Article Text

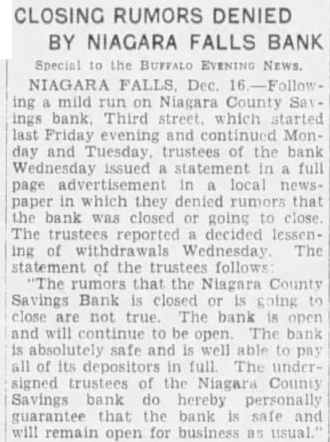

CLOSING RUMORS DENIED BY NIAGARA FALLS BANK Special EVENING NEWS. NIAGARA Dec Niagara County bank Third which Friday and continued Monday and the issued local which that the bank closed or going The ing withdrawals Wednesday statement follows the Niagara County Savings Bank true and The bank safe and its The undersigned trustees the Niagara County Savings bank hereby personally guarantee that the bank will for business usual