Article Text

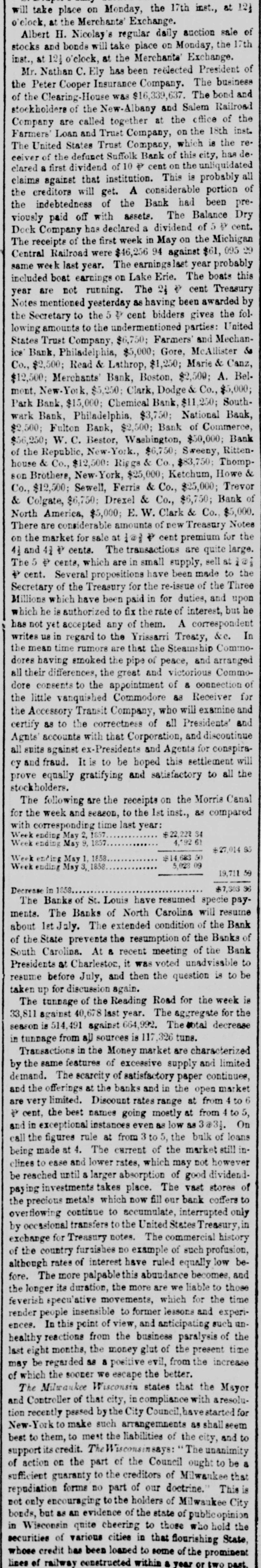

will take place on Monday, the 17th inst., at 121 o'elock, at the Merchants' Exchange. Albert H. Nicolay's regular daily auction sale of stocks and bonds will take place on Monday, the 17th inst., at 12, o'clock, at the Merchants' Exchange. Mr. Nathan C. Ely has been reelected President of the Peter Cooper Insurance Company. The business of the Clearing-House was $16,339,637. The bond and stockholders of the New-Albany and Salem Railroad Company are called together at the office of the Farmers' Loan and Trust Company, on the 18th inst. The United States Trust Company, which is the receiver of the defunct Suffolk Bank of this city, has declared & first dividend of 10 # cent on the unliquidated claims against that institution. This is probably all the creditors will get. A considerable portion of the indebtedness of the Bank had been previously paid off with assets. The Balance Dry Dock Company has declared a dividend of 5 P cent. The receipts of the first week in May on the Michigan Central Railroad were $46,256 94 against $61, 095 29 same week last year. The earnings year probably included boat earnings on Lake Erie. The boats this year are not running. The 21 P cent Treasury Notes mentioned yesterday as having been awarded by the Secretary to the 5 ₹ cent bidders gives the fol. lowing amounts to the undermentioned parties: United States Trust Company, $6,750; Farmers' and Mechanice Bank, Philadelphia, $5,000; Gore, McAllister & Co., $2,500; Read & Lathrop, $1,250; Marie & Canz, $12,500; Merchants' Bank, Boston, $2,509; A. Belmont. New-York, $5,250; Clark, Dodge & Co., $5,000; Park Bank, $15,000; Chemical Bank, $11,250; Southwark Bank, Philadelphia, $3,750; National Bank, $2,500; Fulton Bank, $2,500; Bank of Commerce, $56,250; W. C. Bestor, Washington, $50,000; Bank of the Republic, New-York., $6,750; Sweeny, Rittenhouse & Co., $12,500: Riggs & Co., $83,750; Thompson Brothers, New-York, $25,000; Ketchum, Howe & Co., $12,500; Sewell, Ferris & Co., $25,000; Trevor & Colgate, $6,750; Drexel & Co., $6,750; Bank of North America, $5,000; E. W. Clark & Co., $5,000. There are considerable amounts of new Treasury Notes on the market for sale at l@} P cent premium for the 41 and 41 P cents. The transactions are quite large. The 5 P cents, which are in small supply, sell at 10; + cent. Several propositions have been made to the Secretary of the Treasury for the re-issue of the Three Millions which have been paid in for duties, and upon which he is authorized to fix the rate of interest, but he has not yet accepted any of them. A correspondent writes us in regard to the Yrissarri Treaty, &c. In the mean time rumors are that the Steamship Commodores having smoked the pipe of peace, and arranged all their differences, the great and victorious Commodore consents to the appointment of & connection of the little vanquished Commodore 88 Receiver for the Accessory Transit Company, who will examine and certify as to the correctness of all Presidents' and Agnts' accounts with that Corporation, and discontinue all suits against ex-Presidents and Agents for conspiracy and fraud. It is to be hoped this settlement will prove equally gratifying and satisfactory to all the stockholders. The following are the receipts on the Morris Canal for the week and season, to the 1st inst., as compared with corresponding time last year: $22,222 84 Week ending May 2, 1857 4,192.61 Week ending May 9, 1857 $27,014 9 $14,683.50 Week ending May 1, 1858 5,028.09 Week ending May 3,1858 19,711 59 $7,803 36 Decrease in 1858. The Banks of St. Louis have resumed specie payments. The Banks of North Carolina will resume about 1st July. The extended condition of the Bank of the State prevents the resumption of the Banks of South Carolina. At & recent meeting of the Bank Presidents at Charleston, it was voted unadvisable to resume before July, and then the question is to be taken up for discussion again. The tunnage of the Reading Road for the week is 33,811 against 40,678 last year. The aggregate for the season is 514,491 against 664,992. The Total decrease in tunnage from all sources is 117,326 tuns. Transactions in the Money market are characterized by the same features of excessive supply and limited demand. The scarcity of satisfactory paper continues, and the offerings at the banks and in the open market are very limited. Discount rates range at from 4 to 6 P cent, the best names going mostly at from 4 to 5, and in exceptional instances even as low as 3@31. On call the figures rule at from 3 to 5, the bulk of loans being made at 4. The current of the market still inclines to ease and lower rates, which may not however be reached until & larger absorption of good dividendpaying investments takes place. The vast stores of the precious metals which now fill our bank coffers to overflowing continue to accumulate, interrupted only by occasional transfers to the United States Treasury, in exchange for Treasury notes. The commercial history of the country furnishes no example of such profusion, although rates of interest have ruled equally low before. The more palpable this abuudance becomes, and the longer its duration, the more are we liable to those feverish specu'ative movements, which for the time render people insensible to former lessons and experiences. In this point of view, and anticipating such unhealthy reactions from the business paralysis of the last eight months, the money glut of the present time may be regarded as a positive evil, from the increase of which the sooner we escape the better. The Milwaukee Wisconsin states that the Mayor and Controller of that city, in compliance with aresolution recently passed by the City Council, have started for New-York to make such arrangemnents as shall seem best to them, to mest the liabilities of the city, and to support credit. The Wisconsineys: The unanimity of action on the part of the Council ought to be a sufficient guaranty to the creditors of Milwaukee that repudiation forms no part of our doctrine." This is not only encouraging to the holders of Milwaukee City bonds, but as an evidence of the state of publicopinion in Wisconsin quite cheering to those who hold the securities of various cities in that flourishing State, whose credit has been loaned to some of the prominent