Article Text

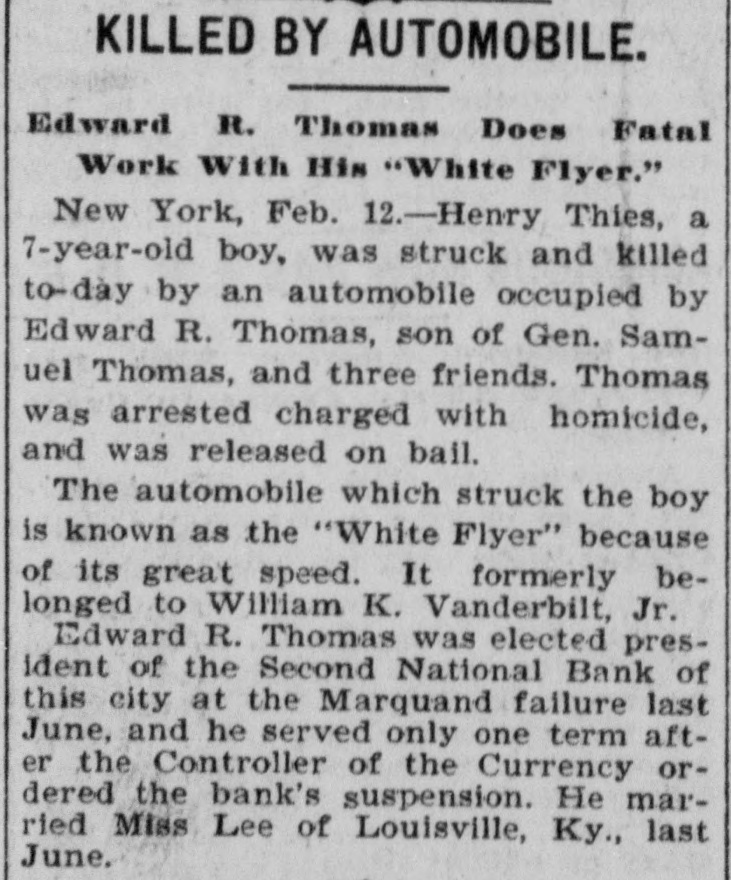

KILLED BY AUTOMOBILE. Edward R. Thomas Does Fatal Work With His "White Flyer." New York, Feb. 12.-Henry Thies, a 7-year-old boy, was struck and killed to-day by an automobile occupied by Edward R. Thomas, son of Gen. Samuel Thomas, and three friends. Thomas was arrested charged with homicide, and was released on bail. The automobile which struck the boy is known as the "White Flyer" because of its great speed. It formerly belonged to William K. Vanderbilt, Jr. Edward R. Thomas was elected president of the Second National Bank of this city at the Marquand failure last June, and he served only one term after the Controller of the Currency ordered the bank's suspension. He married Miss Lee of Louisville, Ky., last June.