Click image to open full size in new tab

Article Text

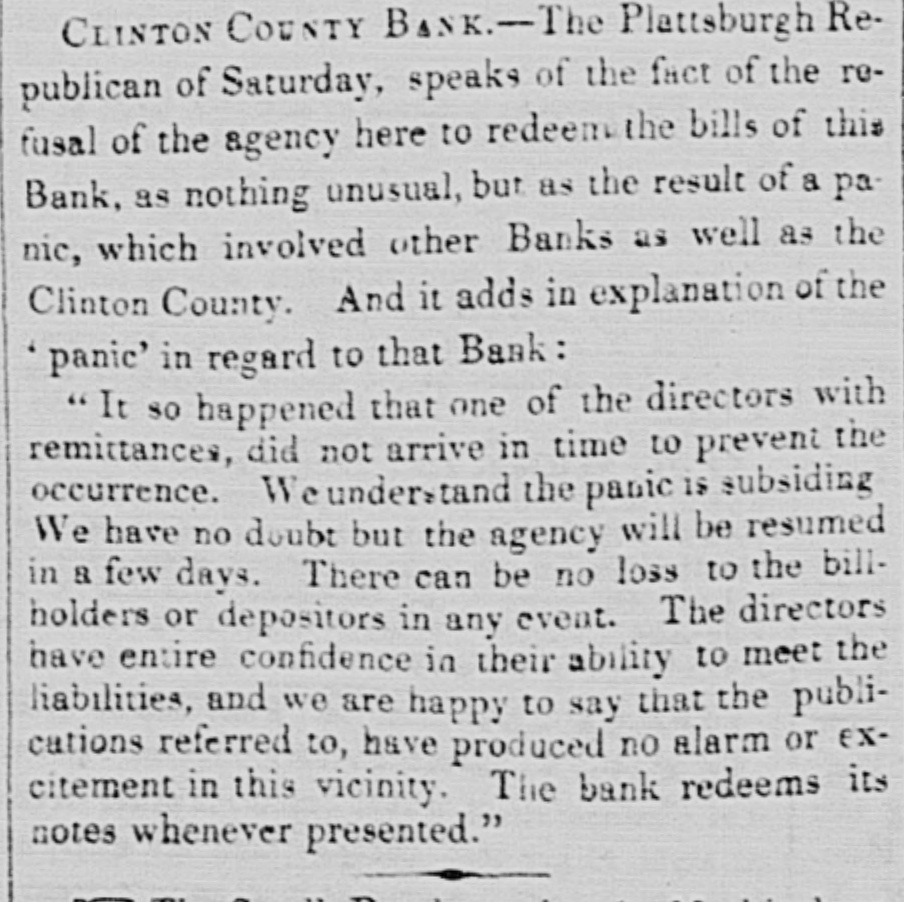

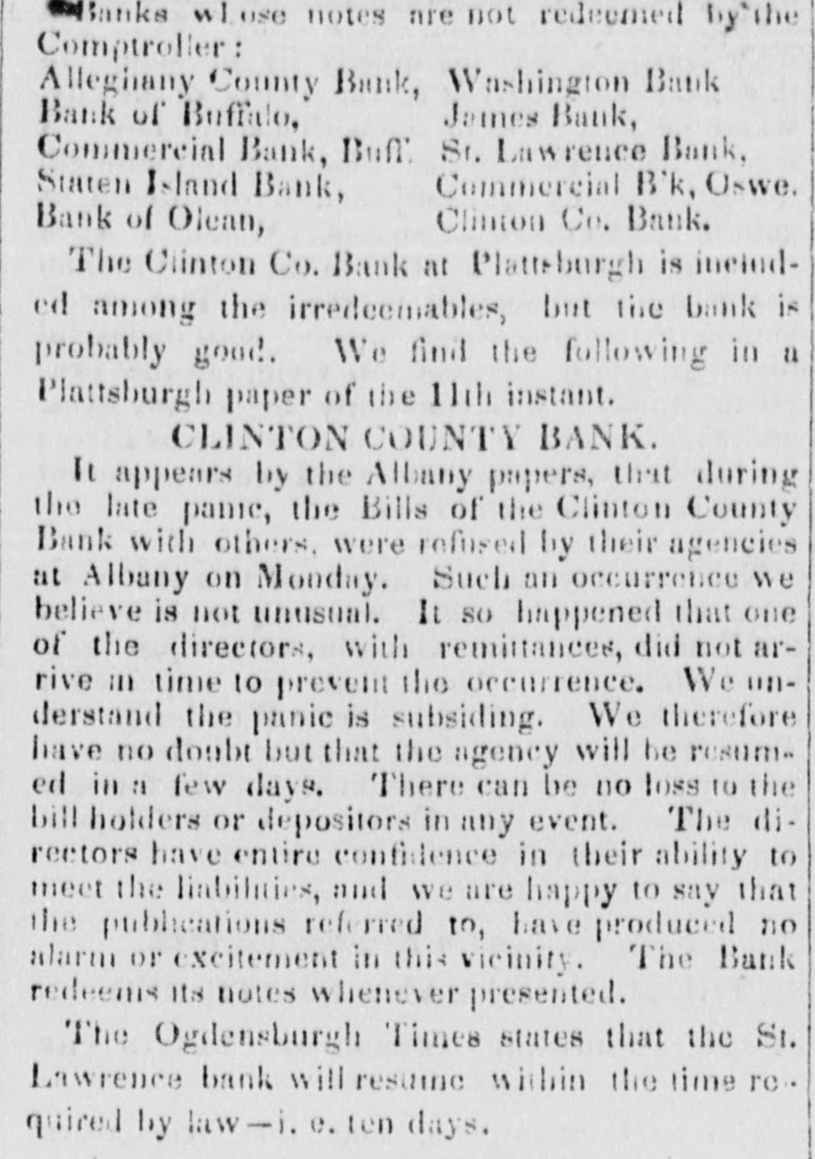

MONEY MARKET. Tuesday, August 9-6 P. We have no new features to remark at the Stock Board to-day. Sales were as usualsmall. Farmers' Loan, fell 1; Utica and Schenectady, 1; Harlem, improved 1. After the Board a public sale of State Stock was made at auction, with the following results:17} $11,000 Michigan 6 per cts. issued to Pontiac R.R. 16 10,000 Illinois 6 " " J. Delafield, Esq. " 6 10,000 " Po*keepsieWh'ing Co.17} The Illinois bonds at 16, were bought by a broker, un. der the impression that they were available to meet contracts. They are worth 11 per cent. The situation of the Alabama Banks is truly ridiculous, particularly the branch at Mobile. It is notoria us at Mobile, among buainess men, that not an individual in that concern has business capacity sufficient to fill an ordinary clerkship. The affairs of the bank are a perfect riddle, and its assets or liabilities could not be arrived at within a million of dollars. The whole Banking concern of Alabama is one of the most absurd farces that was ever got up. The wonder is not that specie is worth 65 per cent in Mobile, but that the obligations of the banks are worth any. thing. The only circumstance that makes them worth anything whatever, is the blind credulity of the planters which induces them to give their produce, the result of their labors, in exchange for it. The,plea is that they can pay their debts to the banks with it, but they could do the same thing if they sell their cotton for specie and then buy their bills with the specie. For instance, suppose a planter has (10,000 lbs. cotton; if he sells it for specie at 5 cents he gets $500, with which he may buy at 65 per cent $1,428, paper dollars, and pay his note at the bank. To do the same thing and receive paper, he must get 14 cents per lb. for the same cotton. If, however, paper is generally refused at any price, it will fall very low, and he may buy $2,000 with $500 of specie, because the demand will then exist for the bills only from those who owe the banks. The demand for circulation will cease. This simple fact of the refusal of paper and the demand for specie, will fill the State with a sound currency. It is utterly impossible that the present state of things can exist more than a few weeks, or months at the outside, and any political party that is insane enough to countenance those farcical banks will be destroyed in their fall. H. K. Averill, the receiver of the Clinton County Bank, has notified the creditors of said bank to exhibit their respective claims, with the vouchers thereof, at his office in Plattsburgh, en or before the first Monday of March next. A meeting of the stockholders of the Atlantic Insurance Company of Boston, is to be held in that city on the 11th inst. to take into consideration the expediency of closing the concerns of the Company, and the transaction of such other business as may legally come before them. The following is a statement of the State Bank of Illinois and branches, July 4, 1842, and Feb. 7, 1842 :STATEMENT OF THE AGGREGATE CONDITION OF THE STATE