Article Text

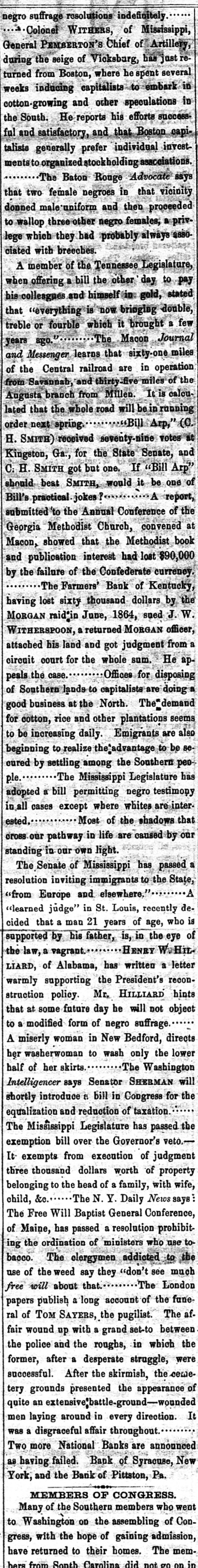

negro suffrage resolutions indefinitely Colonel WITHERS, of Mississippi, General PEMBERTON'S Chief of Artillery, during the seige of Vicksburg, has just returned from Boston, where he spent several weeks inducing capitalists to embark in cotton growing and other speculations in the South. He reports his efforts successful and satisfactory, and that Boston capitalists generally prefer individual investmentsto organized stockholding asscciations. The Baton Rouge Advocate says that two female negroes in that vicinity donned male uniform and then proceeded to wallop three other negro females, a privlege which they bad probably always associated with breeches. A member of the Tennessee Legislature, when offering a bill the other day to pay his-colleagues and himself in gold, stated that "everything is now bringing double, treble or fourble which it brought a few The Macon Journal ago. years and Messenger learns that sixty-one miles of the Central railroad are in operation from Savannab, and miles of the Augusta branch from Millen. It is calculated that the whole road will be in running order next spring. Bill Arp," (0. H. SMITH) received seventy nine votes at Kingston, Ga., for the State Senate, and C. H. SMITH got but one. If Bill Arp" should beat SMITH, would it be one of Bill's practical jokes ? A report, submitted 'to the Annual Conference of the Georgia Methodist Church, convened at Macon, showed that the Methodist book and publication interest had lost $90,000 by the failure of the Confederate currency. The Farmers' Bank of Kentucky, having lost sixty thousand dollars by the MORGAN raid"in June, 1864, sued J. W. WITHERSPOON, a returned MORGAN officer, attached his land and got judgment from a circuit court for the whole sum. He apOffices for disposing peals the case. of Southern lands to capitalists are doing a good business at the North. The demand for cotton, rice and other plantations seems to be increasing daily. Emigrants are also beginning to realize the'advantage to be secured by settling among the Southern peoThe Mississippi Legislature has ple. adopted a bill permitting negro testimony in all cases except where whites are interested. Most of the shadows that cross our pathway in life are caused by our standing in our own light. The Senate of Mississippi has passed a resolution inviting immigrants to the State, A "from Europe and elsewhere. "learned judge" in St. Louis, recently decided that a man 21 years of age, who is supported by his father, is, in the eye of HENRY W.HiLthe law, a vagrant. LIARD, of Alabama, has written a letter warmly supporting the President's reconstruction policy. Mr. HILLIARD hints that at some future day he will not object to a modified form of negro suffrage A miserly woman in New Bedford, directs her washerwoman to wash only the lower half of her skirts The Washington Intelligencer says Senator SHERMAN will shortly introduce 8 bill in Congress for the equalization and reduction of taxation The Mississippi Legislature has passed the exemption bill over the Governor's veto.It exempts from execution of judgment three thousand dollars worth of property belonging to the head of a family, with wife, The N. Y. Daily News says child, &c. The Free Will Baptist General Conference, of Maine, has passed a resolution prohibiting the ordination of ministers who use tobacco. The elergymen addicted to the use of the weed say they "don't see much The London free will about that papers publish a long account of the funeral of Tom SAYERS, the pugilist. The af. fair wound up with a grand set-to between the police and the roughs, in which the former, after a desperate struggle, were successful. After the skirmish, the cemetery grounds presented the appearance of quite an extensive'battle-ground-wonnded men laying around in every direction. It was a disgraceful affair throughout Two more National Banks are announced as having failed. Bank of Syracuse, New York, and the Bank of Pittston, Pa. MEMBERS OF CONGRESS. Many of the Southern members who went to Washington on the assembling of Congress, with the hope of gaining admission, have returned to their homes. The mem bers from Sonth Carolina did not 20 on in