Click image to open full size in new tab

Article Text

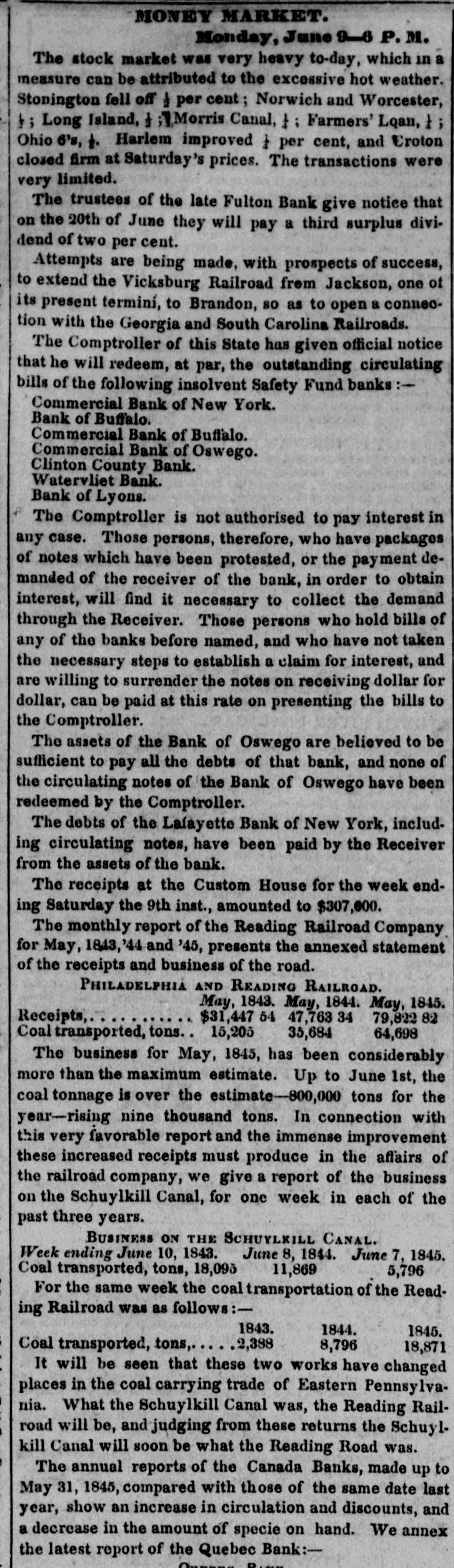

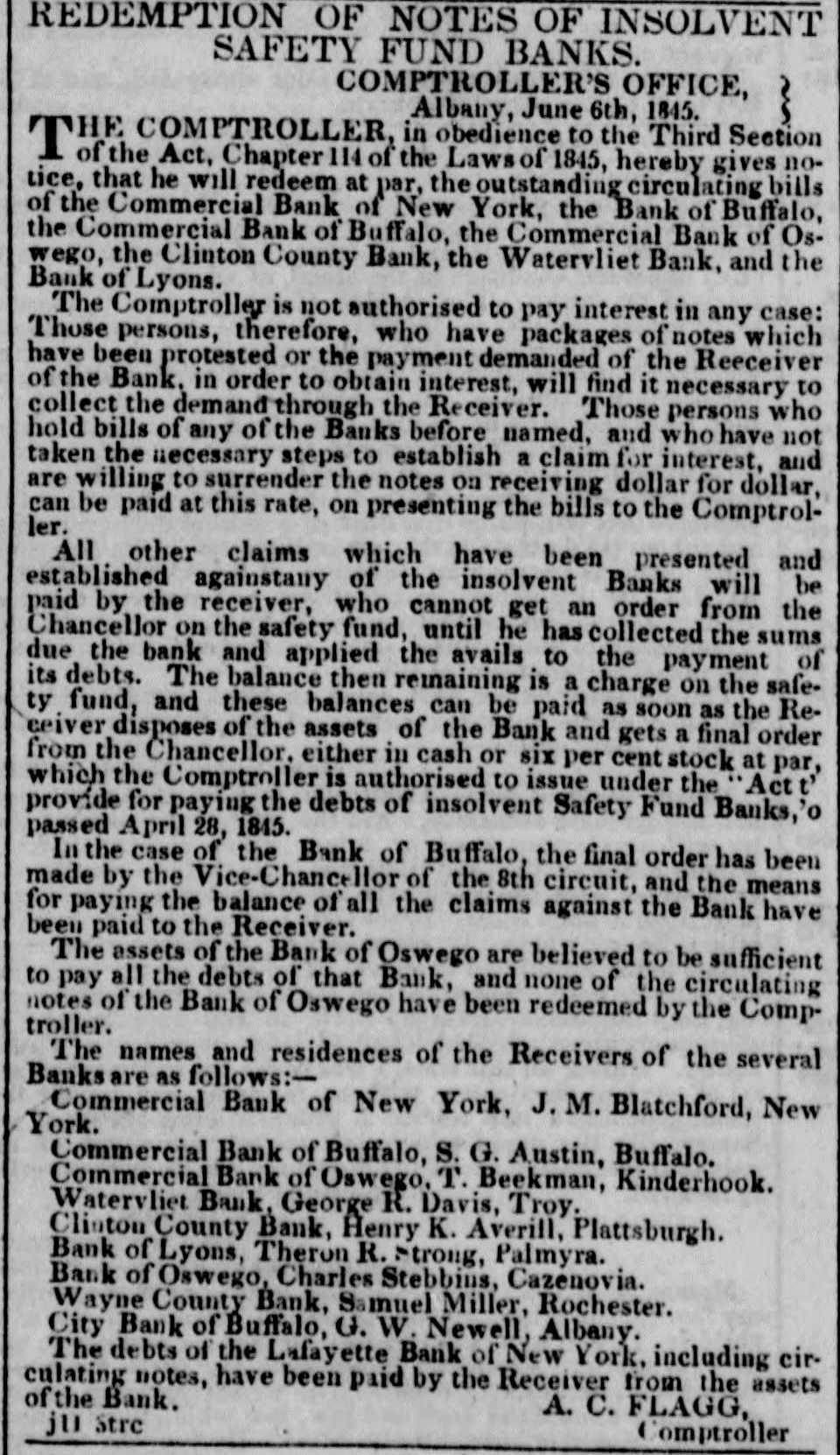

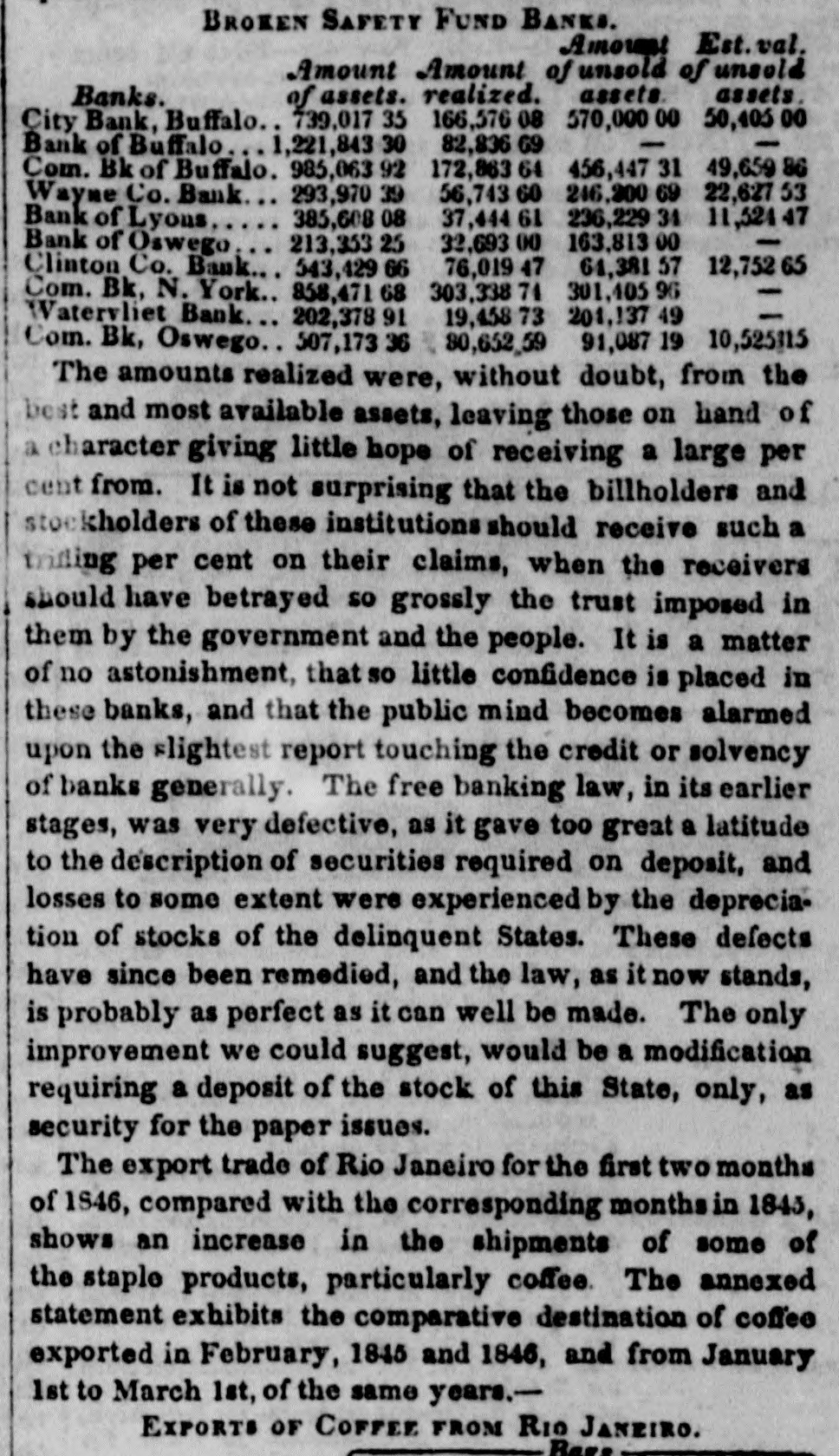

MUSIC. LADY, who has a thorough knowledge of music, being A taught by the first masters in Europe, and feeling heself fully competent to instruct in thataccomplishment, would wish to devote her time to the instruction of young ladies, on moderate terms. A note addressed to A B. C., at the office of jell 1w*re this paper, shall be punctually attended to. ANTED-By a French young woman, a situation to take W charge of children, or as lady S maid, with a family going to France. She can give the best of references. Address by letter, to M. P. A.. Herald Office. ju10 lw*m FOLLOWING STATEMENT is from one lof the THE most eminent Physicians of New Jersey, and well and favorably known to very many of the citizens of New York. Having seen in the New York papers certain advertisements emanating from P. S. Beekman, I would beg to inform the public that I am acquainted with J. H. Scheuck, and have been so since 1834-that in 1839 he commenced the manufacture of Schenck's Pulmonic Syrup in Flemington. I have seen several persons of this vicinity who have been cured of Pulmonary disease by this Syrup when all other means had failed. I am acquainted with P. S. Beekman, and know that the original Pulmonic Syrup had been established several years before he heard of it, and that Beekman has said that it was Schenck's Pulmonic Syrup that cured him. Beekman has told me that he acted as Agent for Mr. Schenck, and had no interest in the business further than the agency. I know, also, that Mr. Schenck is the originator of the Pulmonic Syrup, and believe that Beekinan knows nothing of its composition, and is using every eadeavor to deceive the public. I am a practising physician, residing near Flemington, Hunterdon county, N.J., and am utterly opposed to all Empericism; but having seen the good effects of the Pulmonic Syrup, and believing that an effort is now being made, by every unpiincipled means, to injure an honest and honorable man, it is from a sense of duty that I make the above statement. GEORGE P. REX. M. D. Office exclusively for the sale of Schenck's Pulmonic Syrup, No. 4 Courtla d street New York. P.S. Beekman, of 491/2 Courtland street, is no longer Agent j14 3t*rh for the sale of Schenck Pulmonic Syrup. REDEMPTION OF NOTES OF INSOLVENT SAFETY FUND BANKS. COMPTROLLER'S OFFICE, Albany, June 6th, 1845. THE COMPTROLLER. in obedience to the Third Section of the Act. Chapter 114 of the Laws of 1345, hereby gives notice, that he will redeem at par, the outstanding circulating bills of the Commercial Bank of New York, the Bank of Buffalo, the Commercial Bank of Buffalo, the Commercial Bank of Oswego, the Clinton County Bank, the Watervliet Bank, and the Bauk of Lyons. The Comptroller is not authorised to pay interest in any case: Those persons, therefore, who have packages of notes which have been protested or the payment demanded of the Reeceiver of the Bank. in order to obtain interest, will find it necessary to collect the demand through the Receiver. Those persons who hold bills of any of the Banks before named. and who have not taken the necessary steps to establish a claim for interest. and are willing to surrender the notes on receiving dollar for dollar, can be paid at this rate, on presenting the bills to the Comptroller. All other claims which have been presented and established againstany of the insolvent Banks will be paid by the receiver, who cannot get an order from the Chancellor on the safety fund, until he has collected the sums due the bank and applied the avails to the payment of its debts. The balance then remaining is a charge on the safety fund, and these balances can be paid as soon as the Receiver disposes of the assets of the Bank and gets a final order from the Chancellor. either in cash or six per cent stock at par, which the Comptroller is authorised to issue under the Act t provide for paying the debts of insolvent Safety Fund Banks,'o passed April 28, 1845. In the case of the Bank of Buffalo, the final order has been made by the Vice-Chancellor of the 8th circuit, and the means for paying the balance of all the claims against the Bank have been paid to the Receiver. The assets of the Bank of Oswego are believed to be sufficient to pay all the debts of that Bank, and none of the circulating notes of the Bank of Oswego have been redeemed by the Comptroller. The names and residences of the Receivers of the several Banks: are as follows:Commercial. Bank of New York, J. M. Blatchford, New York. Commercial Bank of Buffalo, S. G. Austin, Buffalo. Commercial Bank of Oswego, T. Beekman, Kinderhook. Watervliet Bank, George R. Davis, Troy, Clinton County Bank, Henry K. Averill, Plattsburgh. Bank of Lyons, Theron R. Strong, Palmyra. Bank of Oswego, Charles Stebbins, Cazepovia. Wayne County Bank, Samuel Miller, Rochester. City Bank of Buffalo, G. W. Newell, Albany. The debts of the Lafayette Bank of New York, including circulating notes, have been paid by the Receiver from the as sets A. C. FLAGG, of the Bank Comptrolle j11 Stre