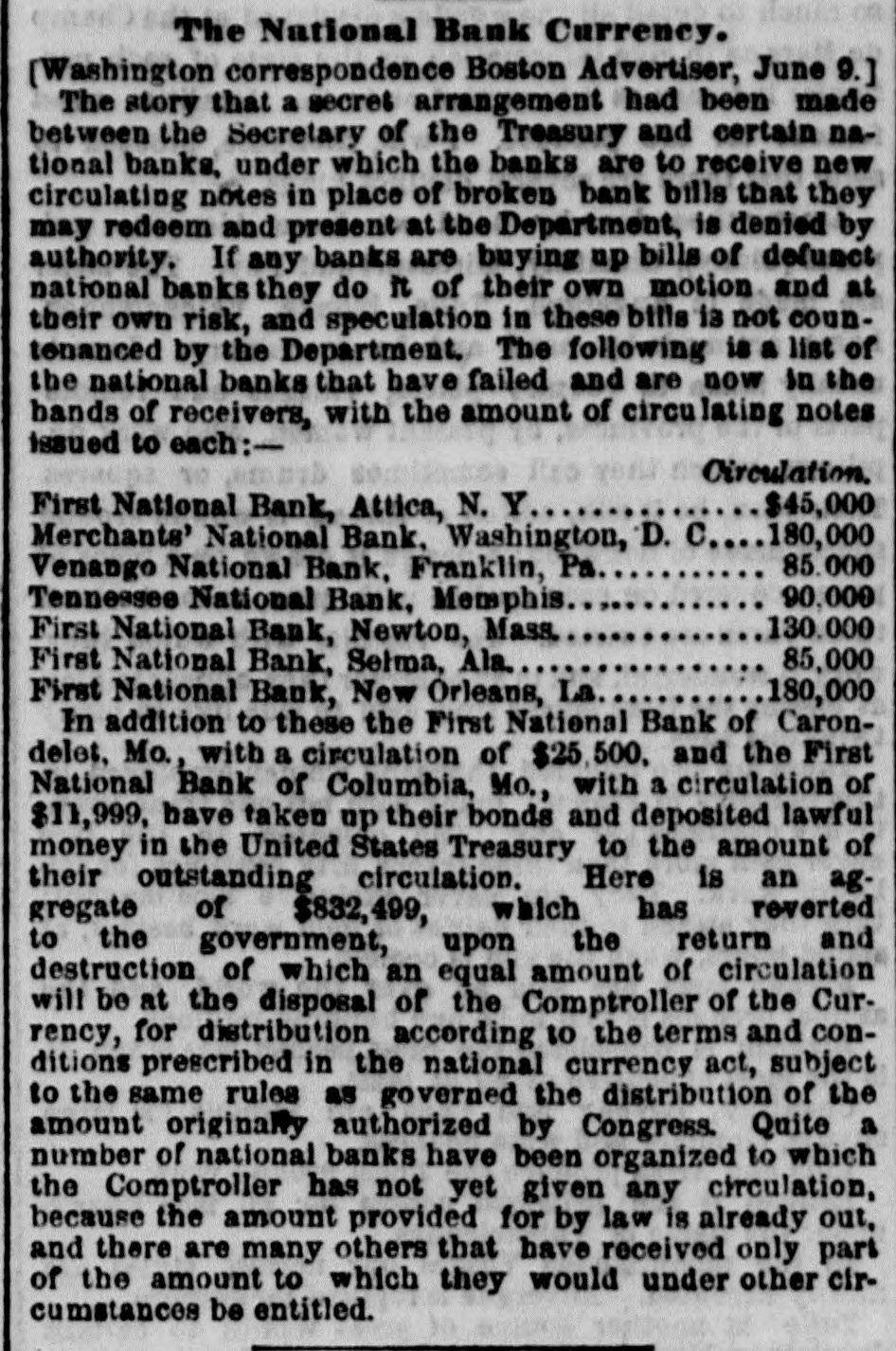

200.000 Arkansas Alabama Utah 100,000 100,000 Oregon 548,700 403,500 837,750 Nevada and 2 235,000 166.000 195.000 Montana Total 1,663 16 1,647 $417,245,154 $332,467,700 $293,671,753 From the number of banks organized, heretofore stated to be 1,663, should be deducted 16, leaving the number in active operation 1,647. The banks to be excluded are the following: NEVER COMPLETED THEIR ORGANIZATION so AS TO COMMENCE BUSINESS. The First National Bank of Lansing Michigan The First National Bank of Penn Yan, New York. The Second National Bank of Canton, Ohio. The Eecond National Bank of Ottutowa, Iowa. SUPERSEDED RY SUBSEQUENT ORGANIZATIONS WITH THE TITLES. The First National Bank of Norwich, Connecticut. The First National Bank of Utica, New York. RECEIVERS THE HANDS OF IN The First National Bank of Attica, New York, The Venango National Bank of Franklin, Pennsyl vania. The Merchants' National Bank of Washington, District of Columbia OLOSED AND CLOBING UNDER THE PROVISIONS OF SECTION 42 OF ACT The First National Bank of Columbia, Missouri The First National Bank of Carondelet, Missouri The First National Bank of Leonardsville New York The National Union Bank of Rochester New York The Pittston National Bank of Pittston, Pennsylvania, consolidated with the First National Bank of Pittston, Pennsylvania. The Berkshire National Bank of Adams Massachusetts, consolidated with the First National Bank of Adams, Masanchusetts The Fourth National Bank of Indianapolis, Indiana consolidated with the Citizens' National Bank of Indianapolis, Indiana An abstract, by States. of the quarterly returns made to this office for the quarters ending January 1, April 2. July 2 and October 1. 1866, with detailed statement of the condition of each bank at the close of the last quar ter, is herewith submitted, A statement showing the names and compensation of the clerks and employés and the total expenses of the bureau for the fiscal year ending June 30, 1866, is also appended. Two banks which had given notice of going into ligut. dation under section fortv two of the act, prior to the date of the lest report. have paid over to the Treasury of the United States the amount of their outstanding. circulation in lawful money and taken up the bonds which they had on deposit with the Treasurer for the security of such ne follows notes, The First National Bank of Columbia, Missouri, $11,990 The First National Bank of Carondelet, Missouri, $25,500. These banks are now closed. During the year the First National Bank of Leonardsville, New York, and the National Union Bank of Rochester. New York have voluntarily given notice of going into liquidation as required by law. The First National Bank of Leonardsvi has Capital of Circulation $50,000 $45,000 50,500 Bonds deposited The National Union Bank of Rochester has $400,000 Circulation Capital of $192,500 250,000 Bonds deposited The Merchants National Bank of Washington and the Venango National Bank of Franklin Pennsylv ing failed to redeem their circulating notes when presented for that purpose. have been placed in the hands of receivers, as required by law. The circumstances attending the failure of these two banks were fully investigated and reported by a committee of the House of Representatives during the last session of Congress The receiver of the First National Bank of Attica, N Y. has brought his labors nearly to close, and a dividend will be declared to the general of the bank on or about the Ist of January, 1867. The bonds deposited to secure its circulating notes $31,600 of six per cent and $18,500 of five per cent bonds, were sold at public acction in the city of New York, on the 8th day of October last, in accordance with the provisions section 48 of the Currency act The net amount real. ized from the sale was $51,556. Of this sum, $44,000 in lawful money was deposited with the Treasurer of the United States. for the redemption o: the outstanding circulation of the bank, and, under Instructions of the receiver, $7. 550 was paid into the treasury, according to the provisions of section 50 of the act for the benefit of the general creditors of the bank. The amount of out standing circulation redeemed to October 1 was $5,220. With these exceptions, the national banks throughout the United States seem to be in sound and healthy condition, as evide need by their quarterly to office, verified by carefo examinations made by agente appointed for that purpose Their total the of October last were $1,525,493,960 their liabilities to the public for circulation and deposits were $1,024,374,886, leaving a surplus of $501,221,574 for capital and earnings, which are llkewise a pledge for the payment of all debta to the public The increase of capital, bonds and circulation of na tional banks for the year ending October 1, 1866, has been as follows Increase of capital paid in $21,515,557 Increase in bonds deposited to secure circulation 56,247,750 Increase of circulation issued 101.824.698 This statement shows an increase of something more than one hundred millions of national currency but during the same period national banks which have been converted from State banks have retired fully fifty mil lions of their state circulation. making the actual Increase in the volume of currency only about fifty millions To correct a misapprehension which exists in the minds of many that the entire amount of national circu. lation issued has been added to the of currency it may be well to take into consideration the amount of State bank circulation a period just prior to the in of the national system. The bank circula tion of the United States in January 1862, was one hun dred and eighty four millions of dollars, distributed as follows:Northern and Western States $144,000,000 Southern States 40,000,000 Substquent to this date no further returns were celved from the Southern States. Immediately following the suspension of specie pay ments there WAR an expansion of bank note circulation. which reached in January. 1863, in the Northern States aloue $200,000,000, making an increase in one year of $56,000,000. Relieved of all liability to redeem. the evident tendency of the banks was to still greater expan sion. No trustworthy returns later than January, 1863. are accessible; but the prevailing tendency of the times toward inflation, and the great temptation to banks to avail themaelves of the opportuntty to put in circula. tion very large amounts of their notes, without any re straints in the way of redemptions, would favor the opinion that this was not the highest point reached by the circulation of State banks. The $40,000,000 of currency in the Southern States mar now be added, giving an aggregate of $240,000,000 State bank circulation. which has been in great part replaced by national currency Without making any invidious comparisons, it injustion to MAY that the substitution of a currency based upon United States bonds, secure beyond any contingency, for the miscellaneous taxuer of State banks, has done much toward sustaining public confidence preventing distrust and possible financial disaster. EDEMPTIONS The law as " now stands provides for the redemption of national currency in the cities of St. Louis, Louisville, Chicago, Detroit, Milwaukee, New Orieans, Cincinnati Cleveland, Pittaburg, Baltimore, Philadelphia, Boston, New York, Albany, Leavenworth San Francisco and Washington An amendment to the law was proposed during the last session of Congress, requiring all national banks to redeem either in Boston, New York or PhHs. delphia, but was postponed until the present SESSION Some system of practical and effective redemptions is desirable for the preservation of a healthy currency and safeguard against redundancy Under the existing requirements 1,320 banks out of 1,647 voluntarly deem in New York, Boston and Philadelphia These banks represent $240,000,000 currency. of which three fourths are redeemed in New York The same argtments urged in favor of requiring re demptions in these three cities would, if carried to their logical conclusion, establish the expediency of requiring redemotions at one central point Every national bank in the United States obliged by the necessities of boei. near to keep an account in New York city clearly show ing current of trade and the tendency of money, and affording evidence that New York is the great commer eta! and Annual centre